Deutsche Bank Expands Into Revolut’s Canary Wharf HQ in a Major London Shift

Hey Digital Banking Fanatics!

Deutsche Bank is taking over roughly 250,000 square feet inside Revolut’s headquarters at Canary Wharf.

That’s about double the space Revolut occupies today. Revolut became the first tenant of the building last year, taking on 40% more floor space for its new headquarters.

A powerful leap forward for the district, fueled by the rebound in office demand and the fresh reshaping of London’s financial scene.

The bank is moving into the YY building on South Colonnade, according to people briefed on the matter, as reported by Reuters.

And here’s a quick reminder from earlier this week

I covered this earlier today in my Daily Newsletter when Visa locked in a 300,000 square foot, 15-year lease for its new European HQ in Canary Wharf.

👉 I also walked through the details in my LinkedIn post, Visa is moving its European headquarters to Canary Wharf, London.

As you probably know, this has been in the rumour mill for a while, but seeing the final lease terms drop puts real weight behind it. Today, Deutsche takes the spotlight.

If you're into Digital Banking shake-ups, definitely check out the updates below 👇

Cheers,

INSIGHTS

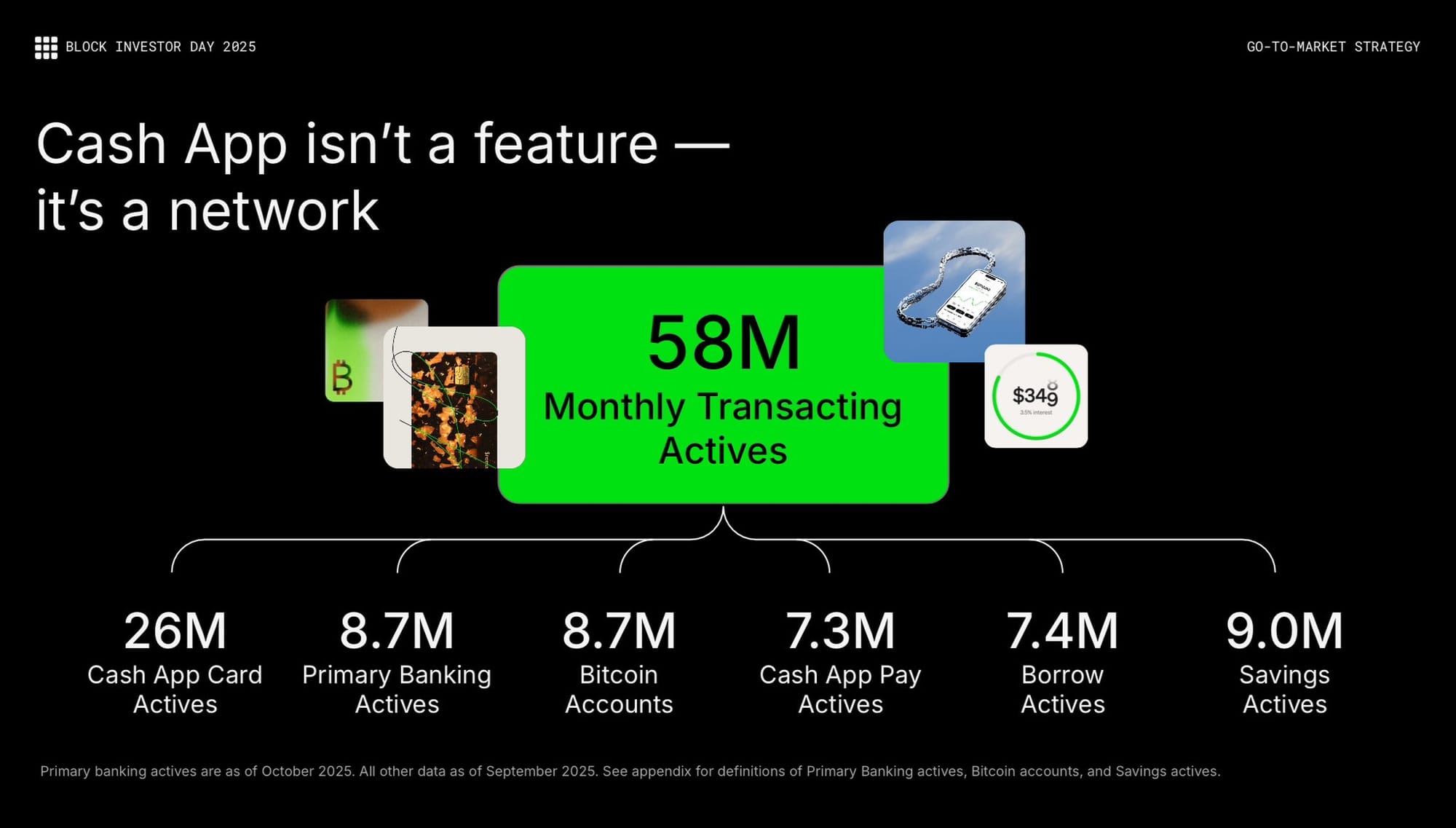

📈 Cash App’s Investor Day update shows just how big the network has become.

Here’s the scale of the network Block revealed:

NEWS

🇺🇸 Airwallex raises $330M Series G at $8B valuation. The investment will fuel Airwallex’s continued growth in the U.S. and key markets worldwide. Airwallex has established a second global headquarters in San Francisco and will deploy more than $1 billion from 2026-2029 to scale its U.S. operations, attract top talent, and expand its physical and brand footprint.

🇬🇧 Deutsche Bank to move into Revolut's Canary Wharf headquarters. The German bank will take about twice as much space in the YY building on South Colonnade as Revolut, the report said. Read more

🇺🇸 Rosen Law Firm encourages Klarna Group investors to inquire about securities class action investigation. Following a Yahoo! Finance article noting that Klarna’s first post-IPO earnings showed record revenue but higher-than-expected provisions for credit losses, resulting in a $95 million net loss and a stock drop of 9.3% on November 18, 2025.

🌍 Aspora names Varun Sridhar CEO to lead global FinTech expansion. At Aspora, his mandate will focus on accelerating the company’s entry into priority markets such as the US, UK, UAE, Germany, Italy, and Ireland, alongside building tailored wealth and loan products for globally mobile Indian professionals and families.

🇺🇸 Nuuvia’s CUSO secures $4m investment from VyStar and Desert Financial Credit Unions. The investment reinforces Nuuvia's mission to partner and collaborate with progressive financial institutions to build best-in-class youth engagement tools that address critical membership growth challenges.

🇬🇧 UK FinTech Plum follows Klarna in securing an e-money licence. The move gives Plum the green light to essentially operate as a bank with a narrower scope by offering online transfers, prepaid cards, and managing digital wallets. The company has more than 2M clients and helps to automate complex aspects of personal finance.

🌍 Xero rolls out AI bank reconciliation with JAX tool. The beta is available on Xero Grow plans in Australia, New Zealand, and the UK, the Growing plan in the US, and Standard plans in other markets and above. The system aims to give users a more current view of their cash position by matching and coding transactions as they arrive.

🇺🇸 Prometeo launches Name Match, a new capability within its U.S. Bank Account Verification API that helps businesses evaluate likely bank-account ownership before initiating payments. The feature returns an indicative outcome, Match, Partial Match, No Match, or No Data, that institutions can incorporate into risk and payment-decision flows.

🇺🇸 AllScale raises $5m seed led by YZi Labs to build the world's first self-custody stablecoin neobank. The company’s mission is to provide the underlying payment infrastructure for the next generation of "super individuals" and small and medium-sized businesses (SMBs).

🌍 OPay appoints James Perry as Chief Financial Officer. In this role, Jim will lead OPay’s financial strategy, capital planning, and investor relations as we continue to scale our FinTech ecosystem across Africa and expand globally. Keep reading

🇦🇷 Argentina's Central Bank is considering allowing banks to operate with cryptocurrencies. The publication reports that regulations are being drafted, but no date has yet been set for their presentation. A cryptocurrency brokerage operating in Argentina said that the measure could be approved in April 2026.

🇬🇧 Monzo Bank has launched Double Payday. Matt Jones shared that Monzo Bank has launched Double Payday, a new feature that each month doubles the net salary of ten eligible customers, randomly selected from the previous month’s qualifying payments. Monzo will match up to £10,000 per winner.

🇨🇴 Cards that drive the evolution of digital payments in Colombia. Colombia’s payments ecosystem is rapidly modernizing as credit, debit, and prepaid cards shift from simple payment tools to digital platforms, driving inclusion and innovation. With credit card issuance up 59% and debit cards up 17.2% in early 2025.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.