Installment Payments Just Got Easier for Monzo’s UK Users

Hey Digital Banking Fanatic!

Monzo introduced an update that might impact millions of their British customers. Now, clients will be able to use buy now, pay later when paying with Apple Pay.

The change affects Monzo Flex, letting customers split eligible purchases into three interest-free monthly installments or longer plans with interest over six or 12 months.

Before the update, shoppers had to pay in full with their Monzo Flex credit card and then choose to spread the cost later in their banking app.

Looks like Monzo is working to maintain its leadership in customer satisfaction in the UK.

I've lined up more Digital Banking headlines for you.

Cheers,

INSIGHTS

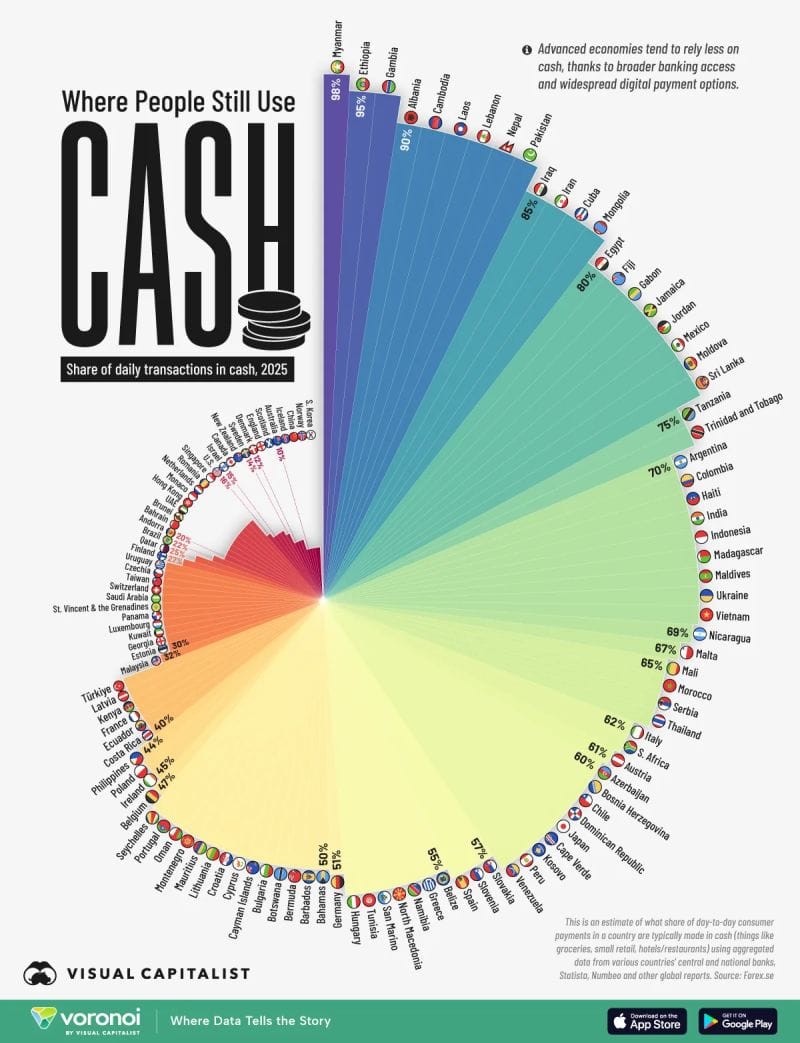

🌍 Countries That Use the Most Cash in 2025👇

NEWS

🇬🇧 Monzo makes changes to buy now, pay later for millions of customers. The digital bank is simplifying the use of its service by allowing customers to select the "pay later" option at checkout and extend their repayment period to six or twelve months, albeit with interest.

🇯🇵 Japan approves major stablecoin project backed by top banks. Banks will start issuing payment stablecoins pegged to the yen, designed to streamline business-to-business transactions and improve overall productivity in Japan’s financial ecosystem. According to the FSA, the project will include user-protection measures and full transparency around the systems used.

🇬🇧 Revolut and Scandinavian Airlines partner to turn everyday spending into rewards. Through this partnership, Revolut users can transfer their RevPoints into EuroBonus points at a 1:1 ratio, with no minimum transfer amount, making it easier than ever to turn daily spending into unforgettable experiences.

🇺🇸 FIS launches Innovative Asset Servicing Management Suite. The suite combines the traditionally separate critical functions of corporate actions processing to revolutionize asset servicing, creating a seamless experience that helps capital investment work more efficiently and underscores FIS's commitment to unlocking financial technology for the world.

🇨🇭 Alpian names Miren Rubio Zuluaga as Chief Product Officer. In her new role, she is expected to lead the bank’s product strategy and innovation roadmap, focusing on scaling the platform and enhancing client experience. Zuluaga has been with the firm for over five and a half years.

🇮🇹 UniCredit set to appeal ruling over Italy’s demands for BPM deal. The bank’s board is considering an appeal as a way to clarify the regulatory framework for future consolidation moves. It is also intended to protect the bank against any future complaints from investors.

🇲🇽 Invex, from Mexico, joins forces with Walmart and strengthens its financial ecosystem. With this new partnership, the entity seeks to expand access to formal credit, especially among the less banked sectors, through secure, digital products adapted to daily consumption.

🇻🇳 VPBank transitions to cloud-native core banking with Temenos and Red Hat. The upgraded system enables the bank to launch products more quickly, integrate easily with partners, and deliver richer, more reliable digital services to its customers, leading to improved performance.

🇬🇧 Snap Finance UK redefines lending with an instant-access virtual card. The new proposition makes point-of-sale finance more accessible and manageable, offering customers instant loan access with more flexibility on how they spend and pay, and full visibility through the Snap Wallet mobile app.

🇸🇬 DBS rolls out a gen AI-powered chatbot to all corporate clients. The virtual agent automatically connects users to a customer service specialist, who is in turn equipped with a digital co-pilot that helps them provide more tailored support to clients. Users can access the service via the bank’s digital banking platform, IDEAL.

🇮🇹 Italy's banks back digital euro, want costs spread over time. Italian banks support the European Central Bank's digital euro project, but want investments required by them to implement it to be staggered over time because the costs are high, a top official of the Italian Banking Association said.

🇰🇪 Irish FinTech Umba hits profitability in Kenya and eyes next growth phase with stablecoin launch. Tiernan Kennedy, the company’s Chief Executive, said it is eying further success on the back of a move into stablecoins and the rollout of an AI bot. Umba is a digital financial services provider offering innovative banking solutions primarily by smartphone.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.