GoTyme Bank Launches In-App Crypto Trading for Filipino Users

Hey Digital Banking Fanatic!

As we start the week, I’m watching new shifts unfold in Digital Banking and crypto, with institutions expanding their rails across emerging markets. So, let’s dive in!

GoTyme Bank is introducing Go Crypto, a new in-app feature that lets users buy, sell, and manage 11 digital assets directly inside its mobile banking platform.

The rollout brings access to Bitcoin, Ethereum, Solana, Ripple and others, all managed within GoTyme’s closed-loop ecosystem built to streamline onboarding and enhance security.

The bank says the feature aims to make crypto more accessible for Filipinos who still see it as fragmented. As a licensed Virtual Asset Service Provider, GoTyme applies bank-level due diligence to each asset.

Users get instant fiat-to-crypto transfers, real-time market data, transparent pricing, and a dedicated crypto account for portfolio tracking. The bank continues to warn that crypto remains volatile and is not covered by local deposit insurance.

What's the next big move in Digital Banking? Find out tomorrow... I'll be back in your inbox with more industry-shaping updates. Be the first to know, always!

Cheers,

INSIGHTS

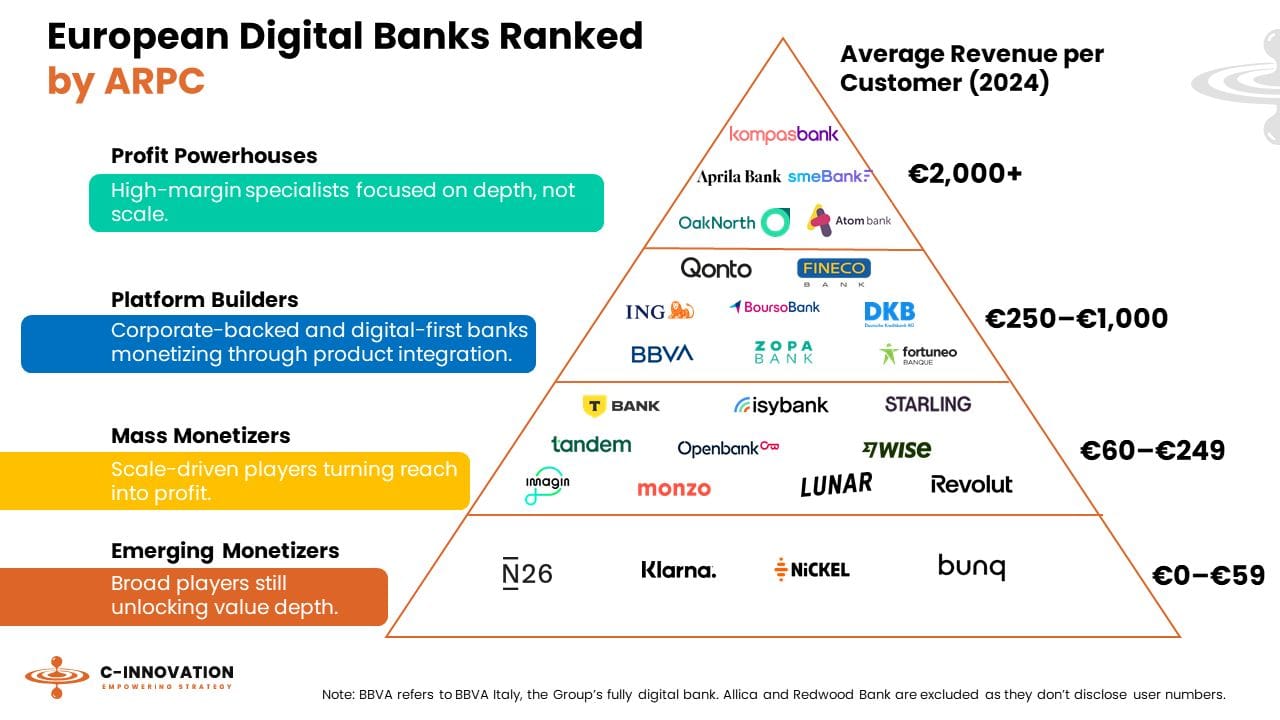

🌍 Europe’s digital Banks ranked by Average Revenue Per Customer (ARPC) 👇

Who’s truly monetising, and who’s just scaling?

NEWS

🇵🇭 GoTyme Bank unveils crypto trading feature with 11 digital assets. Go Crypto is a new in-app feature that allows users to buy, sell, and manage digital assets directly through the GoTyme platform. The feature supports 11 cryptocurrencies, offering Filipinos a way to invest in virtual assets without registering on external exchanges.

🇬🇷 Neobank Project advances despite the church of Greece's withdrawal. Despite losing Church backing, Filippidis is pressing on: the company approved issuing one million non-voting preferred shares at €35 each, raising €35 million, with €1 million added to share capital and €34 million booked as a share-premium reserve.

🇬🇧 Tandem unveils new portfolio Cash ISA. The Portfolio Cash ISA brings instant access and fixed-rate ISAs under one easy-to-manage portfolio, allowing customers to tailor savings to their needs. Savers can open up to 20 ISAs across any combination of instant access and fixed-term accounts, offering flexibility or guaranteed returns.

🇨🇴 Nu Colombia doubles its customer base and reaches 4 million users in just one year. The company reports a presence in 100% of the country's departments and more than 95% of its municipalities, a reach superior to that of several traditional banks with decades of operation.

🇲🇽 Nu and Revolut lead FinTech quest for Mexico’s middle-class wealth. Their arrival is shaking up one of Latin America’s most competitive financial markets and pressuring major lenders to modernise, though newcomers will face tough regulators, weak infrastructure and fierce competition from both incumbents and local FinTechs.

🇳🇬 Bank78 MFB launches as Nigeria’s first fully private digital bank. Customers can expect effortless digital onboarding, intuitive navigation, and 24/7 AI-powered support through its virtual assistant, Ruby. The bank’s fully digital infrastructure eliminates the frustrations associated with traditional banking.

🇮🇳 Jupiter Money Marketing Head Adityan Kayalakal steps down after joining in May 2025. He announced the move on LinkedIn, writing, “Signing off from this incredible rocket ship… this astronaut is heading back to Earth.” Keep reading

🇲🇦 Morocco’s Cash Plus hits $550m valuation as Mediterrania Capital Partners sells down stake in IPO. The deal was structured as a mix of growth capital and shareholder liquidity, marking a partial exit for private equity firm MCP, while the company’s founding families retained their full share count.

🇮🇳 Amazon and Flipkart aim for India's banks with new consumer loan offerings. Amazon is preparing to offer loans to small businesses as part of a broader financial services push, following its acquisition of non-bank lender Axio, which will restart SME lending and add cash-management tools. Additionally, Flipkart is preparing to launch BNPL products through its lending arm, Flipkart Finance, pending final RBI approval, with plans to offer no-cost instalments over 3–24 months and consumer durable loans at 18%–26% interest.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.