Circle and BitGo Eye U.S. Bank Charters as Crypto Firms Seek Regulatory Clarity

Hey Digital Banking Fanatic!

Major cryptocurrency firms, including Circle and BitGo, are reportedly preparing to apply for U.S. banking licenses, signaling a strategic shift toward deeper integration with the traditional financial system.

The push for banking licenses aligns with recent legislative developments, including the advancement of the Stablecoin Transparency and Accountability for a Better Ledger Economy (STABLE) Act and the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act. These bills propose frameworks for stablecoin regulation, potentially requiring issuers to secure federal or state charters.

Bank status would give these crypto players direct access to the financial rails, offering services such as deposit-taking and lending. While this transition would subject them to stricter regulatory oversight, it could also provide greater legitimacy and access to the broader financial infrastructure.

If Circle and BitGo pull this off, expect a wave of others to follow. The next crypto chapter may not be about going around banks, but becoming one.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

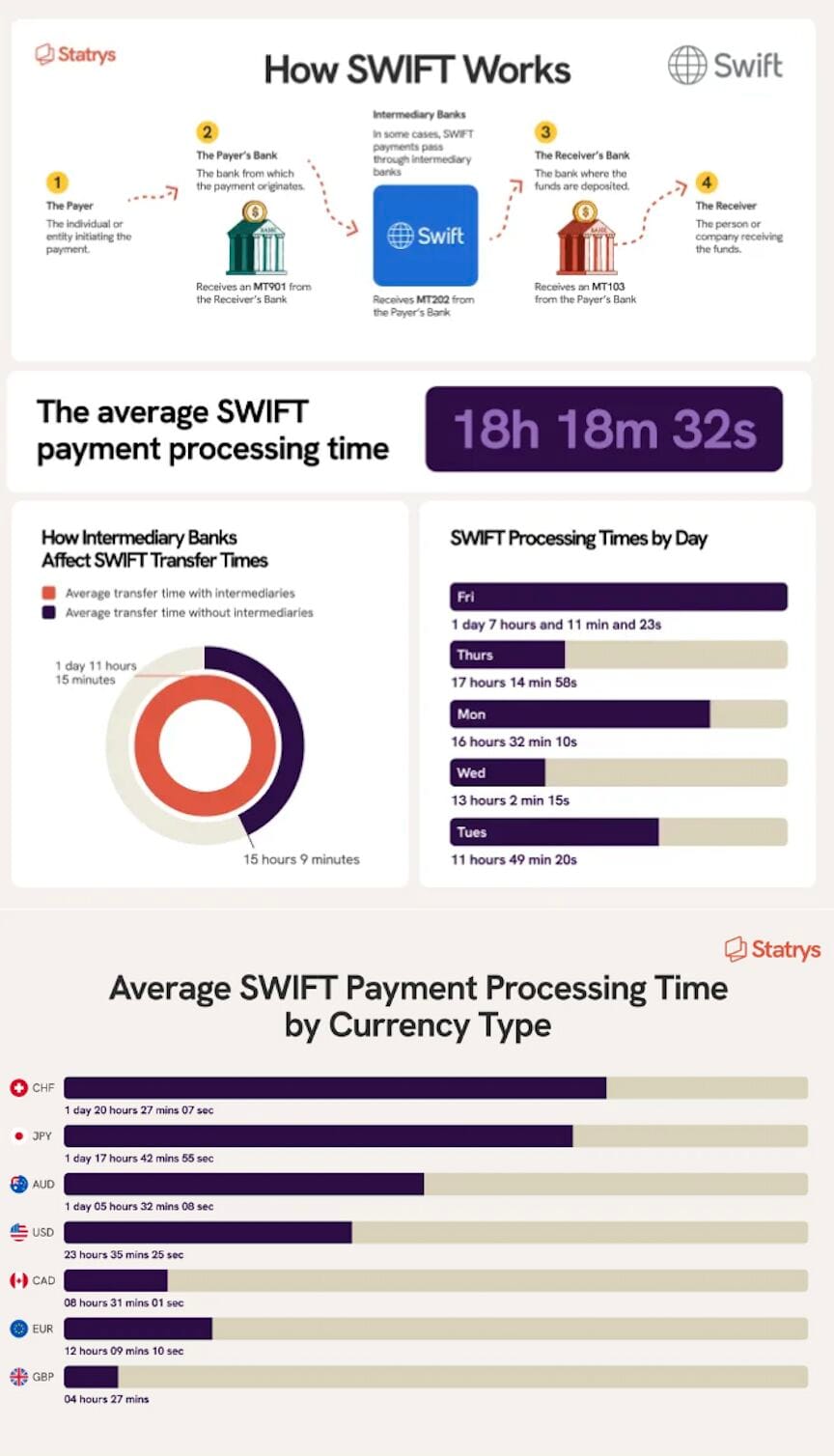

💰 What is a SWIFT Payment? And how long do SWIFT Payments take in 2025?

DIGITAL BANKING NEWS

🇺🇸 Big shift in U.S. banking: Federal payments go 100% digital by September 2025. The initiative aims to improve efficiency, lower costs, and reduce check-related fraud. Industry experts view the executive order as a significant policy shift. Phil Bruno, Chief Strategy and Growth Officer at ACI Worldwide, noted that its true significance lies in Washington’s expanding role in shaping the movement of money across the economy.

🇺🇸 Circle and BitGo are about to apply for bank charters. According to a Wall Street Journal report, Circle, BitGo, and others are considering applying for some form of banking license. Other firms cited include the publicly traded US-based crypto exchange Coinbase and the stablecoin issuer Paxos.

🇸🇬 Revolut app in Singapore now supports 39 currencies. The firm has expanded its currency offerings by adding five new currency wallets to its app. Customers can now exchange and hold Chinese yuan (CNY), Vietnamese dong (VND), Moroccan dirham (MAD), Icelandic króna (ISK), and Serbian dinar (RSD).

🌍 Europe’s FinTechs want to bank the rich. Europe’s digital private banking FinTechs spot opportunity as Revolut and Robinhood push into targeting wealthy clients. Continue reading

🇵🇭 Winston Damarillo’s Higala building a ‘Pix+Nubank’ for Philippines. That means taking an existing but overlooked real-time payments network, called InstaPay, and transforming it to better serve the country’s many community, rural, and thrift banks, which to date have lacked the resources to embark on their own digitalization.

🇬🇧 Swiss private bank EFG courts wealthy Asian clients in London. It is launching a London-based team to attract Asian clients who are looking to diversify. The move is the latest sign that the UK capital has retained its position as a hub for managing the money of the ultra-rich.

🇺🇸 BNY upgrades compliance monitoring by completing the implementation of Behavox Quantum AI. The SaaS implementation of Behavox covers BNY’s various communication channels across 16+ languages. BNY is benefiting from Behavox’s flagship Quantum AIRP across Compliance and Conduct.

🇳🇱 Bunq introduced a new way to protect users from Apple Pay and Google Pay scams. Whenever a bunq card is added outside of the app, two layers of security are in place. First, users receive the standard SMS containing a one-time verification code. In addition they are required to give their explicit approval within the bunq app.

🇲🇦 Bank Al-Maghrib issues digital banking security guide as online services grow, to help customers protect themselves from the growing digital crimes. Customers can check balances, transfer money, and even apply for loans with just a few clicks on a computer or smartphone.

🇺🇸 Private Bancorp of America, Inc. announces strong net income and earnings per share for the first quarter of 2025. The Company reported net income of $10.6 million, or $1.80 per diluted share, compared to $10.7 million, or $1.82 per diluted share, in the prior quarter.

🇬🇧 NatWest investors to scrutinise pay in last AGM before full privatisation. NatWest will hold its last annual shareholder meeting before returning to full private ownership, with the government expected to sell its remaining stake in the bailed-out bank in the coming weeks.

🌍 Fake banking apps leave sellers thousands out of pocket. These apps, which convincingly mimic legitimate platforms, display false ‘successful payment’ screens in person, allowing fraudsters to walk away with goods while the money never arrives.

🇵🇭 LandBank digital transactions jump 67% in 2024. Landbank President and CEO Lynette Ortiz stated that through Landbank’s digital banking channels, the institution is empowering every Filipino to take control of their finances. The bank's goal, she added, is to make safe, reliable, and convenient banking accessible to all.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.