Block Expands Cash App into Full-Service Banking

Hey Digital Banking Fanatic!

Block is expanding its services to position Cash App as more than just a payments tool. The FinTech, led by Jack Dorsey, is pushing deeper into banking products for US households.

The app now counts 57 million monthly active users, but converting them into banking customers is a challenge. Currently, 2.5 million users are routing their paychecks into Cash App, a figure that has grown by 25% year-over-year. Block sees this as a key indicator that users are willing to go beyond P2P transfers.

To solidify that shift, Cash App now offers high-yield savings accounts, debit cards, and short-term lending. The FinTech has also leaned into BNPL through its Afterpay acquisition. In March, its banking subsidiary, Square Financial Services, received FDIC approval to issue consumer loans, further blurring the line between FinTech and traditional banks.

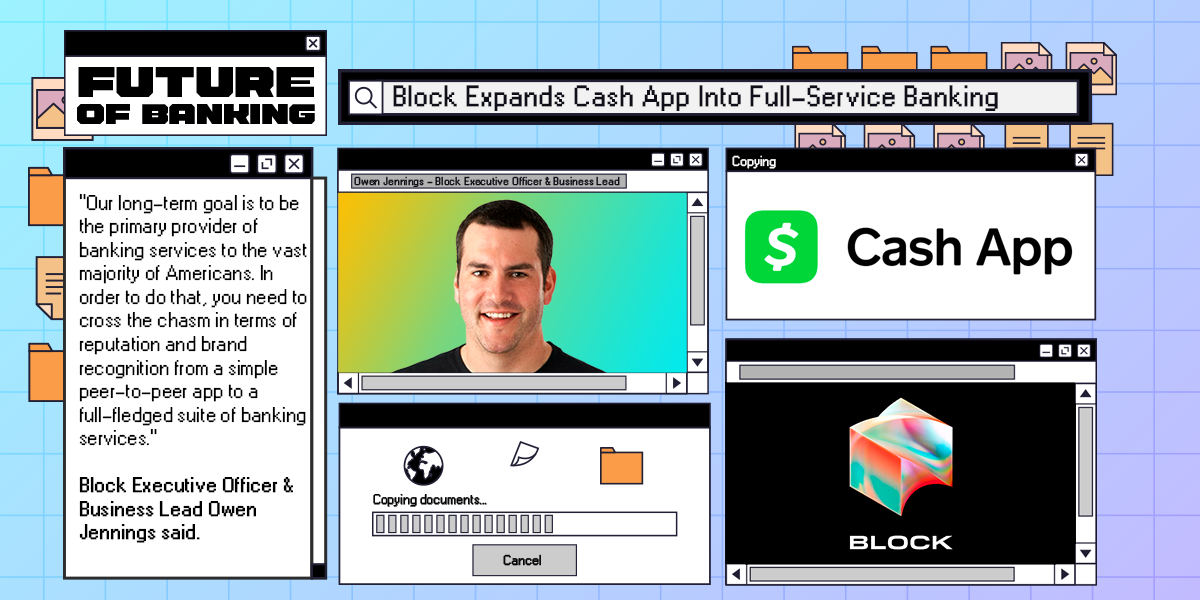

“Our long-term goal is to be the primary provider of banking services to the vast majority of Americans. In order to do that, you need to cross the chasm in terms of reputation and brand recognition from a simple peer-to-peer app to a full-fledged suite of banking services.” Block Executive Officer & Business Lead Owen Jennings said.

But Block isn’t the only FinTech making a play for mainstream digital banking. Chime, Robinhood, and other FinTechs have already built significant customer bases. At the same time, regulatory scrutiny has intensified—Cash App was recently ordered by the CFPB to refund $120 million over fraud-related disputes.

Read more on Digital Banking industry below 👇 and I'll be back with more tomorrow!

Cheers,

Network & Run - Looking for a space where networking meets fitness? Join our weekly runs and connect with FinTech Fanatics while staying active! Check out April/May schedule & Sign Up Here to be part of a vibrant community of over 19+ cities.

DIGITAL BANKING NEWS

🇺🇸 FinTech firm Block expands its mobile platform into banking. The app now offers high-yield savings accounts, debit cards, short-term lending, and buy now, pay later options via Afterpay. Read more

🇺🇸 BNY Mellon launches Blockchain Accounting Tool, BlackRock as first client. The tool, officially named Digital Asset Data Insights, allows the bank to publish a fund’s net asset value (NAV) directly onto a blockchain, eliminating reliance on third-party accounting services.

🇺🇸 Brex sees procurement push onto its card. Corporate buyers are exploring ways to move their spending onto cards for better tracking and insight. The goal is to facilitate the purchase and the subsequent tracking of those transactions, including ways to supervise, analyze, optimize, and ultimately improve a company’s spending.

🇧🇷 Itaú Unibanco is exploring the creation of a real-pegged stablecoin as it awaits regulatory clarity from the Central Bank’s ongoing public consultation. Speaking at a bank event in São Paulo, Guto Antunes, the Head of Digital Assets at Itaú Unibanco, said that stablecoins have long been on the bank’s radar.

🇬🇷 Revolut surpasses 1.5 million users in Greece. The increase in the use of investment services in Greece is notable, with a 212% rise in the number of customers opening investment accounts. This development underscores the growing trust in digital financial services.

🇲🇦 Is Morocco next on Revolut’s global roadmap? Rumours suggest that Revolut is hiring senior managers in Morocco, hinting at a possible market entry. The waitlist has been active since 2021, and with over 3 million Moroccans living in Europe, the remittances corridor makes this move a strategic one.

🌎 Jumpstart raises R$2.8 million and uses AI to give credit and advice to immigrants. The company leverages artificial intelligence (AI) to provide immigration assistance and finance services, such as visa processing, housing, and car rentals.

🇺🇸 Tether eyes issuing new stablecoin for U.S. market. It plans to set up a U.S. domestic entity, potentially called Tether USA. The new stablecoin could be used for payments, digital economy and interbank settlement. Market makers could help convert the US stablecoin to USDT, providing liquidity for the new token.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.