🇮🇳 India Goes Full FinTech Mode: Amazon + Revolut Shake Things Up

Hey Digital Banking Fanatic!

If there were a FinTech World Cup, India 🇮🇳 would be leading the table this week.

At the Global FinTech Festival, Amazon Pay unveiled UPI Circle, a family payment ecosystem that’s part budgeting tool, part super app.

The idea: one main account holder manages a shared wallet where family members can spend, send, and split payments without needing their own bank account.

It’s secure, biometric, and comes with spending limits and real-time control, basically “banking with parental supervision” turned into a product.

Meanwhile, Revolut officially entered the Indian market after years of teasing it.

The UK-based FinTech Giant is bringing UPI-linked wallets, Visa cards, kids accounts, same-day remittances, and multi-currency features to India’s massive digital user base.

CEO Paroma Chatterjee didn’t hold back, calling traditional forex fees “criminal.”

She says Revolut’s mission is simple: stop the $600 million Indians lose each year on hidden bank charges.

And if you thought Revolut’s expansion was the only headline, wait till you see where its founder just moved.

Quiz of the Day: To which country did Nik Storonsky relocate?

A) USA B) Russia C) UAE D) Singapore E) UK

You can find the answer here.

Scroll down for the full stories 👇 and the rest of today’s digital banking highlights.

Cheers,

INSIGHTS

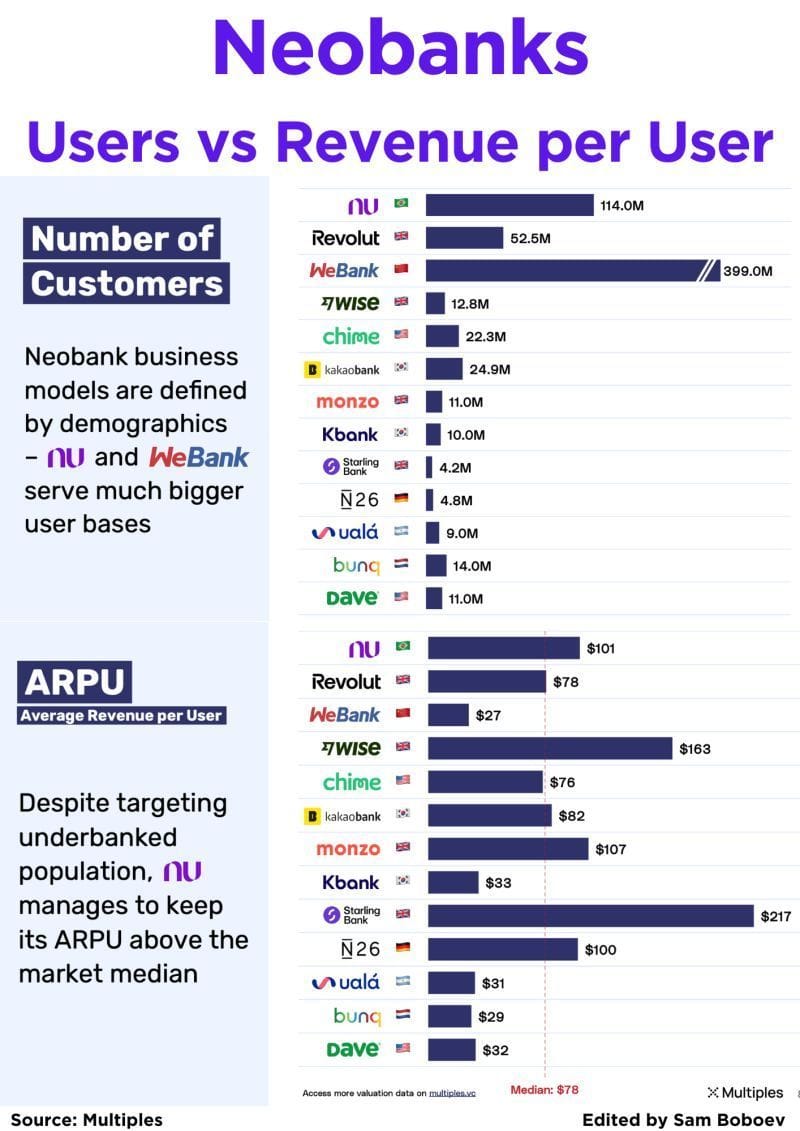

💰 Here is how much money the big neobanks make per customer.

A comparison on Average Revenue Per User (ARPU)👇

NEWS

🇮🇳 UK's Revolut to launch India payments platform, eyes 20 million users by 2030. Revolut will let Indian users make domestic and international payments via its tie-ups with the UPI and Visa, starting with 350,000 waitlisted customers later this year before opening to others. Additionally, Revolut introduces Pay by Bank payment method in Finland to its payment processing service, offering businesses a new tool that enables fast and secure payments directly from a customer’s bank account.

🇮🇳 Amazon Pay introduces UPI Circle. UPI Circle now enables primary UPI account holders to securely add family members to their payment circle with either one-time approval or transaction-by-transaction authorisation. Keep reading

🇸🇬 Trust Bank now offers a customisable savings plan in Singapore with up to 2.5% p.a. Under the plan, customers can choose any three bonus interest categories from a menu of eight, depending on their lifestyle and financial habits, such as spending, saving, or investing.

🇮🇩 Superbank denies going public for 2025 IPO despite strong signals. Backed by Emtek and Grab, the bank plans to allocate 70% of IPO proceeds for loan disbursement and the rest for digital infrastructure. Read more

🇬🇧 Atom Bank opens new headquarters in Newcastle city centre. Mark Mullen, CEO of Atom bank, emphasized that the move to the Pattern Shop represents more than just a change of location; it's a strong statement about the bank's future and its commitment to the North East.

🇺🇸 Ex-BlockFi CEO Zac Prince returns to the crypto spotlight to lead Galaxy Digital’s new banking platform. The appointment places Prince at the center of another effort to merge crypto services with mainstream finance, but this time, under markedly different conditions. In an interview, Prince said his personal risk appetite is “more conservative” after what he experienced with BlockFi.

🇮🇱 QNB Group receives Central Bank of Egypt license approval for a new digital bank. ezbank will combine advanced digital technology with international best practices to offer seamless financial services to a broad customer base. The bank will use mobile-first platforms, AI-driven tools, and smart risk management to make transactions easier, increase access, and support Egypt's digital economy.

🇪🇸 ID Finance and myTU Partner to deliver instant loan payouts with programmable banking infrastructure. The partnership enabled ID Finance to deploy instant loan payouts within a single business day, avoiding a potentially costly disruption. Keep reading

🇺🇸 Jiko announces strategic investments from key industry players, including Coinbase and Blockstream Capital Partners. These strategic partners will join a growing number of institutions adopting Jiko as a banking partner to utilize its U.S. T-bill-based model for storage, settlements, and payments.

🇺🇸 Baltimore sues MoneyLion over alleged predatory loan practices. The complaint, filed by the city's Department of Law, claims that the company violated Baltimore's Consumer Protection Ordinance by promoting small, short-term "Instacash Advances" with deceptive terms.

🇩🇪 Bullish and Deutsche Bank partner to deliver seamless fiat integration for institutional crypto trading. Through this partnership, Deutsche Bank will provide comprehensive corporate banking services to Bullish, including the seamless facilitation of fiat deposits and withdrawals for customers of Bullish Exchange’s Hong Kong SFC and German BaFin-regulated businesses.

🇬🇧 Moniepoint reports $1.2million loss in first year of UK operations and acquires FCA-regulated Bancom Europe. The company did not generate any revenue between February and December 2024, with operations continuing to be funded by its parent company. In July 2025, it completed the acquisition of Bancom Europe.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.