HSBC Partners with Mistral to Supercharge Its AI Strategy

Hey Digital Banking Fanatics!

HSBC just locked in a multi-year partnership with Mistral AI.

It gives the bank access to its commercial models and whatever comes next. It’s a major move for a global institution that wants to speed up how gen AI hits real workflows across the bank.

The focus is clear. HSBC wants faster analysis, better internal tools, and smarter ways for employees to work at scale.

Lending decisions, heavy documentation, multilingual reasoning, and even rapid prototyping all get the AI upgrade... those internal workflows that used to drag now move a lot faster.

Internal gains first. Customer-facing improvements are already lined up. You can guess where this is going, and the next steps aren’t hard to spot!

Here’s another update to kick off the day…

Revolut just rolled out “Street Mode” across the UK and EEA to curb phone-theft-driven fraud. Extra checks. Delays on forced transfers. Location-based protection kicks in when it matters.

And a neat parallel: Nubank launched its own “Street Mode” years ago. Same logic, different timing.

If you're into Digital Banking shake-ups, definitely check out the updates below 👇

Cheers,

INSIGHTS

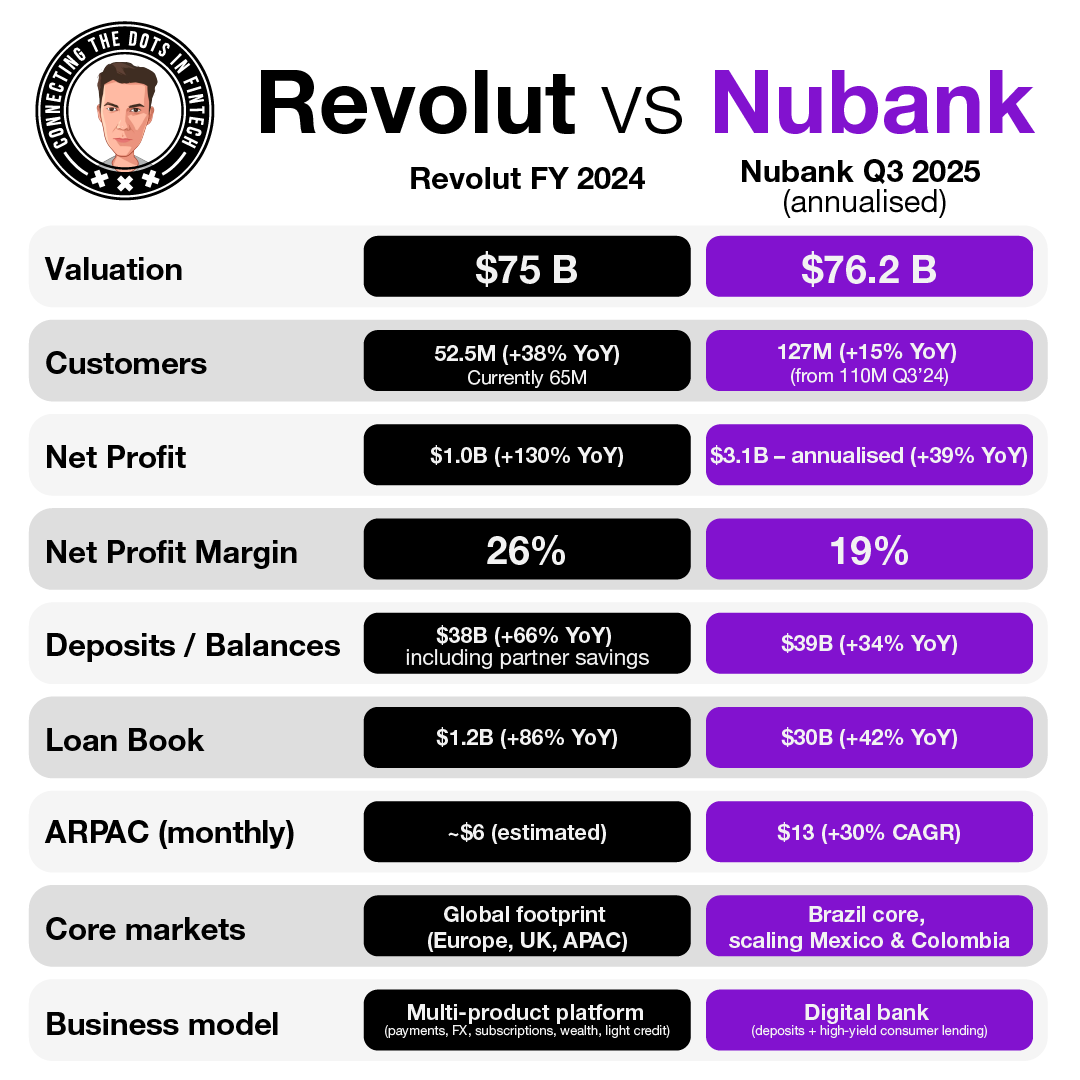

📊 Nubank 🆚 Revolut

NEWS

🌍 HSBC partnered with French start-up Mistral AI to accelerate the bank’s use of generative AI. The bank says the partnership will boost efficiency and support future customer-facing innovations, including improved lending, onboarding, and fraud prevention.

🇮🇳 India relaxes rules for digital banking operations. Banks can now display products and services after customers log in to digital platforms. They can showcase government schemes and third-party financial products if these are also available in physical branches.

🌍 Revolut is rolling out "Street Mode" to secure customer funds during the holiday season. A new security feature designed to help protect customers from theft in the event of phone snatching or assault to force a transfer, Street Mode offers an additional, customizable, location-based layer of fund protection when customers are on the move.

🇧🇷 PicPay launches a marketplace and makes its debut in online retail. The new platform integrates financial services and online retail, with technological support from OmniK, and reinforces the company's strategy to expand monetization and engagement.

🌍 Klarna launches Tap to Pay for in-store purchases across 14 markets, bringing flexible payments into physical retail at scale and transforming the Klarna app into an everyday contactless wallet. Tap to Pay brings consumers the ease of online shopping into brick-and-mortar stores.

🇮🇹 Scalable Capital appoints Michele Raisoni as Branch Manager Italy. In his new role, Raisoni will work alongside Alessandro Saldutti, Country Manager Italy, in managing the domestic market, contributing to strengthening the local infrastructure and ensuring adherence to the highest compliance and operational standards.

🇰🇷 South Korea's NH NongHyup Bank pilots blockchain-based cross-border payments. The pilot executes transactions based on realistic cross-border payment and foreign currency liquidity management scenarios for the Korean market, validating key technical capabilities such as system interoperability, message processing accuracy, and real-time settlement functionality.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.