Circle Co-Founder Sean Neville Raises $18M for AI-Native Bank

Hey Digital Banking Fanatic!

More than a decade after cofounding Circle, Sean Neville is stepping back into the spotlight. This time, he’s turning to AI. His new venture, Catena Labs, has just secured $18 million in funding from backers including Andreessen Horowitz, Coinbase Ventures, Breyer Capital, and Circle Ventures. Even Tom Brady joined the round.

Catena’s ambition is to build an AI-native bank. One that, in Neville’s words, envisions a future where “there won’t be any humans or businesses that are executing financial transactions directly… only agents, only AIs.”

This isn’t a sudden pivot. Since leaving Circle in 2020, Neville spent time in quiet study, researching identity, decentralization, and AI. What began as a venture studio evolved into a focused project. By 2023, with the public release of ChatGPT, Catena took shape.

Together with Matt Venables, formerly a senior engineering lead at Circle, and a lean team of seven others, Neville is working to reimagine financial infrastructure: open-source, AI-led, and built for a machine-to-machine economy.

Neville said software from Catena Labs will integrate, but not be defined, by stablecoins. “It solves certain problems,” he said of the cryptocurrency. “It doesn’t solve all the problems.”

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

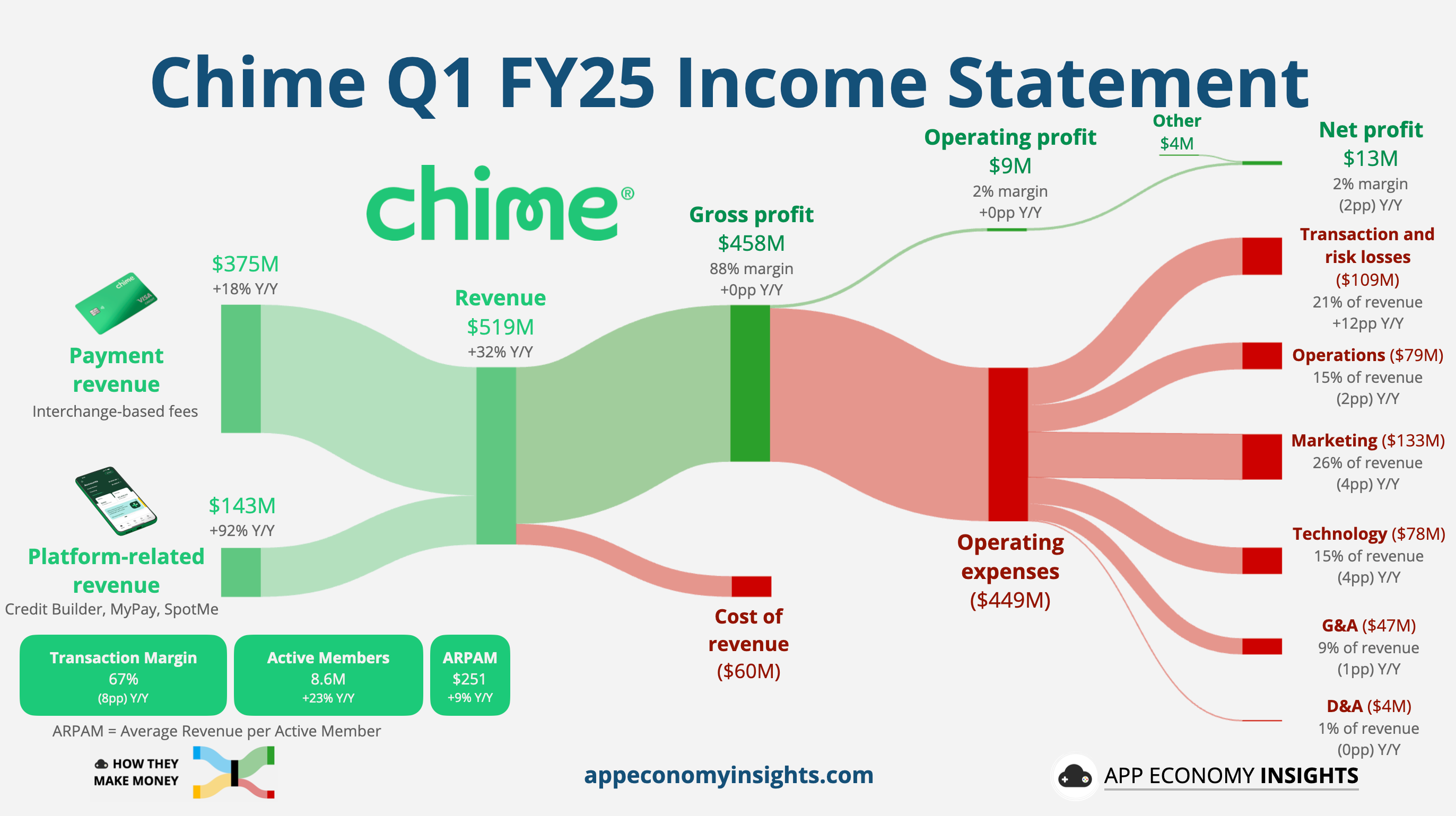

💰 Chime has officially filed for its long-awaited IPO, aiming to make a splash in the FinTech world.

Let’s dive into the numbers to see how Chime makes money👇

DIGITAL BANKING NEWS

🇳🇱 Qonto is launching POS terminals, tap to pay, and payment links. Qonto partnered with Adyen for its POS terminals and Tap to Pay solutions, and with Mollie for its Payment Links offering. This strategic expansion marks Qonto's evolution from a business finance leader to a complete financial management one-stop shop, addressing one of the most pressing needs faced by European SMEs today.

🇺🇸 Circle cofounder raises $18 million to build ‘AI-native bank’. Sean Neville has a new venture that aims to capitalize on the AI boom. He announced that his startup, Catena Labs, which he said plans to build an “AI-native bank,” had raised $18 million in a seed round.

🇨🇭 Temenos launches Gen AI Copilot to accelerate banking innovation. It provides a simple, conversational way for products to explore the full breadth of Temenos’ core banking functionality and data insights, helping banks design and launch retail products faster and more easily and making them more relevant to their customers.

🇬🇧 UK’s Moneycorp selects Temenos SaaS to scale global business. The UK headquartered payments and FX specialist will adopt Temenos SaaS for core banking and payments to achieve speed to market and scale efficiently as it expands products and services around the world.

🇩🇪 Dutch Government cuts ABN Amro Holding to below one third. The move means the state loses the right to prior approval of capital hikes or substantial deals carried out by ABN Amro. Read more

🇦🇺 Westpac to cut more than 1500 jobs in the biggest cut in a decade. The overhaul involves transforming the business by simplifying its processes and technology under a plan known as Unite. It comes after the appointment of Anthony Miller as CEO in who has already made significant changes to the executive team.

🇬🇧 Chase to launch its first-ever credit card next month. The launch will follow some changes to its savings account and popular current account. Last week, Chase cut the interest rate on its boosted savings account, meaning savers can now only earn up to 4.5%.

🇦🇪 Mashreq rolls out API Marketplace to support digitalisation. The API Marketplace rolls out several features, including automated developer registration, real-world case studies, and a flexible subscription model, focused on fostering development via a more agile and collaborative digital ecosystem.

🇺🇸 Slash just raised $41 million. The startup will use the funding to expand its business, providing specialized financial services as a neo-bank. This means offering a limited array of banking services without the overhead of physical branches or a full-blown bank license.

🇨🇦 Keep raises C$108m to transform small business banking in Canada. This investment will accelerate Keep's mission to solve critical cash flow and operational challenges faced by Canada’s 3 million small businesses. Continue reading

🇫🇷 French banking giant Société Générale to launch bank-issued dollar stablecoin on Ethereum. The move would make Société Générale the first global banking group to issue a dollar stablecoin on a public blockchain. It also plans to expand the stablecoin to other networks, including Solana, after the initial launch.

🇰🇷 K Bank falls behind Kakao and Toss amid shrinking profits and crypto risk. In terms of net profit, the gap between K Bank and KakaoBank has continued to widen, and it has even fallen behind Toss Bank, which does not offer mortgage loans.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.