Klarna’s Neobank Pivot Ahead of U.S. Listing

Hey Digital Banking Fanatic!

For all the new products Klarna has launched, and despite public efforts by its CEO to shift perception, the company’s name still evokes “buy now, pay later” for many consumers and investors.

This comes as Klarna prepares for a second U.S. IPO, after putting its April plans on hold amid trade-driven market volatility.

Meanwhile, Klarna is focusing on the U.S. market. New debit cards, mobile plans, and savings products have been launched recently. Its services now include FDIC-insured accounts and Google Pay.

“With mobile plans we’re taking [saving customers time and money] one step further, as we continue to build our neobank offering,” said co-founder and chief executive Sebastian Siemiatkowski in a statement.

The FinTech company has held a Swedish banking license since 2017, but it seems that shifting from a BNPL identity to a broader banking narrative is proving to be more complex than a product launch cycle.

Despite that, the company keeps moving forward, announcing a new partnership with Bolt to integrate its payment options into Bolt’s checkout operating system.

This deal means Klarna will show up as a buy now, pay later choice on Bolt devices. Merchants using Bolt can offer Klarna’s Pay in 4 or monthly financing options to shoppers in physical stores, and shoppers can choose that option with a single click.

The integration is set to go live later this year, first in the U.S. 🇺🇸 and then in other markets around the world.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

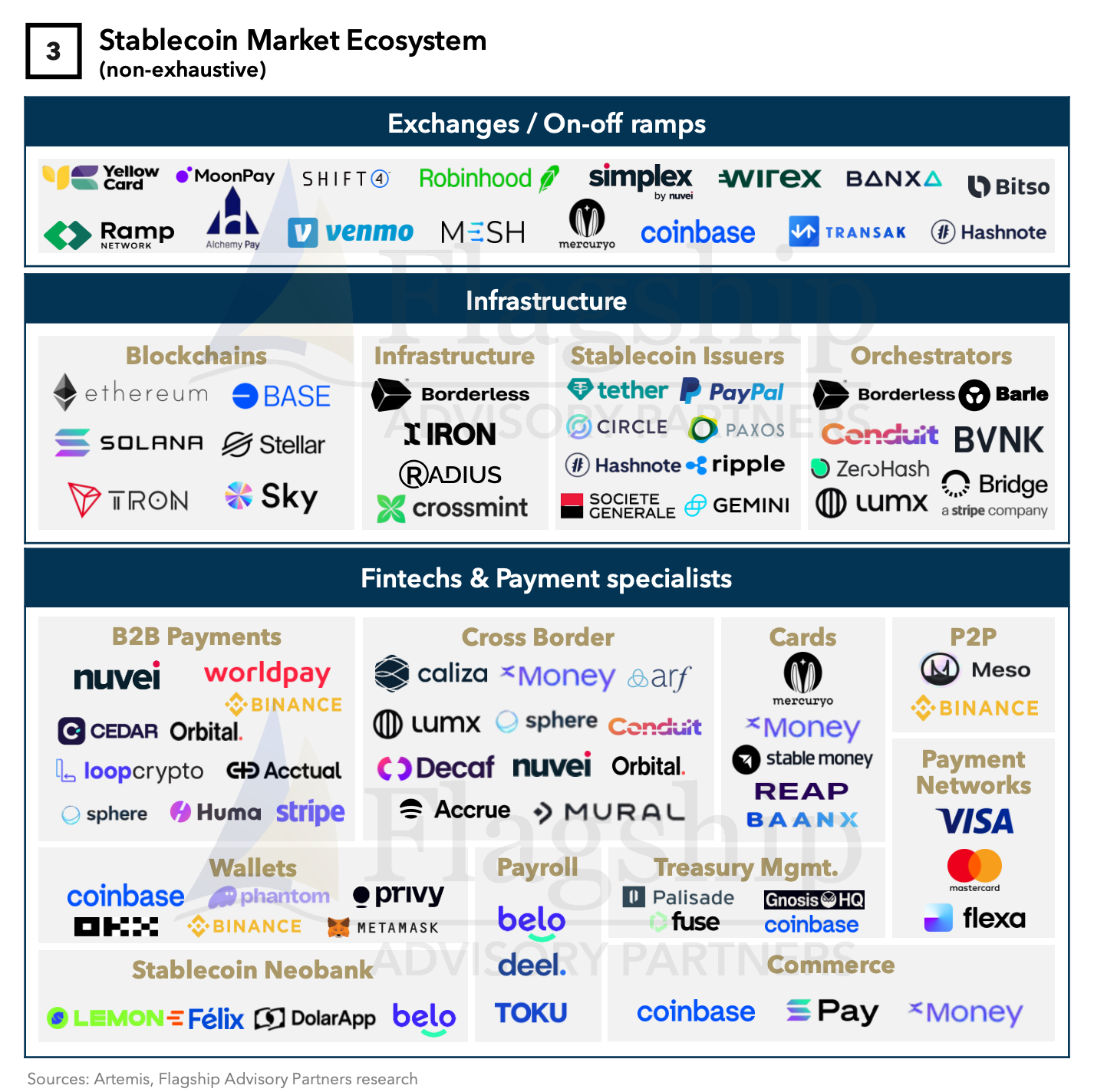

📈 2025 is THE Year of Stablecoins 🤯

With Record Volumes and M&A Momentum👇

NEWS

🇺🇸 Klarna accelerates shift to digital bank ahead of second IPO attempt. Klarna must prove to investors that it can be sustainably profitable as it prepares a second attempt to list in the US after earlier plans were thwarted in April by market turmoil linked to the US trade war.

🇺🇸 Klarna and Bolt announced a partnership that will see Klarna’s payment options integrated into Bolt’s checkout operating system. This deal means Klarna will show up as a buy now, pay later choice on Bolt devices. Merchants using Bolt can offer Klarna’s Pay in 4 or monthly financing options to shoppers in physical stores, and shoppers can choose that option with a single click.

🇦🇺 CommBank deploys AI-powered bots to fight scams. These bots are deployed by Apate.ai, a cyber-intelligence firm that spun out from Macquarie University. Apate.ai’s system is based on a “honeypot” system, said Dali Kaafar, CEO and founder of the company.

🇸🇬 Moneythor launches AI suite to deliver deep banking. The suite enables banks to leverage the full potential of their data to deliver experiences that resemble those of popular technology and media apps in terms of personalisation, proactivity, and engagement, a challenge which many of the region’s banks are currently struggling to deliver in practice.

🇦🇷 Revolut's plan in Argentina and the difference with Nubank's setback. Revolut is actively recruiting a "Head of Expansion" to build a local team within a year and secure necessary licenses, partnerships, and regulatory approvals. Meanwhile, Nubank is taking a more cautious approach.

🌍 Europe’s neobanks want to help customers buy a house. Mortgages are key to convincing customers to use challenger banks as their primary accounts. UK neobanks Revolut and Monzo are both looking into the home ownership space, while Germany’s N26 and Dutch challenger bank Bunq have launched mortgage products in recent years.

🌍 NymCard raises $33M to scale embedded finance across MENA. With this investment, it is deepening its presence across 10+ markets in MENA, strengthening its payment infrastructure solutions to better serve banks, enterprises, FinTechs, telecom providers, and more across its three core verticals: Card Issuing Processing, Embedded Lending, and Money movement.

🇬🇷 Natech secures $33 million ahead of the launch of the Greek digital bank. The company says it is already actively preparing for the next funding round to deepen its presence across key European markets and support the scale-up of its modular Banking-as-a-Service product suite.

🇲🇽 Klar raises $190 million at $800 million valuation. Klar has positioned itself as an alternative to legacy institutions by offering lower-cost, app-based financial products to a broad swath of Mexican consumers and small businesses. Read more

🇮🇳 Slice rolls out UPI credit card and opens India’s first UPI-powered bank branch. The newly launched Slice Super Card functions like a UPI-based credit card. It has no joining or annual fees and allows users to scan QR codes or make UPI payments directly from a pre-approved credit line.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.