Circle and Qonto Are Going After Banking Licenses

Hey Digital Banking Fanatic!

Quick one before we dive into your daily dose of news updates.

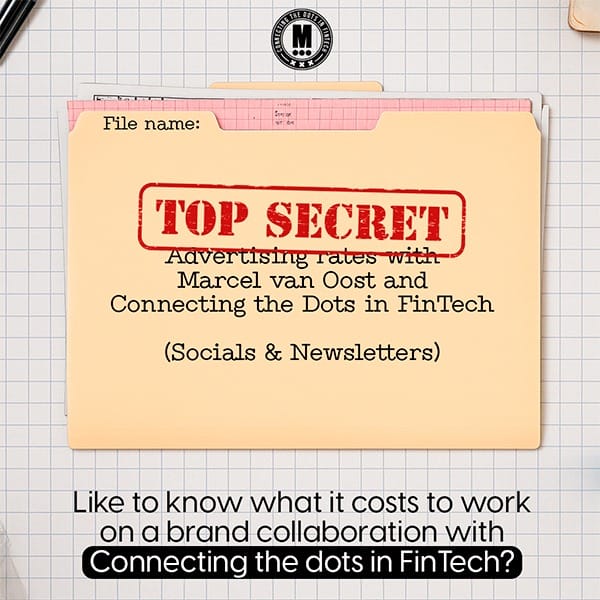

For the first time, I am sharing a full media kit that has partnership opportunities with Connecting the Dots in FinTech... at your fingertips.

Want in? Just drop your email here, and I will revert with the details.

Scroll on for today’s digital banking drops, especially Circle applying for a U.S. trust bank license post its bumper IPO, and Qonto may soon apply for a full banking license, probably in France.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

NEWS

🇺🇦 Solidgate has teamed up with Monobank. This collaboration opens powerful new opportunities for international businesses. Solidgate is now making it easier than ever to succeed in the Ukrainian market with seamless, tech-driven card payments powered by Monobank’s innovative platform.

🇺🇸 Circle applies for US trust bank license after bumper IPO. If the charter is granted by the U.S. Office of the Comptroller of the Currency, it would enable Circle to act as a custodian for its reserves and hold crypto assets on behalf of institutional clients.

🇫🇷 Qonto is likely to apply for a banking licence within the year. “Getting a banking licence would, in the same way, enable us to do more internally, to own more of the value chain and not be dependent on some banking partner’s speed,” Alexandre Prot, CEO and co-founder, said.

🇪🇸 Trade Republic launches the first Spanish payroll account with Bizum and 2% interest on unlimited cash balances. The new payroll account, which includes Bizum functionalities, completes Trade Republic’s bank offering in Spain, which enables customers to have a fully localised banking experience.

🇳🇱 Finom validates trust and information security standards with ISO/IEC 27001:2022 Certification across 100+ security requirements. This certification validates Finom’s comprehensive Information Security Management System (ISMS) and demonstrates the company’s commitment to meeting rigorous information security standards expected by financial regulators across Europe.

🇪🇸 Revolut follows CaixaBank and launches a new service in Spain. Revolut confirmed that its Pro or Business customers will be able to accept contactless payments using only an iPhone and the Revolut app. Read more

🇩🇪 Deutsche Bank aims to launch a crypto custody service in 2026. It has enlisted crypto exchange Bitpanda’s technology unit to help build the offering. Its custody project comes as large financial institutions increasingly focus on digital assets, encouraged by new regulations in Europe and a favorable environment in the US.

🇬🇧 Monzo top UK bank for SME current account switch gains in 2024. Monzo experienced the highest net current account switch gains for SMEs and charities last year, according to the latest data from the Current Account Switch Service (CASS). Continue reading

🇩🇪 N26 appoints Jochen Klöpper as CRO and Managing Director. Effective 1 December 2025, Klöpper will be appointed Managing Director and assume responsibility for risk management and compliance functions. He replaces Carina Kozole, who will leave the company effective 31 July 2025 to take on a new professional challenge.

🇳🇿 Westpac and POLi partner to deliver secure open banking payments. With this new integration, POLi transitions to secure, bank-approved open banking APIs, allowing Westpac customers to authenticate and authorise payments directly within Westpac’s secure digital banking environment.

🇬🇷 Kostas Xiradakis joins Snappi as Chief Commercial Officer. In this role, Kostas will lead Snappi’s marketing, sales, and customer experience efforts as the company accelerates its growth and sharpens its focus on customer-first innovation. Read more

🇬🇧 Barclays appoints new Chief Operating Officers. Craig Bright, Chief Information Officer, and former Goldman Sachs banker Anne Marie Darling would assume the role of group Co-Chief Operating Officers. Keep reading

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.