LemFi Acquires Pillar to Expand Migrant Credit Access

Hey Digital Banking Fanatic!

LemFi has acquired UK-based credit card issuer Pillar in a move to expand its credit offering for immigrant communities. The terms of the deal were not disclosed.

Founded in 2021 by Opay alumni Ridwan Olalere and Rian Cochran, LemFi began as a remittance platform and now serves +2 million users across Europe and North America. The company processes over $1 billion in monthly transfers and recently raised $53 million in fresh funding. It has since broadened its focus to include credit services, and an early beta saw over 8,000 users sign up within 6 weeks.

Pillar was launched by former Revolut executives Ashutosh Bhatt and Adam Lewis to help newcomers to the UK access credit.

Over the past 4 years, the company has built an alternative credit scoring system that uses global data and non-traditional signals to assess financial eligibility, enabling migrants to access credit cards before they even arrive in the country. Since launch, Pillar has issued around 20,000 cards and raised $16.9 million from backers, including Global Founders Capital.

With this acquisition, LemFi gains more than just technology. It now holds an FCA credit license, a proprietary credit engine covering 18 emerging markets, and a team with direct experience navigating migrant financial needs. “We’re building our credit decision engine that takes into account your history in your previous country,” Olalere told.

Though they began on separate paths, both LemFi and Pillar set out to solve the same issue: the financial invisibility of migrants. “If we do not fuse, we’ll end up competing, and customers will get confused. It’s just messy,” Bhatt said.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

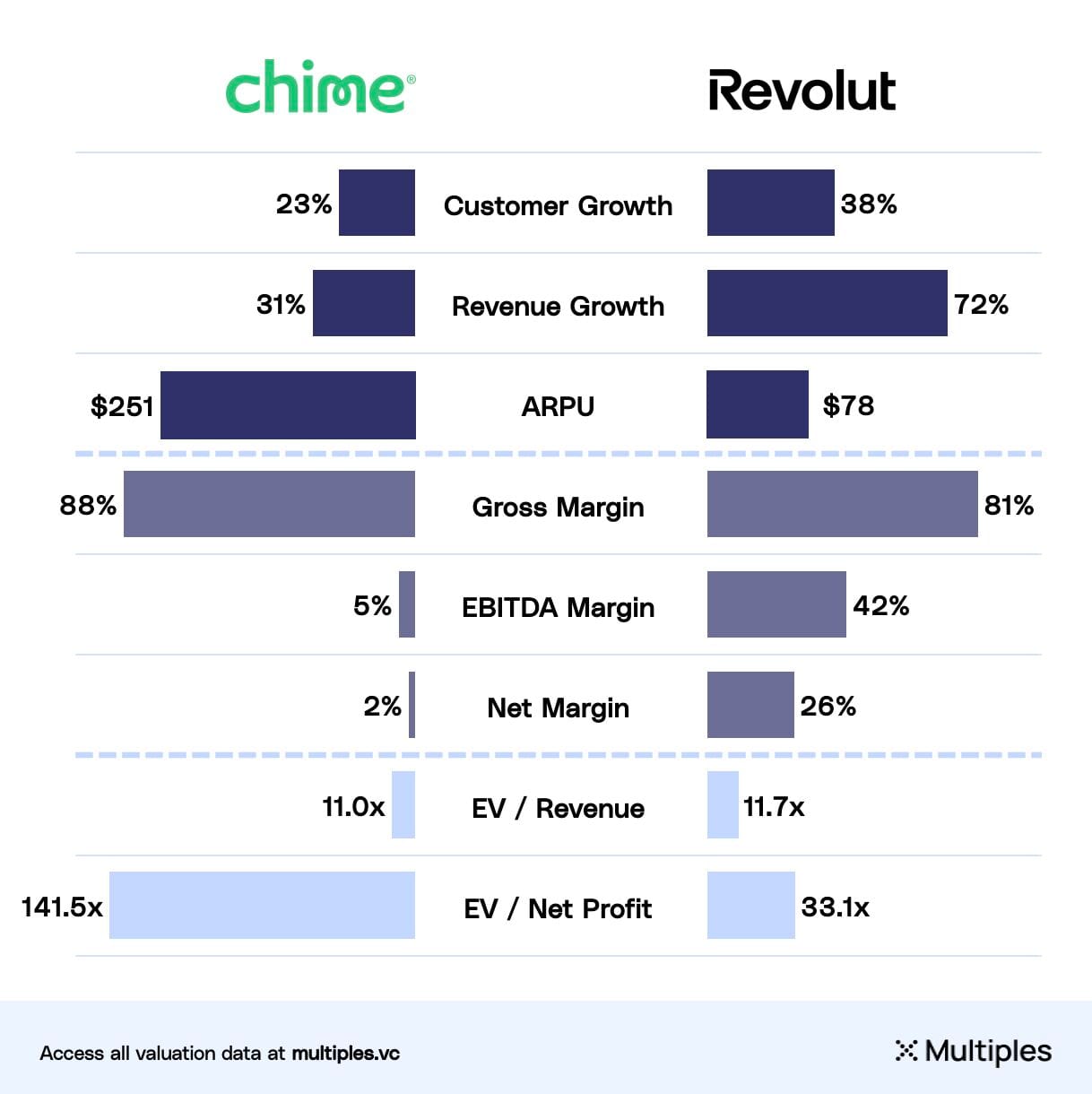

📈 Chime went public last Friday, surging 59% and reaching a valuation of $18.4 billion.

NEWS

🇸🇪 Klarna challenger Zaver becomes a bank. The company has been granted a license for financing activities by the Swedish Financial Supervisory Authority. This authorization allows Zaver to provide payment services under the Swedish Payment Services Act and the European PSD2 regulations.

🇴🇲 Dhofar Islamic’s Mastercard World credit card: An invitation to experience a world of exceptional privileges. The Dhofar credit card allows customers to enjoy an enhanced spending experience as it unlocks a comprehensive suite of rewards, travel benefits, and lifestyle offerings that can be availed of both locally and internationally.

🇦🇪 Jingle Pay collaborates with Western Union to power and enable the delivery of international money transfers (remittances) from select markets. Jingle Pay will serve as a key partner for Western Union, providing support to the flow of cross-border money transfers currently to bank accounts & mobile wallets.

🇫🇷 Carrefour Bank prepares to unify cards and move ‘out of shop’. The initiative involves consolidating the different branded cards, Carrefour, Atacadão, and Sam’s Club, into a single product. This unified card will be tailored based on customers’ income and risk profiles, and it will provide benefits across all of the retailer’s brands.

🇹🇿 CRDB Bank migrates card systems to BPC's SmartVista platform. The platform features multi-card issuance capabilities, including corporate and virtual cards, as well as acquiring services for processing transactions across POS networks, cardless withdrawals, and foreign exchange (FX) at ATMs, among others.

🇬🇧 Pryme to raise £30m to power financial tools for Africa’s freelancers and SMEs. The goal is to scale a platform that has outgrown its e-commerce beginnings and morphed into what Pryme describes as a financial operating system for modern businesses.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.