Agibank Cuts IPO Ambitions as Market Reality Bites

Hey Digital Banking Fanatic!

Agibank just made a sharp late call.

Hours before pricing its US IPO, the Brazilian FinTech cut both the price range and the deal size in half.

The offering now stands at 20 million shares priced between $12 and $13, down from an earlier plan to sell 43.6 million shares at up to $18. Timing mattered. So did sentiment.

The move comes as shares of PicPay are down nearly 20% since their own US debut, a reminder that public markets are in no mood for stretched FinTech valuations right now.

What’s striking is that demand was still there. The book was oversubscribed, but orders clustered at the lower end, forcing a reset just before the bell.

On February 2nd, I shared with you this change that didn't come out of nowhere. I explored exactly this tension in Connecting the Dots in FinTech. That's why I believe that today's price adjustment makes this analysis even more relevant.

More stories from the Digital Banking ecosystem are coming up soon. Scroll down to see what’s really moving the sector today 👇

Cheers,

INSIGHTS

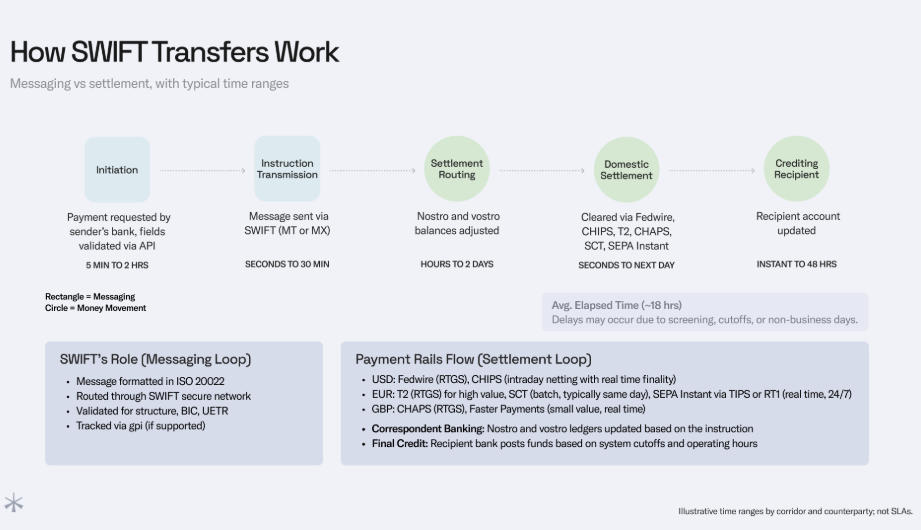

➡️ Stablecoins vs SWIFT: Routing Value by Logic, Not Legacy by Noah. Stablecoins bridge traditional finance and programmable payments, enabling faster, cheaper transfers than legacy rails. Bank cross-border payments still rely on BIC/SWIFT codes for secure messaging, but SWIFT only sends instructions; it does not move money. Read the full article here

NEWS

🇦🇪 Liv and Union Coop enter a strategic partnership to offer more value and rewards to UAE consumers. In collaboration with Mastercard, the companies will launch two co-branded credit cards that aim to enhance the shopping experience and reward everyday spenders in the UAE.

🇺🇸 FinTech Agibank slashes price, size of US IPO hours before sale. Agibank is now offering 20 million shares at $12–$13 each after market volatility and a sharp decline in competitor PicPay’s stock. Despite strong investor demand, orders were concentrated at the lower end of the original range.

🇲🇽 Revolut believes its goal of two million customers in Mexico, its first banking launch outside Europe, and expects rapid growth in the market. CEO Juan Guerra said strong demand during the beta phase prompted the company to double its first-year customer target, aiming for two million users in 2026 instead of one million.

🇬🇧 Revolut hires JPMorgan Chase UK CEO Kuba Fast to head Eastern Europe. Fast, who announced his departure from Chase this weekend via social media, will inherit the responsibilities currently held by Joe Heneghan. He will oversee the neobank's operations and lead Revout's business in Eastern Europe.

🇧🇷 Nubank is highlighting the security tool Street Mode. This feature limits transactions outside of trusted Wi-Fi networks, allows partygoers to enjoy the festivities safely, and provides protected Pix insurance, covering fraud after theft or coercion up to R$5,000 per year.

🇧🇷 PicPay recruits João André Pereira, former Central Bank governor, to lead Risk Management. With an 18-year career at the Central Bank, he worked in the areas of Regulation and Supervision. Read more

🇦🇪 Zand and Ripple are in a strategic partnership to power the digital economy with stablecoin and blockchain innovations. The partnership will see Zand and Ripple work together to explore initiatives, including enabling support for RLUSD within Zand’s regulated digital asset custody and issuance of AEDZ on the XRP Ledger (XRPL).

🇬🇧 Nationwide allows mortgage deeds to be signed digitally. Anyone purchasing a property or looking to remortgage with Nationwide will now be able to sign their mortgage deed electronically if their solicitor or conveyancer is set up to use Qualified Electronic Signature (QES).

🇺🇦 Monobank will offer currency transactions with euros and dollars. Funds remain available for withdrawal at any time. The launch was announced by monobank co-founder Oleg Gorokhovskyi. According to him, now currency savings can bring profit without blocking funds.

🇺🇸 BitGo Bank & Trust, N.A., and InvestiFi partner to support nationwide digital asset investing for banks and credit unions. Through the partnership, InvestiFi will offer digital asset trading capabilities to participating banks and credit unions across all 50 states, supported by BitGo’s Crypto-as-a-Service (CaaS) infrastructure.

🇫🇷 Naboo raises $70M from Lightspeed for AI-powered events procurement. Naboo plans to expand beyond corporate events into broader procurement use cases, using AI to automate booking, payments, and tender management, while exploring adjacent categories with complex spending, compliance, and supply chain requirements.

🇺🇸 Experian introduces high yield digital savings account. With the ability to save built directly into the Experian ecosystem, members can track their savings growth alongside credit improvements, creating a clearer picture of their overall financial health.

🇺🇸 Hobbit-inspired startup Erebor Bank becomes first new bank greenlighted by Trump 2.0, launching with $635 million in capital to serve startups and wealthy clients. The bank aims to fill the gap left by Silicon Valley Bank’s collapse, focusing on defense and industrial tech companies.

🇺🇸 Bottomline and Koxa partner to deliver ERP-Banking. The collaboration enables Bottomline’s bank clients to offer a fully integrated ERP-banking experience to their corporate and treasury customers, but without the cost, risk, or complexity of building and maintaining custom API infrastructure.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.