FinTech Pioneers Unite to Build Bank for High Net Worth Individuals

Interesting news from the UK today: a group of well-known fintech pioneers behind Monzo, Starling, and Nutmeg are launching a new bank aimed at high-net-worth individuals.

Hi Digital Banking Fanatic!

Interesting news from the UK today: a group of well-known FinTech pioneers behind Monzo, Starling, and Nutmeg is launching a new bank aimed at high-net-worth individuals.

Dubbed “Project Arnaud”, the initiative comes from Jason Bates (co-founder of Monzo and Starling), David M. Brear (Group CEO at 11:FS), and Max Koretskiy (co-founder of Zürich-based Blackshield Capital).

Scroll down to read the full story, plus more digital banking updates you need to know.

Enjoy, and I’ll be back in your inbox tomorrow!

Cheers,

INSIGHTS

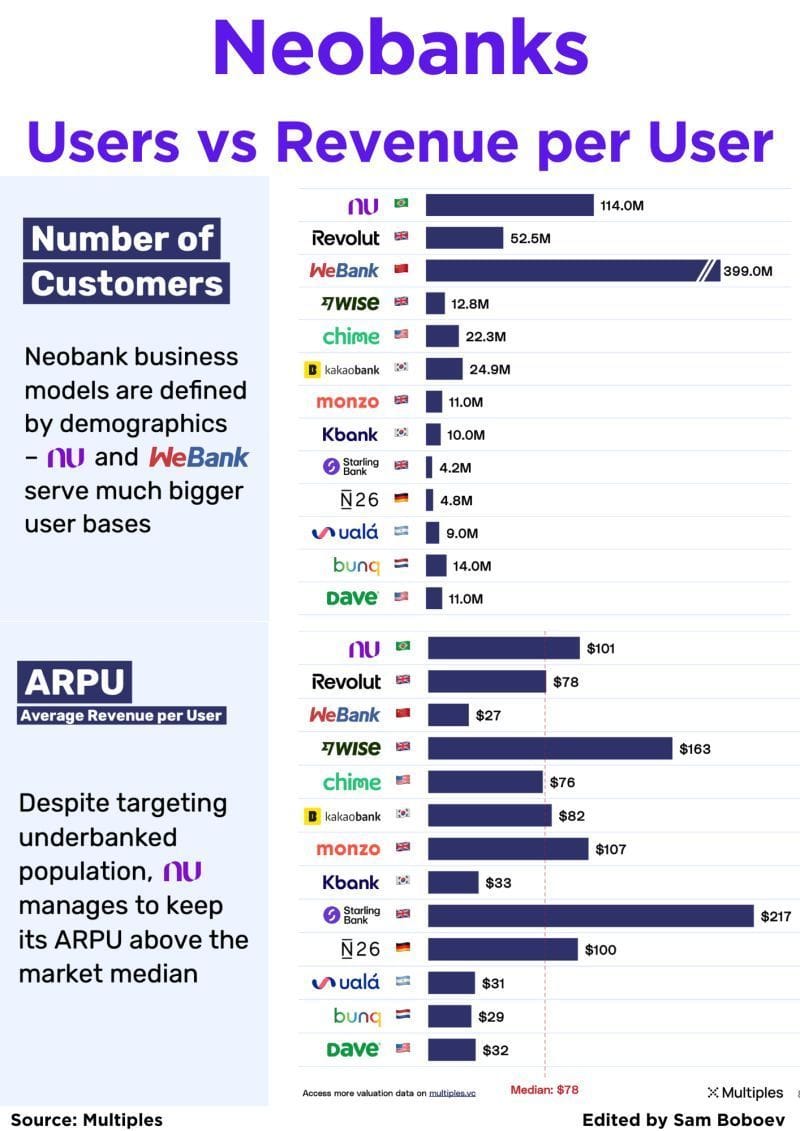

📈 Here is how much money the big neobanks make per customer.

A comparison of Average Revenue Per User (ARPU)👇

NEWS

🇬🇧 FinTech pioneers unite to build a bank for high-net-worth individuals. A group of well-known FinTech pioneers behind the likes of Monzo, Starling, and Nutmeg is launching a bank for high-net-worth individuals. Keep reading

🇦🇺 Revolut pays AUSTRAC $187,000 for reporting failures. Revolut Payments Australia was issued infringement notices of $187,000 for “self-disclosed failures to submit international fund transfer instructions within the timeframe stipulated by the Anti-Money Laundering and Counter Terrorism (AML/CTF) Financing Act”.

🌎 LatAm FinTech Kapital raises funds at $1.3 billion value. The funds will help to build out its artificial intelligence capabilities. The profitable company now has 300,000 customers across the US, Mexico, and Colombia, as well as a $3 billion balance sheet.

🇬🇧 Zopa Bank expands payments grip with retail finance acquisition. The FinTech has snapped up Rvvup, a platform designed to streamline businesses’ acceptance, collection, and management of payments. Zopa said the acquisition will treble the size of its embedded finance business in two years, which covers the integration of financial products into non-financial platforms.

🇰🇷 Toss to expand pay-by-face to 1 mil. stores nationwide by 2026. The service, called "Face Pay" by Toss, enables users to make payments at stores simply by looking at a terminal, after registering their facial information and payment method in advance through the Toss app.

🇺🇸 Sweden's Klarna targets up to $14 billion valuation in eagerly awaited US IPO. The buy now, pay later lender and some of its investors plan to sell 34.3 million shares in the IPO at prices expected to be between $35 and $37, aiming to raise $1.27 billion.

🇪🇺 Klarna launches debit-first card across Europe for everyday spending. The Klarna Card, powered by Visa Flexible Credential, is debit by default, letting users pay instantly with their own money, while also offering flexible options. Within the Klarna app, consumers can choose: Pay in 3, Pay Later, or longer-term financing for larger purchases, subject to approval.

🇪🇸 UniCredit enters the digital banking war in Spain with Aion Bank and launches a competition with ING, Openbank, and Revolut. UniCredit completed the full acquisition of Aion Bank and banking services provider Vodeno, aimed at helping the Italian bank accelerate its journey toward digital banking.

🇩🇪 Finom rolls out an AI accountant for German customers. This system streamlines accounting workflows with proactive transaction categorization and reconciliation, receipt and invoice recognition, bookkeeping record creation, preparation of tax declarations, and submission to tax authorities.

🇦🇺 Westpac to hire hundreds of bankers in business lending push. In an update on its business and wealth unit, the Sydney-based bank said it had hired 135 bankers in the first half of 2025 and plans to add another 350 by the 2027 financial year. Westpac’s digital tool allows faster processing for business loans.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.