Anchorage Digital Prepares A $400M Raise as IPO Talk Gets Louder

Hey Digital Banking Fanatic!

Anchorage Digital is reportedly looking to raise between $200 million and $400 million as IPO speculation builds.

The timing isn’t random. Anchorage has been broadening its footprint, from asset management acquisitions to moves across stablecoins, token infrastructure, and venture exposure.

At a last valuation of $3 billion, the company looks increasingly IPO-ready. Competition is tightening, too. More crypto firms are securing bank charters or trust approvals, raising the stakes for scale and diversification.

Anchorage was the first federally chartered digital asset bank in the US. Watching the moves stack up, this feels like a company preparing for what comes next.

Meanwhile, Revolut Pushes Deeper Into LatAm 🇵🇪

Revolut has applied for a full banking license in Peru, continuing its rapid expansion across Latin America. Mexico is live. Colombia is approved. Argentina acquired. Brazil is already in play.

From Revolut’s perspective, this is about breaking concentration and improving everyday banking for a broader slice of the population.

Peru’s market is highly concentrated, and Revolut sees that as an opportunity... “Our main competitors are incumbents, because there are no huge new players like Nubank or Mercado Pago,” said Revolut Peru Chief Executive Officer Julien Labrot.

If you’re tracking how Digital Banking players are preparing for the next growth phase, keep scrolling 👇

Cheers,

INSIGHTS

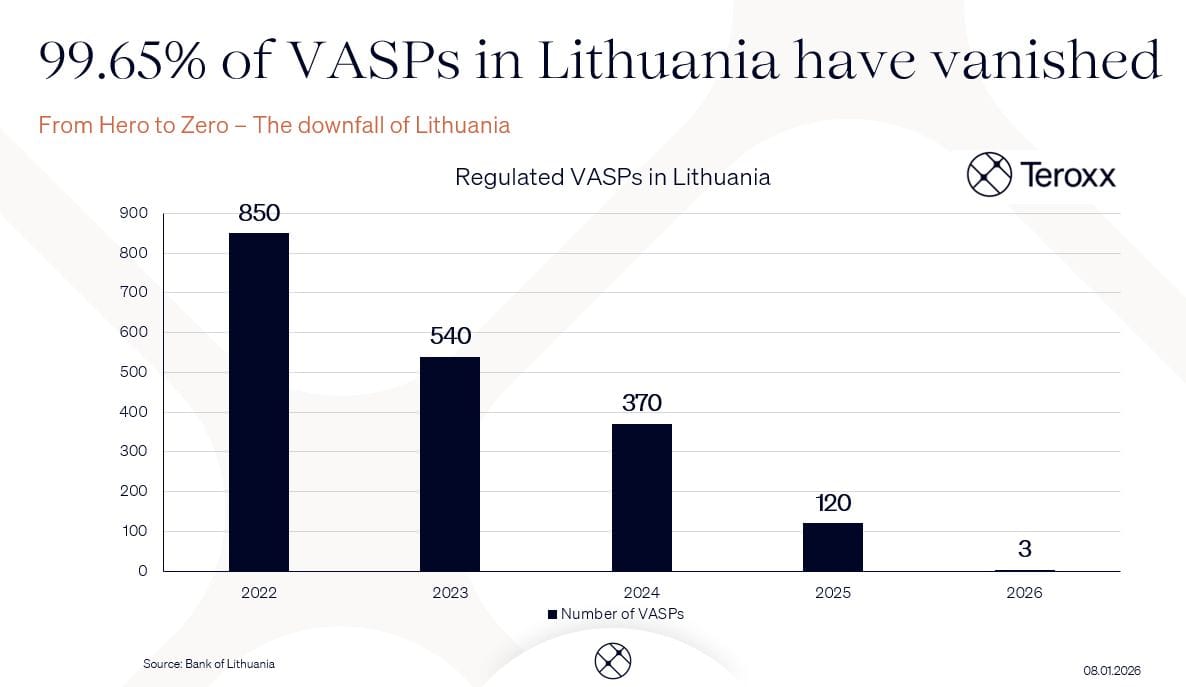

🇱🇹 From Hero to Fallout: Lithuania after MiCA.

From Europe’s fastest crypto gateway to a regulatory hard stop.

NEWS

🇺🇸 Anchorage Digital eyes $400M raise as IPO speculation grows. Crypto bank Anchorage Digital plans to raise between $200 million and $400 million ahead of a possible initial public offering (IPO) expected as early as “next year.” Read more

🇬🇧 Monzo to give outgoing CEO TS Anil an expanded role after investor backlash. Monzo initially planned for Anil to move into an advisory role and leave the board, but after talks with shareholders, Monzo now intends to keep him on with a broader remit. Additionally, Monzo launches a new tool ahead of the income tax policy shift. The bank said its new, free tool will make following the MTD requirements simpler and more accessible.

🇵🇪 Revolut seeks a Peruvian banking license for Latin America expansion. The license would allow Revolut to offer Peruvians a range of localized products and services, giving them greater control over their finances. Revolut sees remittances and multi-currency offerings as a competitive advantage in Peru.

🇪🇺 Revolut to enable frictionless checkout across all agentic commerce platforms for the UK and EEA. This strategic focus will help position Revolut Pay as both the secure, universal, 1-tap payment solution for consumers and a powerful sales booster for Revolut Business merchants in conversational and automated shopping environments.

🇧🇷 Nubank launches Fee Calculator, a calculator that shows the net value of a sale to the merchant. The digital tool informs entrepreneurs of the real net value they will receive in sales made through the company's payment solutions. The new feature focuses specifically on transactions made via payment link and Tap to Pay.

🇬🇧 Atom Bank tops £1bn commercial mortgages lending, with balances growing 24% year-on-year in the past 12 months. Atom said the final three months of 2025 saw it set a new record for commercial mortgage offers, which was achieved with a month remaining within the quarter.

🇰🇷 Kbank cuts valuation by 20% in third IPO push. According to financial industry sources, Kbank filed a securities registration statement with the Financial Services Commission to officially launch its initial public offering (IPO) process for a listing on the main Kospi market.

🇸🇬 Sea injects another S$75 million into MariBank amid revenue growth. The latest funding comes as digital lenders across the region place greater emphasis on improving profitability and strengthening customer engagement, following an initial phase of rapid deposit growth.

🇦🇪 NEO PAY and Wio Bank collaborate to launch a PoS lending solution for merchants across the UAE. This partnership between NEO PAY and Wio Bank empowers SMEs with seamless access to funding, enabling them to overcome financial barriers and drive growth.

🇨🇦 Kuda Bank to launch in Tanzania and Canada. Kuda’s expansion plans follow a strong 2025 performance, marked by significant growth in transactions, savings, and credit usage across its platform. Read more

🇸🇸 South Sudan ends cash payments for passports, launches digital system to curb leakages. Under the new setup, applicants pay digitally through an on-site commercial bank, with receipts automatically linked to the immigration system, allowing documents to be processed without staff handling cash.

🇳🇬 Sterling Bank joins Thunes’ Direct Global Network to transform cross-border payments for Nigerian expatriates. The collaboration means new and existing Sterling Bank account holders can now benefit from seamless, instant cross-border payments.

🇧🇷 CashU raises $23M for credit fund. CashU will use the funds to originate credit and validate the performance of its proprietary credit models within a regulated environment. Keep reading

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.