Everyone Wants a U.S. Banking License 🇺🇸

Hey Digital Banking Fanatic!

It feels like everyone wants a piece of the U.S. banking pie right now 😅

In just one week — Nubank, Monzo, and Coinbase all filed or revived applications for U.S. banking charters.

Let’s unpack that:

🇧🇷 Nubank is going global, applying for a U.S. national bank charter to launch deposit accounts, credit cards, and even digital-asset custody.

Co-founder Cristina Junqueira, now based in Miami, says the goal is to start with Latinos, but ultimately reach all Americans.

🎥 Watch Cristina Junqueira’s interview on Nubank’s U.S. plans here:

Cristina Junqueira’s interview on Nubank’s U.S. plans

🇬🇧 Monzo is making a comeback. Four years after pulling its first attempt, the UK neobank is reportedly reapplying for a U.S. license—betting that Trump’s deregulatory push could finally open the door for approval.

🇺🇸 Coinbase, meanwhile, is blurring the line between crypto and traditional banking with a National Trust Charter application from the OCC.

It’s not trying to “become a bank,” but the move would give it more regulatory clarity to expand custody, payments, and institutional services.

One thing’s clear:

The next big banking battleground isn’t in London or São Paulo, it’s in Washington, D.C.

Scroll down for the rest of today’s headlines 👇 There’s plenty more shaking up digital banking this week.

Cheers,

INSIGHTS

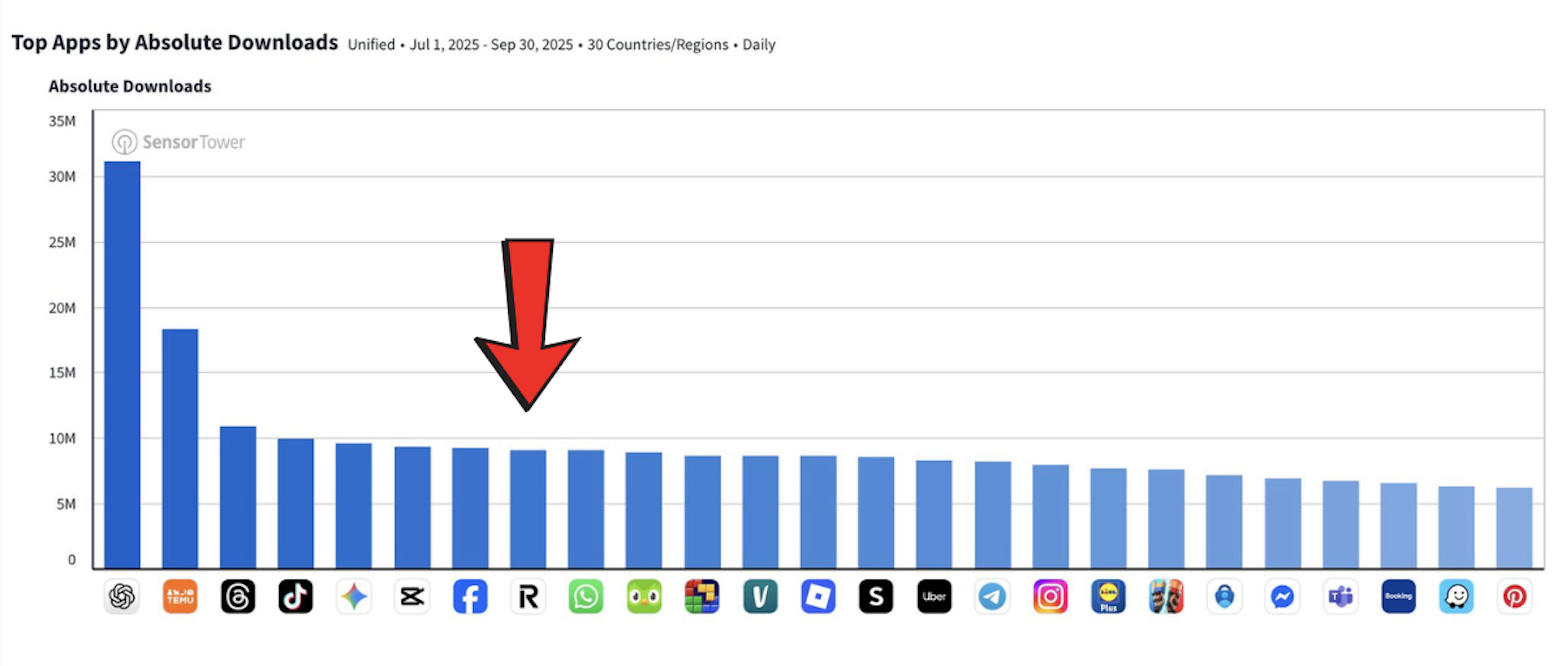

🌍 There’s one FinTech that had more downloads than WhatsApp in Europe 🤯

Check out Europe’s most downloaded apps in Q3 2025👇

NEWS

🇺🇸 SoFi is expanding its options offerings. The new offerings come with no commissions or contract fees, and SoFi said it will provide built-in educational resources to help members understand how they work. SoFi said users will be able to apply for approval in the company's app, and that it plans to make the feature available to all eligible members.

🇺🇸 NCino unveils mortgage-focused AI innovations. The new wave of mortgage-focused AI innovations is designed to accelerate loan origination, reduce underwriting touches, and deliver more responsive borrower journeys. Read more

🇲🇽 Ualá launches "Reserva a Plazo" in Mexico. Ualá Bank announced the launch of Term Reserve. This new investment tool will enable its customers to protect and grow their money in a simple, secure, and flexible manner, creating reserves for various purposes.

🇲🇽 Mexican FinTech Kapital plans IPO within three years, Chief Executive Rene Saul said. "In the next three years, we would be looking for the IPO," he said at a press conference, adding that he would favor a dual listing in the U.S. and Mexico. Continue reading

🇨🇭 Revolut aims to expand the Swiss market amid global growth. In an interview, David Tirado, Vice President Global Business and Profitability at Revolut, described the country as “one of our five key projects”, noting that Swiss users are among the most profitable in its portfolio due to strong demand for currency exchange and investment products.

🇨🇦 Plumery expands digital banking platform to Canada. The digital banking experience platform has expanded into the country with the launch of market-specific capabilities designed to empower Canadian credit unions to deliver personalised, compliant, and future-ready digital banking experiences.

🇺🇸 Walmart-backed FinTech OnePay is bringing crypto to its banking app. By allowing OnePay users to hold bitcoin and ether in their mobile app, customers could presumably convert their crypto into cash and then use those funds to make store purchases or pay off card balances.

🇮🇪 Irish banks to launch instant payments across the euro zone. Banks and credit unions have begun rolling out SEPA Instant payments, which will enable personal and business customers to make euro payments within ten seconds, 24 hours a day. Continue reading

🇹🇿 I&M Bank Tanzania, Mastercard, and OpenWay launch world elite debit and multi-currency cards. The cards aim to support Tanzania’s growing demand for digital payments, offering features such as enhanced payment security, lifestyle privileges, and multi-currency functionality.

🇮🇳 Tamilnad Bank partners with Wegofin for digital banking. Through this collaboration, TMB will enhance its role as a trusted banking partner while enabling seamless UPI merchant acquiring, automated payouts, fraud risk management, and compliance-driven financial operations, the bank said.

🇬🇧 Santander UK boss to exit ahead of TSB merger. Mike Regnier said he will exit in the first quarter of 2026 after stating he intended to “move on after 4-5 years” due to “other interests he would like to pursue”. Continue reading

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.