HSBC’s Zing Burned $87.5M in a Year of Operation

Hey Digital Banking!

Six months after its shutdown, a year and a half after launch, and nearly three years since HSBC began building it, the financial cost of Zing’s time in operation has finally been revealed: $87.5 million.

According to newly released registry filings, Zing’s holding company, MP Payments, reported a pre-tax loss for 2024 driven by an $88.4 million impairment on subsidiary investments. In total, impairments tied to the project have reached $131.7 million since July 2022.

HSBC launched Zing in early 2024, aiming to take on FinTech players like Revolut and Wise. The rollout began in the UK, with plans to expand across Europe and beyond. To accelerate growth, HSBC partnered with companies like Visa, Tink, and Currencycloud.

But from the start, the numbers told a different story... In its first two months, Zing registered roughly 36,000 downloads in the UK. In that same period, Wise saw 203,000, while Revolut crossed the one million mark.

Just a year later, HSBC pulled the plug, citing challenges in restructuring Zing’s compliance operations. The closure marked another reminder of the difficulties traditional banks face when entering a space long dominated by FinTech-native players.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

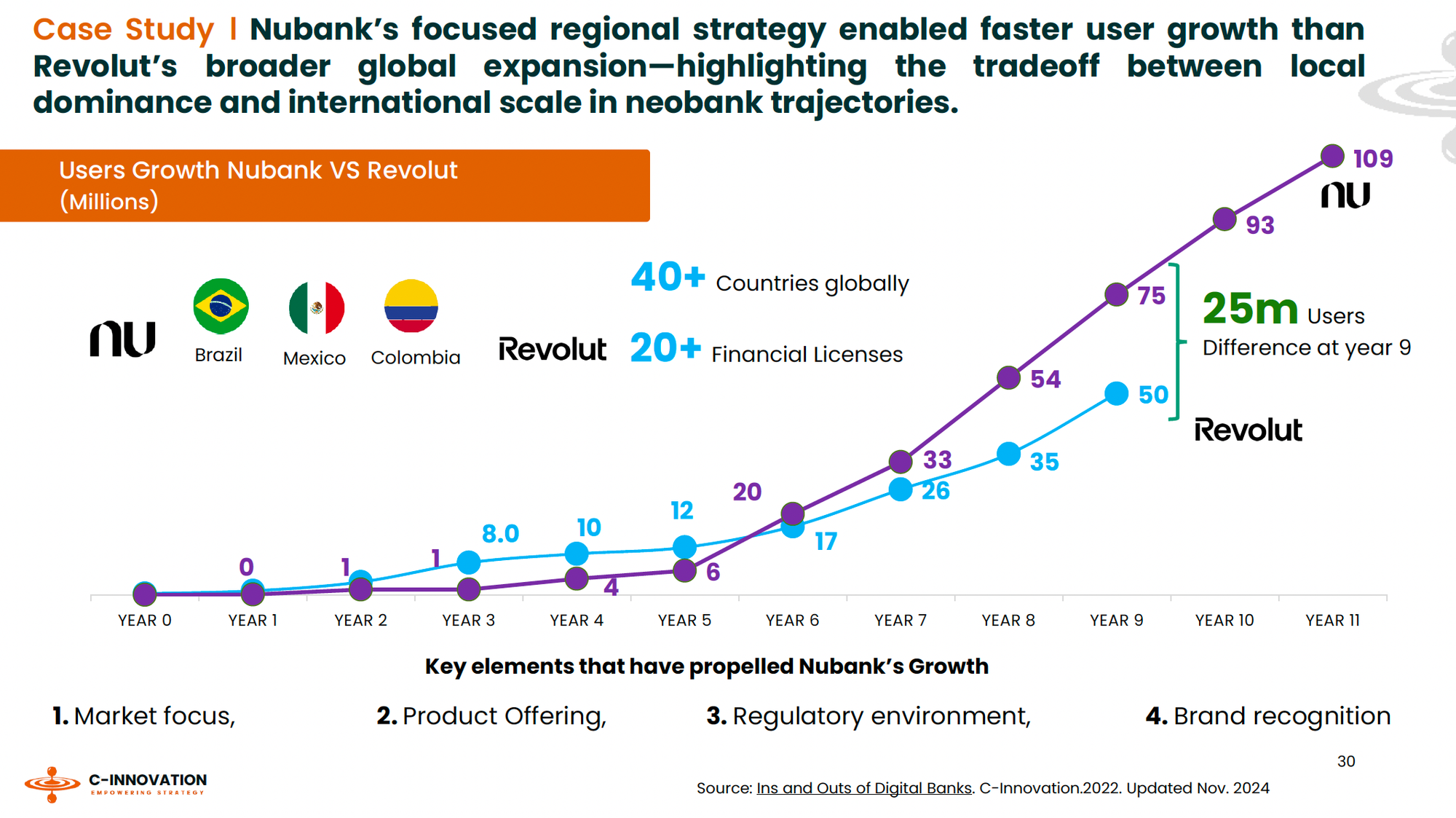

📈 Nubank 🆚 Revolut

Two very different growth strategies👇

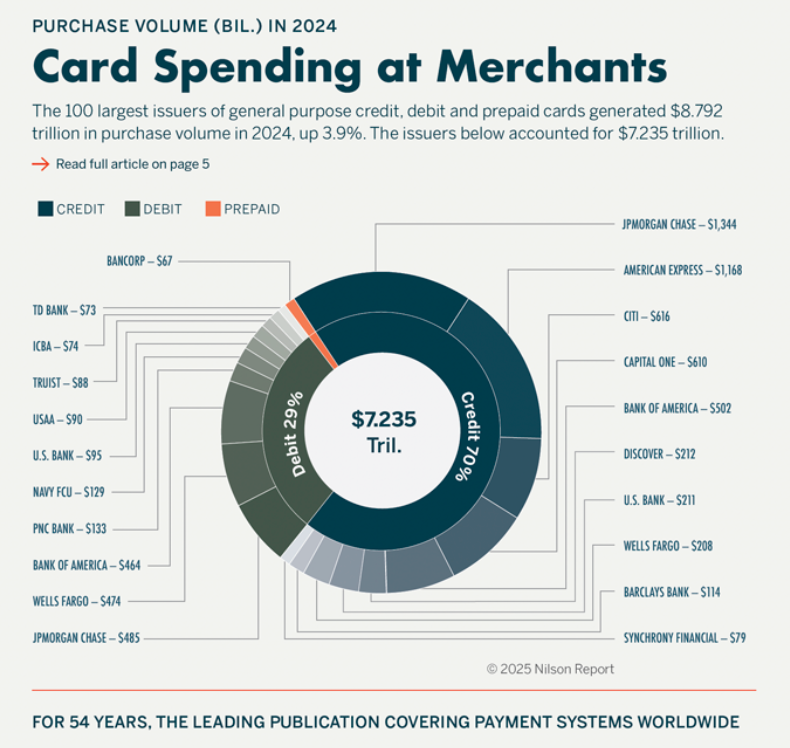

💰 The 100 largest issuers of general-purpose credit, debit, and prepaid cards generated $8.792 trillion in purchase volume in 2024 🤯

NEWS

🇬🇧 Failed FinTech Zing lost $87m before HSBC axed it. The 2024 pre-tax loss for Zing’s holding company, incorporated as MP Payments, reflected a $88.4m impairment charge on its investments in subsidiaries. Zing reported an accumulated impairment loss of $131.7m since its establishment in July 2022.

🇨🇦 Wealthsimple takes on Big Six with launch of credit cards and loans. The company will replicate traditional retail banking services such as credit cards, loans, and even old-fashioned cheques, putting it in direct competition with other financial institutions beyond its core investing products.

🇪🇸 Banco Santander launches Instant Euro Transfers via Bizum in Spain. According to the bank, customers will be able to receive money "by simply selecting a contact from their address book and with the same level of security and trust that Bizum currently offers between Spanish bank accounts."

🇸🇪 Mambu and Avenga power Marginalen Bank’s core banking transformation with successful cloud migration. Bo Andersson, CIO at Marginalen Bank, stated that the collaboration with Mambu and long-term technology partner Avenga has been seamless, enabling the bank to migrate to the cloud and modernize its consumer and business deposit offerings.

🇬🇧 FlexiLoans raises Rs 375 Cr in Series C funding round. The new funding will be utilised to expand operations, fuel product development, and technology infrastructure. The fresh capital raise includes primary equity to support operational growth and secondary transactions to provide liquidity for existing investors.

🇬🇧 Paragon Bank taps Moneyhub capabilities to address major UK savings challenges. By using Moneyhub’s open banking technology, Paragon can connect Spring with a customer’s existing current account. This integration enables customers to view their current account balance in the Spring app and easily move money between accounts, providing users with full control over their savings.

🇺🇸 Treasury Prime partners with People Trust to advance financial inclusion via embedded banking. This partnership includes the possibility for future use of Treasury Prime’s front-end solution to replace the institution’s legacy online banking interface, enhancing member experience and increasing operational efficiency.

🇬🇧 NatWest appoints Dr Maja Pantic as the Bank’s First Chief AI Research Officer. Maja brings deep AI research expertise and is currently serving as Professor of Affective & Behavioural Computing at Imperial College London, having previously been Founding Research Director of Samsung AI Research Centre in Cambridge.

🇺🇸 Varo Bank welcomes Rathi Murthy as Chief Technology Officer, strengthening its commitment to customer financial empowerment. Rathi’s appointment highlights Varo’s commitment to empowering more customers through the development and adoption of technologies such as AI to improve access to financial services, transform how the bank assesses credit risk, and combat fraud.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.