Brazil’s Banking Crisis Worsens as Banco Pleno Follows Banco Master

Hey Digital Banking Fanatic!

Brazil’s central bank just liquidated Banco Pleno.

Another institution tied to Banco Master.

And another escalation in the country’s biggest banking fraud probe. 👀👇

Pleno held just 0.04% of system assets. Small on paper. But 160,000 creditors are affected. Up to R$4.9 billion linked to the case.

This didn’t come out of nowhere. Banco Master was liquidated in November. Executives were arrested. Allegations of fabricated credit instruments and distribution to investors.

The ripple effects are still spreading...

And the pressure lands on the FGC deposit insurance fund. Itaú estimates the Master impact alone could reach R$55 billion. That bill will be replenished by Brazil’s banks. And that matters.

The cleanup phase is gaining speed. I’ll map the next implications for the sector very soon. Keep scrolling for more updates! 👇

Cheers,

INSIGHTS

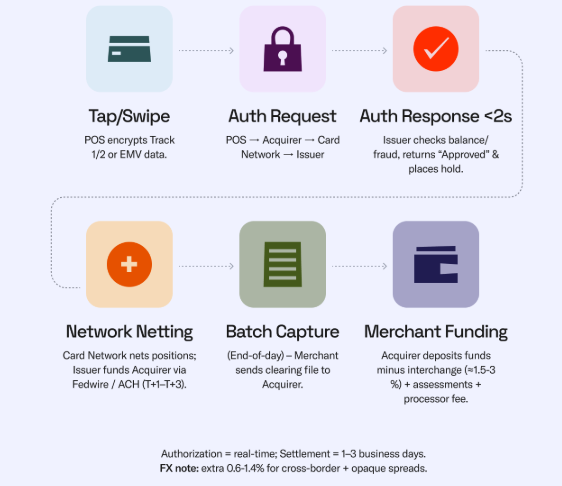

📰 Speed Meets Trust: The Evolution of Money from Paper Bonds to Programmable Dollars by Noah. Stablecoins mark the next step in money movement, combining instant settlement with programmable transparency. Unlike bearer bonds, which enabled borderless speed through anonymous physical certificates, stablecoins provide fast digital transfers with an auditable trail, aiming to balance efficiency with accountability. Read the full article here

NEWS

🇧🇷 Brazilian regulator liquidates bank with ties to Banco Master. Brazil's central bank liquidated Banco Pleno SA due to a deteriorated liquidity situation and violation of central bank decisions. The central bank also liquidated Pleno Distribuidora de Títulos e Valores Mobiliários SA, and blocked assets from controlling shareholders and management.

🇺🇸 Stripe's stablecoin firm Bridge wins initial approval of national bank trust charter. "This approval positions Bridge to help enterprises, FinTechs, crypto businesses, and financial institutions build with digital dollars inside a clear federal framework," the company said in the press release.

🇪🇺 Revolut Bank has begun checking old transfers from Russians living in the EU. The checks specifically concern SWIFT transfers, card number transfers, and transactions through Sberbank. Several clients were asked to confirm the origin of funds transferred from Kazakhstan or other CIS countries.

🇺🇸 Delaware-based Rizon has secured $2 million in pre-seed funding as demand for borderless U.S. dollar banking accelerates worldwide. The fresh capital will help Rizon scale its user base globally and deepen its footprint in new markets where access to reliable dollar banking remains limited.

🇺🇸 b1BANK partners with Covecta to deploy agentic AI. The collaboration focuses on streamlining and automating repeatable, policy-driven activities across core deposit and loan operational processes, reducing manual effort and operational friction so that teams can devote more time to higher value-adding work, including analysis, exception handling, and customer engagement.

🇨🇱 Chilean FinTech Global66 seeks an international banking license to expand its financial services in multiple countries. CEO Tomás Bercovich said the firm is exploring an overseas banking licence to expand regionally and has begun using stablecoins as part of its technology-driven growth strategy.

🇦🇷 Colombian unicorn Habi lands in Argentina after acquiring Pulppo to accelerate the digitalization of mortgage lending. The agreement stipulates that both brands will maintain their independent identities but will integrate operational functions to develop a robust mortgage model in Argentina. This dual-brand strategy allows Habi to penetrate the local market by leveraging Pulppo's existing brand recognition.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.