Brazil’s Digital Bank PicPay Is Heading for Wall Street

Hey Digital Banking Fanatic,

One of Brazil’s biggest mobile banks is dusting off its IPO dreams.

PicPay, yes, the same FinTech backed by the billionaire Batista family (of JBS fame), is reportedly preparing a $500 million U.S. IPO, working with Citi, RBC, and Bank of America.

After pulling its first listing attempt in 2021 (back when it aimed for an $8B valuation), the timing now looks far better: the company doubled revenue year-on-year to R$4.5B and turned a solid profit of R$208M ($38M) in the first half of 2025.

If successful, this could mark the biggest Latin American digital bank listing since Nubank’s blockbuster debut, and another sign that public markets are warming up to FinTech again.

But with the SEC still dealing with a partial shutdown, timing could be everything.

Scroll down👇 to read what else is happening across the digital banking world today.

Cheers,

INSIGHTS

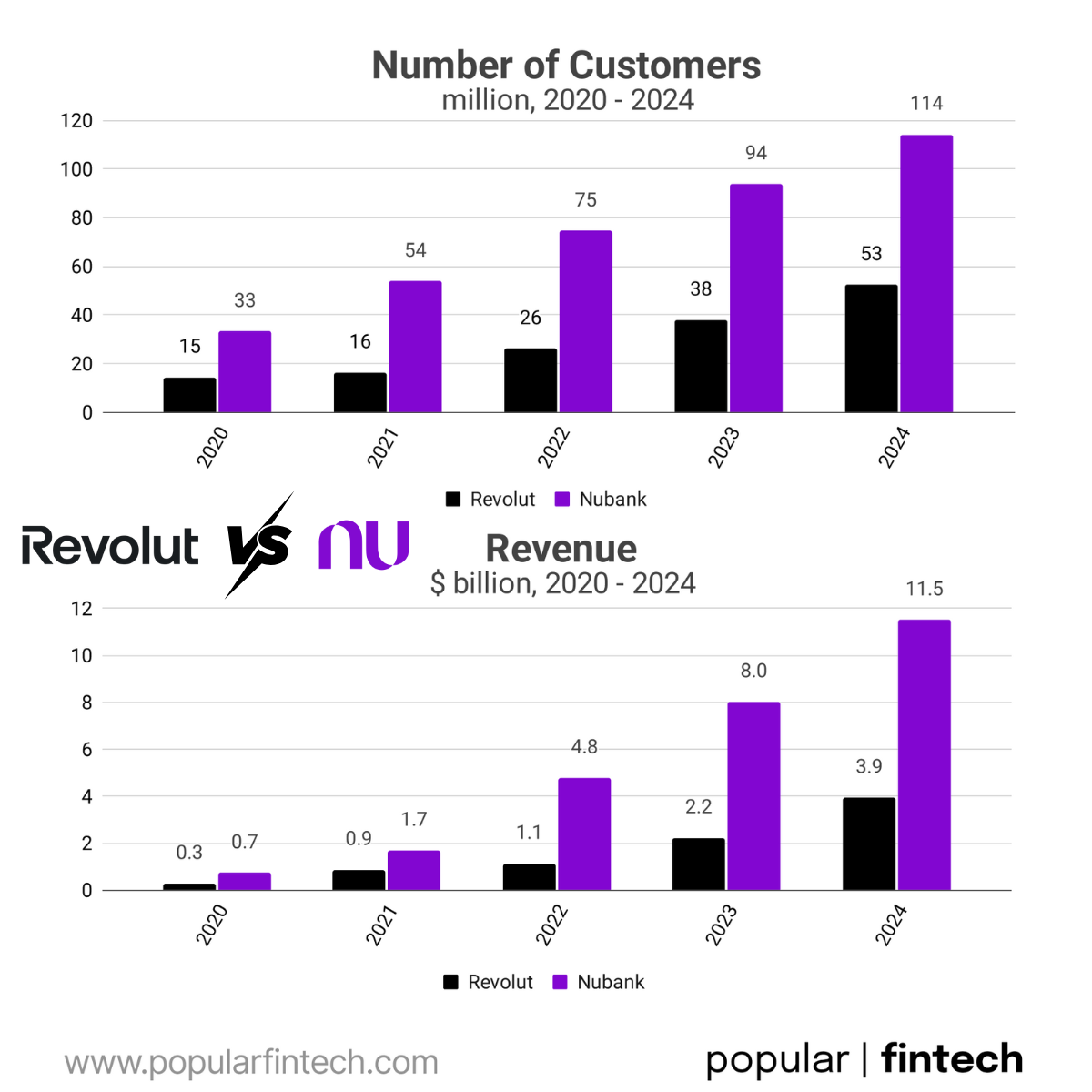

📈 Revolut 🆚 Nubank

The numbers tell a fascinating story👇

NEWS

🇺🇸 Brazilian FinTech PicPay is reportedly seeking $500 million in a US IPO. PicPay offers financial services including digital wallets, cards, loans, and investments, and reported 208.4 million reais in profit on 4.5 billion reais in revenue in the six months through June 30.

🇺🇸 Yodlee launches credit subsidiary. The milestone reflects Yodlee’s commitment to advancing credit decisioning and supporting financial ecosystems with actionable, consumer cashflow data. By partnering with Yodlee Credit, lenders can incorporate alternative consumer data into their credit models to responsibly expand access to credit.

🇬🇧 MQube tokenises £1.3bn mortgage debt in European first. The tokenisation converts mortgage debt into digital tokens recorded on a distributed ledger. While equity, bonds, and real estate have been tokenised in previous transactions. Keep reading

🇪🇬 FABMISR taps Noon Payments to advance FinTech evolution. By combining FABMISR’s banking expertise and technological infrastructure with Noon Payments’ dynamic FinTech platform, the initiative will streamline digital transactions, improve security, and simplify payment processing for merchants across Egypt’s fast-growing online retail sector.

🇵🇪 BCP launches Criptococos powered by BitGo. Criptococos was developed by BCP as part of its initiative to explore digital assets and emerging financial technologies. The goal is to offer clients the trusted security of the Peruvian financial system within the evolving landscape of modern digital assets.

🇰🇷 FSS urges caution on easing FinTech rules after N26 resignations. According to the FSS report, Germany’s Federal Financial Supervisory Authority (BaFin) recently found deficiencies in N26’s company-wide internal control systems and processes and organization in an inspection. Based on this, BaFin signaled sanctions against its co-founder and CEO.

🌍 Major banks explore issuing stablecoin pegged to G7 currencies. The project, which is in its early stages, will explore whether there is value in issuing assets on public blockchains that are pegged 1:1 to real-world currencies, a type of cryptocurrency known as stablecoins.

🌍 HSBC’s former top European banker, Colin Bell, joins Starling. Starling has added the former head of HSBC in Europe to its board as the digital bank looks to grow its international footprint. Colin Bell has joined Starling as an independent non-Executive Director.

🇬🇧 OpenPayd appoints ClearBank's Yasemin Swanson as Chief Operations Officer. In a statement, OpenPayd says Swanson will focus on operational infrastructure to support global expansion, while working with the leadership team, including founder Dr Ozan Özerk and CEO Iana Dimitrova, to deliver the continued development of payment innovations.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.