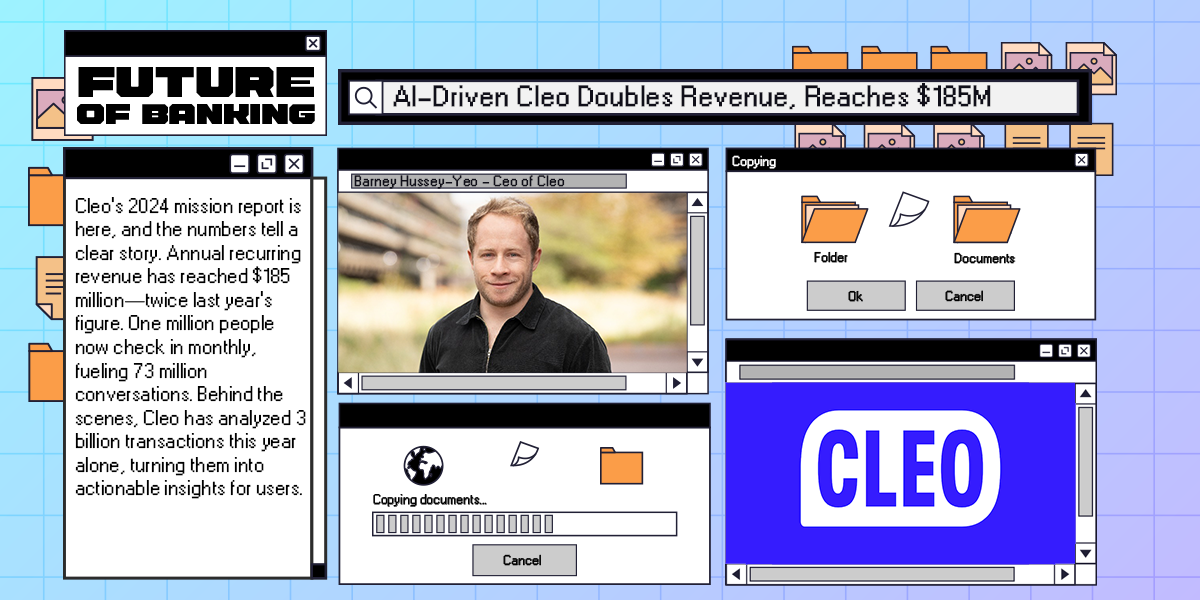

AI-Driven Cleo Doubles Revenue, Reaches $185M

Hey Digital Banking Fanatic!

Cleo’s 2024 mission report is here, and the numbers tell a clear story. Annual recurring revenue has reached $185 million—twice last year’s figure. One million people now check in monthly, fueling 73 million conversations. Behind the scenes, Cleo has analyzed 3 billion transactions this year alone, turning them into actionable insights for users.

Founded in 2016 by machine learning expert Barney Hussey-Yeo, Cleo started as a simple chatbot for budgeting. Today, it’s a full-fledged AI-powered financial assistant, combining automation, insights, and a conversational interface.

Based in the UK but primarily operating in the U.S., Cleo connects with young, tech-savvy users, using gamification and open banking to make money management more engaging.

Since last year, the AI transformation has been in full swing. Cleo now operates on a comprehensive AI system that blends GPT-4, real-time data, and deep learning.

Instead of just responding, Cleo’s models are proactive—they anticipate needs, spot trends, flag risks, and deliver insights before users even ask. Engagement has surged by 264% YoY, showing that users are sticking around.

New features are making everyday money management smoother. AI-powered Save Hacks, spending challenges, and proactive alerts help users catch unnecessary costs before they add up.

Cleo has doubled its key metrics for four straight years. What’s next? Becoming a unicorn or turning profitable?

Scroll down for more interesting Digital Banking industry news updates and I'll be back in your inbox tomorrow!

Cheers,

Stay Ahead in FinTech! Subscribe to my Telegram channel for daily updates and real time breaking news. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

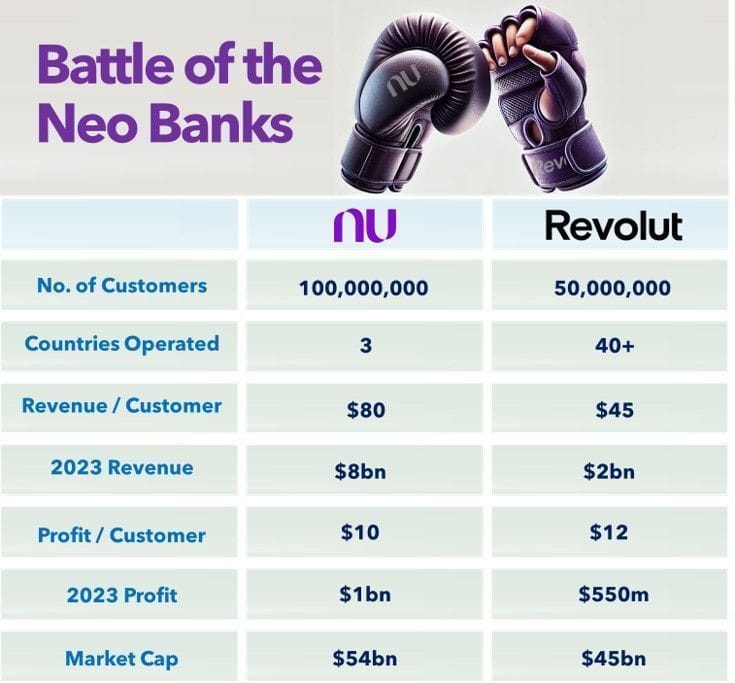

Battle of the neobanks: Nubank 🆚 Revolut

A Comparison of 2024 Key Stats👇

DIGITAL BANKING NEWS

🇬🇧 Cleo released its 2024 Annual Report, doubling its ARR to $185m. The report showcases Cleo's expansion in user base, improvements in its AI-driven financial assistant, and strategic partnerships, emphasizing Cleo's focus on financial inclusion, offering users better insights into their spending and savings.

🇦🇺 Digital bank Up lands new CTO Meera Shanaaz Aneez. Her role as CTO includes overseeing Up’s technical strategy, ensuring the platform continues to scale, and delivering innovative solutions to enhance the banking experience for customers.

🇺🇸 Momnt has bolstered its leadership team. Ryan Brennan has joined as CBO, bringing over 20 years of experience. Cara Rivera has been promoted to COO, responsible for compliance, IT, security, and project management. Lindsay McAndrew has been promoted to CPO, with a background in product roles at Momnt and other companies.

🇮🇹 UniCredit secures ECB's approval for Commerzbank stake. ECB approval was expected given UniCredit's strong balance sheet and the banking supervisor's supportive stance on consolidation efforts. Read more

🇺🇸 Block announces that its industrial bank, Square Financial Services (SFS), received approval from the Federal Deposit Insurance Corp (FDIC) to offer the company’s consumer loan product Cash App Borrow. Continue reading

🇬🇧 Curve lands £37M in funding led by a VC firm that invests in early and growth stage startups. The company said its latest funding will help it on the road to make a full-year profit and new product launches. Keep reading

🇺🇸 Citigroup to ‘hire thousands’ of permanent IT staff and cut contractors. The bank aims to streamline operations and address regulatory failings that led to hefty fines. An internal presentation reveals plans to reduce external IT contractors by 30%.

🇺🇸 Tomo secures $20M in funding as it scales AI-powered mortgage solutions. The new funding will support Tomo’s expansion across the United States, including hiring loan officers and mortgage professionals for its offices in Detroit, Seattle, and New York.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.