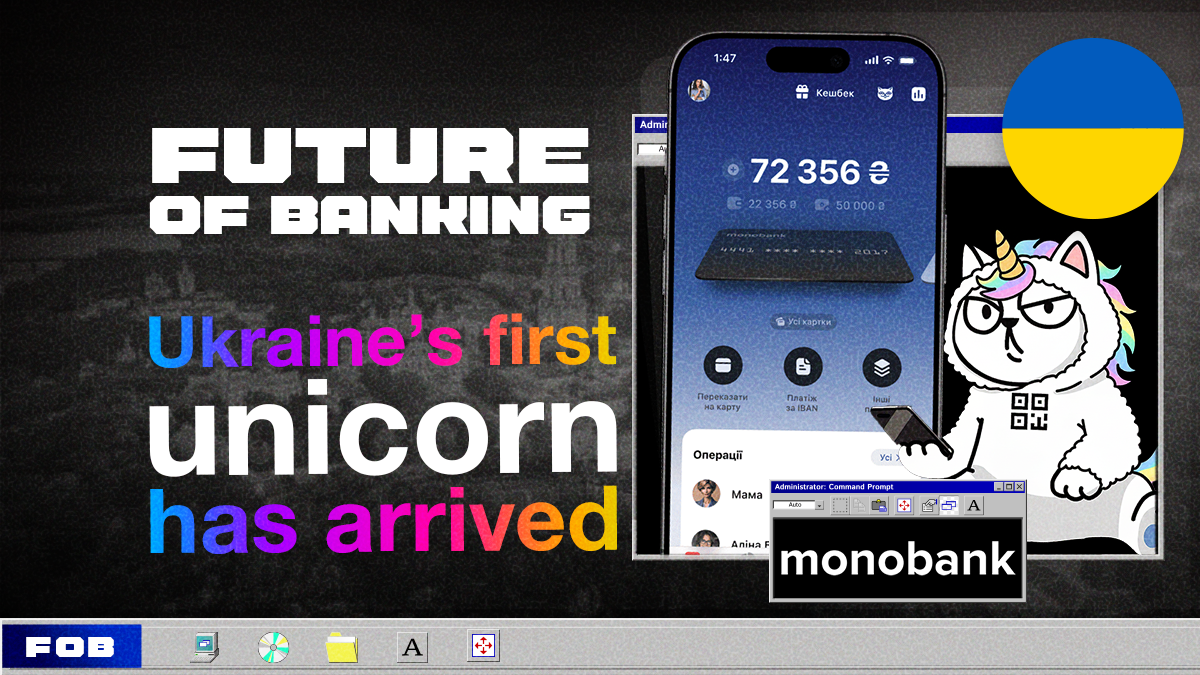

🦄 A FinTech Unicorn Is Born in Ukraine, and It’s a Neobank

Ukraine 🇺🇦 just got its first unicorn, and it’s a neobank!

FinTech-IT Group, the company behind Monobank, has officially joined the billion-dollar club after a major investment from the U.S. Enterprise Fund for Ukraine (UMAEF).

The Kyiv-based company now powers digital banking for nearly 10 million Ukrainians and thousands of SMEs — proving that even in the toughest times, innovation finds a way to thrive.

This isn’t just a FinTech milestone, it’s a symbol of resilience and global confidence in Ukraine’s tech future. UMAEF, backed by U.S. investors, sees FinTech-IT Group as a potential global player, with whispers of a future U.S. IPO already in the air..

Plenty more digital banking stories below 👇 scroll down and dive in.

Cheers,

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

NEWS

🇺🇦 U.S. enterprise fund for Ukraine (UMAEF) invests in FinTech-IT group, powering it to a $1bn valuation as Ukraine's first FinTech unicorn. Jaroslawa Z. Johnson, President and CEO of UMAEF, stated that with this investment, UMAEF is expanding its existing portfolio of FinTech investments made through u.ventures by supporting a local leader founded and developed by top-tier Ukrainian entrepreneurs.

🇬🇧 Shawbrook turns to Ardea and Goldman Sachs as IPO plans take off. Digital bank Shawbrook has confirmed it plans to float in London in a boost to the City. The lender said it intends to publish a registration document on 6 October for a listing on the London Stock Exchange’s main market.

🇵🇹 Revolut reaches an agreement with SIBS and officially joins MB Way. Revolut joined the MB Way network and began allowing instant transfers through the app, like other Portuguese banks. The British financial institution officially signed an agreement with SIBS to launch Multibanco. Additionally, Revolut hopes the Brazilian community in Portugal will help its growth in Brazil. "We believe we have created a base, which is demonstrated by the waiting list in Mexico of more than 200,000 people," Ignacio Zunzunegui, Director of Growth for Southern Europe, said.

🇷🇴 Revolut launches a new service in Romania. It has officially introduced the Beneficiary Name Display Service (BND), a function that allows verification of the recipient's name when initiating a payment to an IBAN account. Continue Reading

🇦🇪 Wio Bank deposits cross Dh50 billion as digital banking accelerates in UAE. The bank’s total customer base has grown 72% year-on-year, driven by a 93% jump in personal customers and a 42% rise in business accounts, reflecting a nationwide shift toward app-based banking solutions.

🇺🇸 Bud launches MCP server for AI-driven banking. With the new MCP server, developers and financial institutions can tap into these insights directly within AI experiences to answer questions about spending patterns, product suitability, affordability, and individual transactions, while respecting data consent and security boundaries.

🇬🇧 Ex-ClearBank executive Yasemin Swanson as a COO at OpenPayd. Swanson will be responsible for scaling OpenPayd’s operational infrastructure as it expands globally and secures additional regulatory milestones. Read more

🇮🇳 Razorpay unveils India’s First RBI-compliant biometric authentication for payments with YES BANK. Businesses, banks, and consumers are embracing online transactions more than ever, but with growth comes complexity. Despite the convenience of card payments, nearly 35% of transactions fail due to OTP delays, incorrect entries, or redirection issues.

🇬🇧 Tap Digital Banking partnership with Moorwand. Through this partnership, Tap will integrate Moorwand’s comprehensive Banking-as-a-Service (BaaS) platform to provide customers with dedicated GBP accounts, complete with Sort Codes and Account Numbers, and EUR accounts with individual IBANs.

🇺🇸 PayDo introduces US IBAN via SWIFT. This new feature allows businesses and professionals to receive US dollar payments directly, without delays from intermediary bank checks. At the same time, PayDo has extended its currency support to more than 60 national and regional currencies.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.