Fasset Launches the World’s First Stablecoin-Powered Islamic Bank

Hey Digital Banking Fanatic! 👋

Big move out of Malaysia today: 🇲🇾 Fasset just became the world’s first stablecoin-powered Islamic digital bank.

The UAE-based FinTech secured a provisional banking license from Malaysia’s Labuan FSA, unlocking full-service, Shariah-compliant digital banking inside a regulated sandbox.

Their goal? To do for Asia and Africa what Nubank did for Latin America — bring mass-market financial inclusion to millions still underserved by traditional banks.

Fasset’s already serving 500,000 users across 125 countries and moving over $6 billion a year.

Now, it’s taking things further with zero-interest accounts, asset-backed savings, cross-border payments, and even a crypto debit card that works anywhere Visa is accepted.

As CEO, Mohammad Raafi Hossain put it:

“We’ve been told Islamic finance can’t go global. We’re here to prove otherwise.”

Scroll down for more of today’s biggest digital banking stories 👇

Cheers,

INSIGHTS

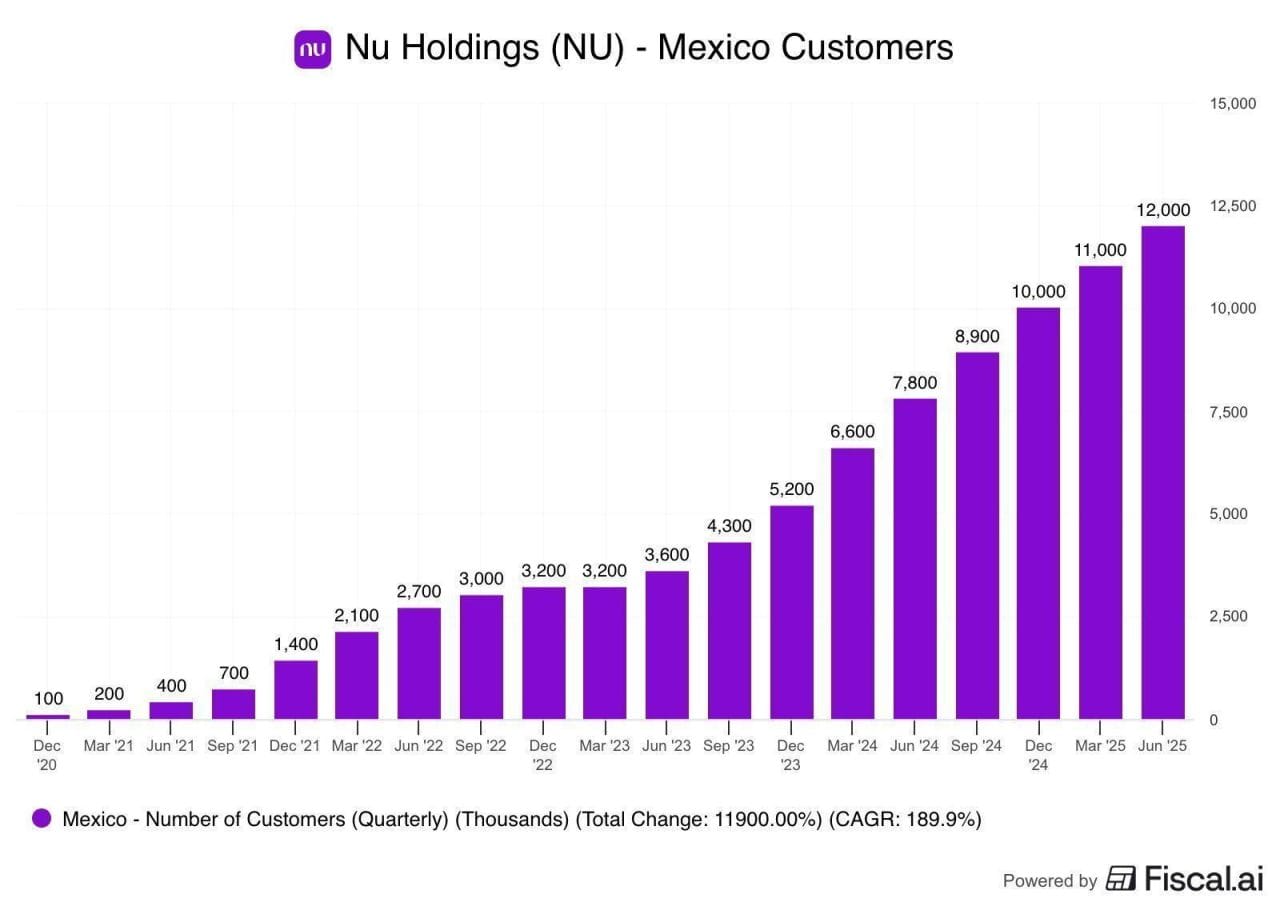

🇲🇽 Nubank went from 100k customers in Mexico to 12 million in less than 5 years.

That means 1 in every 4 banked 🇲🇽 Mexicans is now a Nu customer 🤯

NEWS

🇲🇾 UAE's Fasset secures provisional banking license for stablecoin-powered Islamic bank in Malaysia. The firm said in a statement that the license completes its ability to provide full-service digital banking to its existing global user base of 500,000 within a regulated sandbox for Islamic FinTech innovations, establishing Fasset as the world’s first stablecoin-powered Islamic digital bank.

🇩🇪 Australian-founded business lender Bizcap expands lending in Germany to accelerate fast funding for SMEs. The move underscores Bizcap’s commitment to empowering small and SMEs worldwide with fast, flexible, and transparent financing solutions.

🇫🇷 Net-zero banking movement suffers blow as NZBA ceases operations. The Net-Zero Banking Alliance (NZBA), a UN-backed initiative created to align banking practices with Paris Agreement climate goals, has ceased operations following a member vote on the future of the organisation.

🇪🇺 EU banking review ready in ‘about a year’. The EU’s financial services commissioner expects a review of the bloc’s banking rule book to be ready in about 12 months, with some of the changes requiring updates to EU laws, dampening hopes from some in the industry for a speedier timeframe against a backdrop of swift deregulation in the US.

🇧🇷 MagaluPay hires former Nubank employee, Faizal McBride, as Director of Credit and Data. Faizal McBride will also be responsible for incorporating data, analytics, and data science into decisions across various areas of Magalu's FinTech. Keep reading

🇮🇳 Banking Circle and EbixCash to simplify cross-border payments for Indian students and travellers. Banking Circle will enable EbixCash World Money ('EbixCash') to offer faster and more transparent international money transfers. Keep reading

🇺🇸 BNY Mellon explores tokenized deposits and blockchain payments. The new initiative is part of BNY Mellon’s broader plan to modernize its infrastructure, support instant cross-border payments, and improve overall financial transfer methods using digital assets and blockchain technology.

🇮🇳 Lending startup Niro shuts down operations. Regulatory pressure, credit deterioration, and limited capital forced the company to wind down operations. Niro’s model linked consumer platforms with financial institutions, but tightening lending and risk regulations created a volatile environment.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.