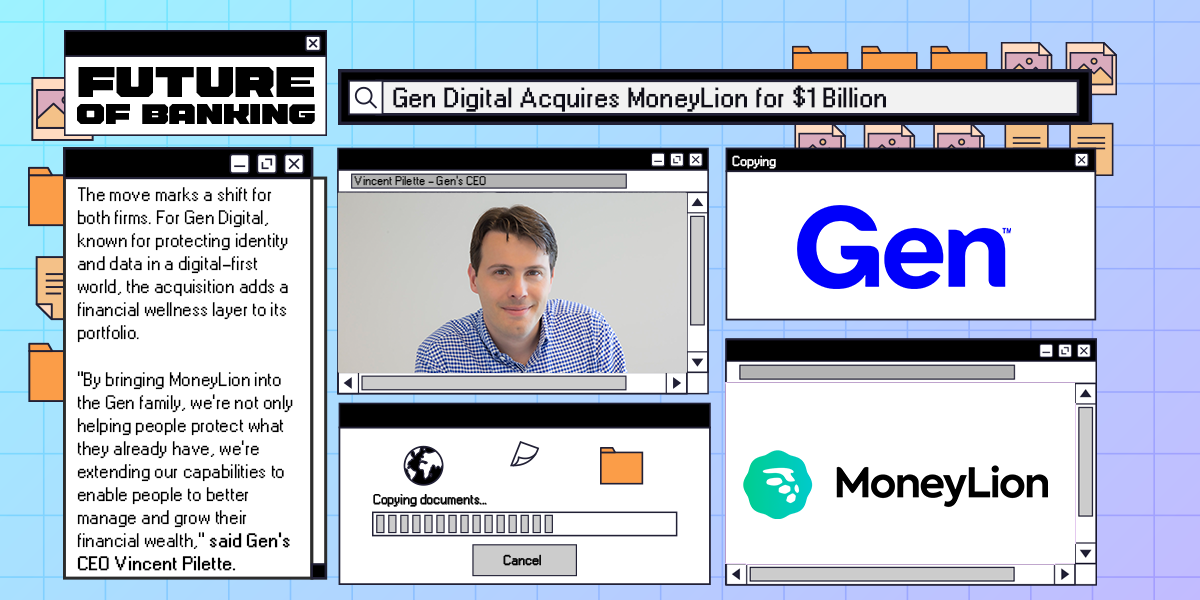

Gen Digital Acquires MoneyLion for $1 Billion

Hey Digital Banking Fanatic!

When MoneyLion first started, it set out to solve a simple question: how can financial services work better for people in a digital world? It aimed to make money management easier, more personal, and more connected to everyday life through an app.

Over the past decade, the company built a platform that merged personal finance, embedded banking, and AI-powered tools—growing its reach to over 20 million customers. This week, that journey entered a new chapter.

Shareholders of MoneyLion voted to approve the company’s acquisition by Gen Digital, the cybersecurity group behind Norton, Avast, and LifeLock, among others. The deal—announced in December—values MoneyLion at approximately $1 billion and is expected to close on April 17. With it, MoneyLion becomes a wholly owned subsidiary of Gen, and its stock will no longer trade on public markets.

The move marks a shift for both firms. For Gen Digital, known for protecting identity and data in a digital-first world, the acquisition adds a financial wellness layer to its portfolio. “By bringing MoneyLion into the Gen family, we’re not only helping people protect what they already have, we’re extending our capabilities to enable people to better manage and grow their financial wealth,” said Gen’s CEO Vincent Pilette.

For MoneyLion, the deal accelerates a strategy long in motion—scaling embedded finance and B2B2C AI services that go far beyond traditional consumer banking. In recent months, the company launched new offerings like MoneyLion Checkout, introduced crypto trading directly in checking accounts, and reported a record year in 2023 with 29% revenue growth and $92 million in adjusted EBITDA.

CEO Dee Choubey emphasized that “2024 was MoneyLion’s strongest year ever,” and highlighted how the partnership with Gen would expand the company’s reach. “We’ll deliver MoneyLion’s leading personal financial management tools and embedded financial marketplaces to Gen’s users,” he said, “while bringing Gen’s strong identity, trust and cybersecurity solutions to our customers.”

Read more on Digital Banking industry below 👇 and I'll be back with more tomorrow!

Cheers,

Stay Updated on the Go! Join my new Telegram channel for daily Digital Banking updates and real-time breaking news. Stay informed and explore the Future of Banking—subscribe now!

INSIGHTS

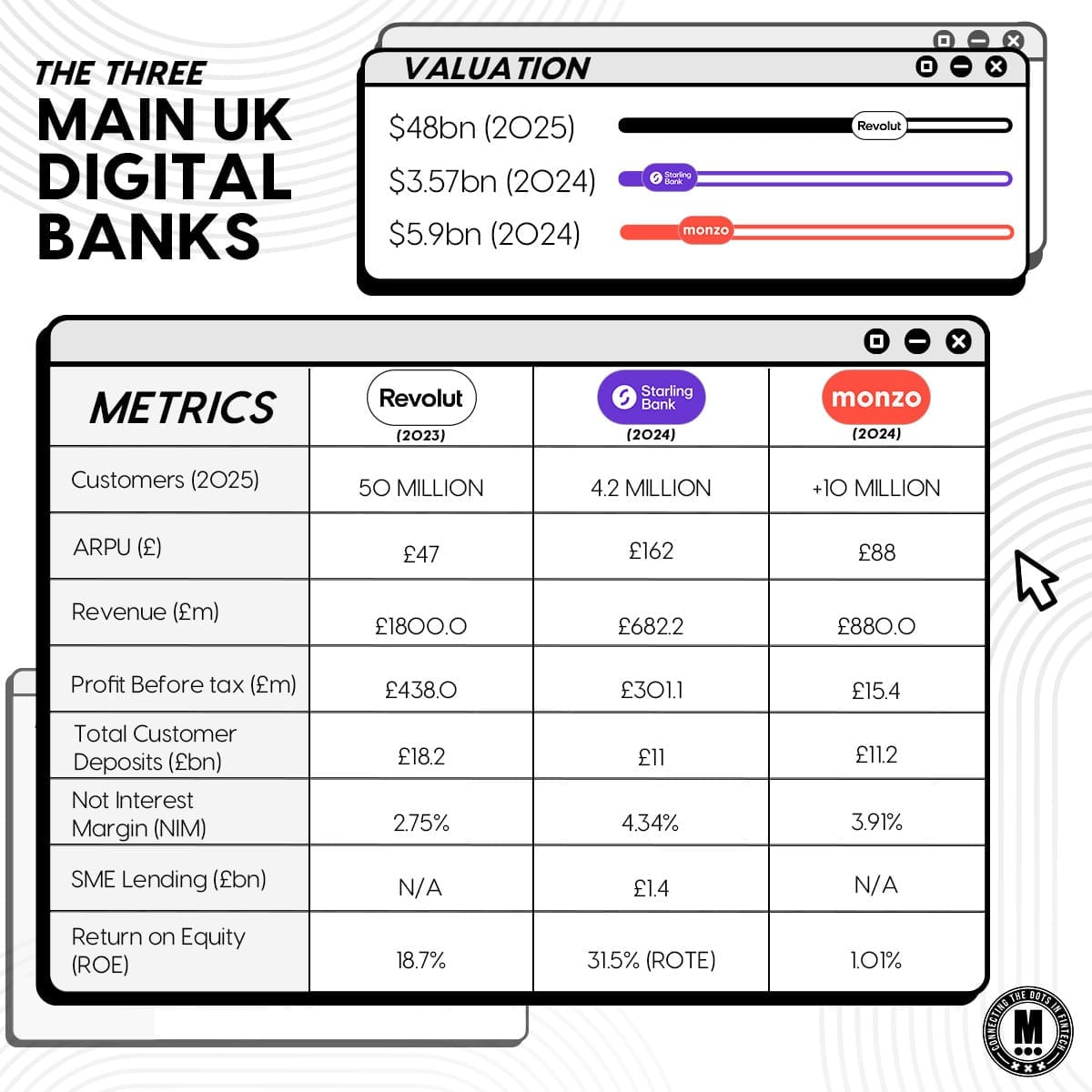

📊 Revolut 🆚 Starling Bank 🆚 Monzo Bank

DIGITAL BANKING NEWS

🇺🇸 MoneyLion stockholders approve acquisition by Gen Digital. The companies said in a statement that all regulatory approvals have been obtained, and the deal is slated to be completed. Once it goes through, MoneyLion will be a subsidiary of Gen Digital, and its common stock will no longer be listed on any markets.

🌏 BNY scales up its Asia Pacific offerings in cross-border payments, liquidity management, and digital trade finance. The Bank of New York Mellon Corporation (BNY) is transforming its global business through a unified platform operating model designed to deliver more for its clients, run its company better, and power its culture.

🇳🇬 OPay’s valuation climbs to $2.75B despite slowdown in venture funding. While the valuation increase is notable, the filings also reveal a sharp slowdown in unrealised fair value gains. Opera Limited’s 9.4% stake in OPay rose slightly to $258.3M in 2024, while unrealised gains dropped sharply from $89.8M to $5M, reflecting slower growth.

🇦🇱 Albanian banks apply to join SEPA credit transfer scheme. These schemes allow businesses to make euro credit transfers between bank accounts that are part of the payment area. Keep reading

🇦🇪 OKX and Standard Chartered pilot crypto collateral mirroring offering in UAE. The Pilot will be carried out under the umbrella of Dubai’s VARA. OKX institutional clients will be able to use crypto and tokenized money market funds as collateral.

🇦🇷 Ualá, the Argentine FinTech company, has joined Google Wallet, allowing users of its prepaid card to make contactless payments using their Android devices. The integration offers a faster and more secure payment experience, thanks to Google Pay’s multiple layers of security.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.