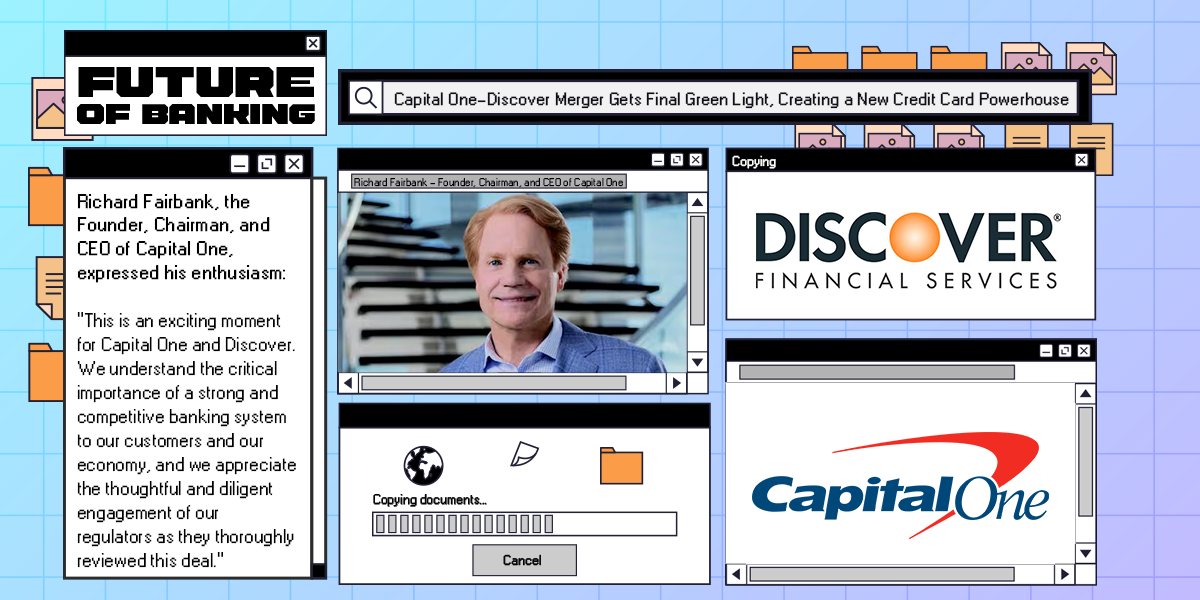

Capital One-Discover Merger Gets Final Green Light, Creating a New Credit Card Powerhouse

Hey Digital Banking Fanatic!

After a thorough 14-month review, Capital One has secured all necessary regulatory approvals to acquire Discover Financial Services in a $35.3 billion all-stock deal. When the transaction closes on May 18, 2025, it will create the largest credit card issuer in the United States. Both the Federal Reserve and the Office of the Comptroller of the Currency (OCC) have given their approval, though the OCC has made its approval contingent on Discover resolving some outstanding enforcement actions and customer remediation issues.

Richard Fairbank, the Founder, Chairman, and CEO of Capital One, expressed his enthusiasm: "This is an exciting moment for Capital One and Discover. We understand the critical importance of a strong and competitive banking system to our customers and our economy, and we appreciate the thoughtful and diligent engagement of our regulators as they thoroughly reviewed this deal."

Discover's Interim CEO, Michael Shepherd, shared similar sentiments: "The combination of our two great companies will increase competition in payment networks, offer a wider range of products to our customers, increase our resources devoted to innovation and security, and bring meaningful community benefits."

Shareholders from both companies have shown strong support for the merger. As part of the deal, Capital One has committed to a $265 billion, five-year community benefits plan aimed at fostering economic opportunity across the country. Customers can breathe easy knowing that no immediate changes are expected for their accounts once the merger is complete.

Read all the other Digital Banking industry news below, and I'll be back with more tomorrow!

Cheers,

Network & Run - Looking for a space where networking meets fitness?🏃♂️💬Join our weekly runs and connect with FinTech Fanatics while staying active! 📅Check out April/May schedule & Sign Up Here to be part of a vibrant community of over 19+ cities.

DIGITAL BANKING NEWS

🇺🇸 Capital One’s $35 billion deal for Discover gets the Green Light. Approval could help encourage deals in the financial services industry. The deal is expected to close in May, subject to closing conditions. Continue reading

🇹🇻 Tuvalu, with just 11,000 citizens, makes banking history; gets its first-ever ATMs in 2025, marking a significant milestone in its financial modernization. The ATMs, located in Funafuti and other key areas, currently support prepaid cards, with plans to expand to debit and credit card services in the future.

🇺🇸 U.S. Bank closes five local branches. The Blackfoot closure is one of several branch shutdowns scheduled in southern and eastern Idaho over the next month. U.S. Bank notified customers of the affected branches in January and assured them their accounts and services would remain uninterrupted.

🇮🇹 Bancomat lands on Google Pay: Intesa Sanpaolo opens up to digital payments via smartphone. For the first time in Italy, the banking group’s customers can now add their card to Google Wallet and make payments directly with an Android smartphone.

🇵🇰 SBP launches 'Go Cashless' campaign to promote digital economy. This move is part of the central bank’s broader push to enhance financial inclusion and increase documentation of the economy through digital transactions. Keep reading

🇺🇬 MTN’s SASE solution powers PostBank’s digital revolution. For Post Bank, this means optimized connectivity across its branches, improved reliability, and cost-effective scalability—critical factors in Uganda’s competitive banking sector.

🇺🇸 Credit Builders Alliance and VantageScore expand nonprofit lenders pilot program. The platform developed in collaboration with data firm Pentadata provides lenders with a comprehensive view of consumers' financial behavior by combining traditional credit data with real-time, consumer-permissioned cash flow insights from bank accounts.

🇨🇳 Payoneer enters China with Easylink payment acquisition. According to CEO John Caplan, the acquisition strengthens Payoneer’s global regulatory infrastructure and enhances its ability to serve customers with more localized and advanced products and services.

🇧🇦 Card payments are getting more popular in Bosnia and Herzegovina. According to a recent report, cash on delivery was still the most commonly used payment method in the country, with a share of 46.4 percent last year. However, card payments are on the rise, growing from 32.8% in 2023 to 43.1% in 2024.

🇶🇦 QNB joins hands with Harrods and Visa to provide ‘unrivalled’ payment experience. This collaboration will see the launch of the QNB Harrods co-branded Visa credit cards exclusively in Qatar, offering customers an unprecedented blend of superior, convenient, and secure payment methods.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.