Dock Executive Arrested Over $10M Acquisition Dispute

Hey Digital Banking Fanatic!

Dock’s country manager in Mexico, Anderson Olivares, was arrested in Mexico City, accused of a $10 million fraud tied to the 2021 acquisition of card processor Cacao.

Prosecutors point to irregularities in the deal, and a court has barred Dock from changing its shareholder structure. That restriction, sources say, blocked the company’s plans to go public in 2023.

Dock has denied any wrongdoing, calling it a private dispute. The company says the deal was fully paid, and one Cacao co-founder remains on staff.

But there's more on this and other Digital Banking, scroll down to find more 👇

Cheers,

INSIGHTS

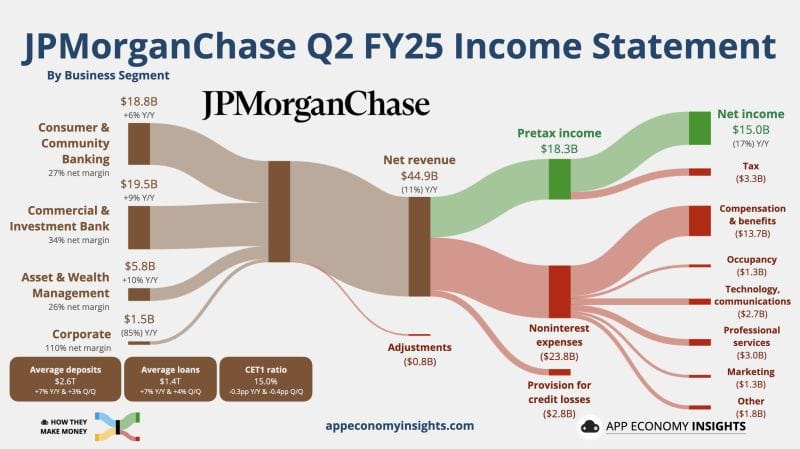

📈 Here are JP Morgan Chase Q2 FY25 Earnings Key Insights:

NEWS

🇲🇽 Dock Executive Anderson Olivares de Oliveira arrested in Mexico for $10 million fraud. Olivares was detained at Mexico City International Airport following an alert from the Attorney General's Office. He is accused of fraud in a case involving corporate disputes and regulatory questions about the company's operations in the country.

🇬🇧 FCA fines Barclays £42 million for poor handling of financial crime risks. Barclays Bank UK PLC failed to check that it had gathered sufficient information to understand the money laundering risk before opening a client money account for WealthTek.

🇶🇦 QIIB and Visa launch Biometric Click to Pay. Users can employ a unique identifier, such as their email address or phone number, to swiftly complete transactions with participating merchants. Integrated with Visa’s Payment Passkey Service, this solution leverages biometric authentication, eliminating the need for manually entering card details or one-time passcodes.

🇬🇧 Bank of England readying the new retail payment infrastructure plan. This new model, the central bank’s Payments Vision Delivery Committee said in a news release, “embeds public and private sector collaboration, utilizing the right expertise in the right functions to drive transformation.”

🇺🇸 ZBD secures EU EMI license and announces partnership with ClearBank to merge digital assets with traditional finance. ClearBank will provide ZBD with operational accounts for business expenses and safeguarding accounts for holding client funds. This enables ZBD EU users to fund a EUR balance in their virtual account.

🇩🇪 Vivid Money and Adyen launch payouts on speed. Adyen processes have been integrated into the Vivid Money interface, allowing customers, upon acceptance of Adyen's terms and conditions, to withdraw revenue from payments directly to their account.

🇬🇧 Starling Bank makes major comms restructuring. Alexandra Frean has stepped down as Chief Corporate Affairs Officer at Starling Bank, as part of a shake-up of the comms team. Read more

🇺🇸 Jamie Dimon says JPMorgan Chase will get involved in stablecoins as the FinTech threat looms. Last month, JPMorgan announced it will launch a more limited version of a stablecoin that only works for JPMorgan clients; a true stablecoin would presumably be more universally accepted.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.