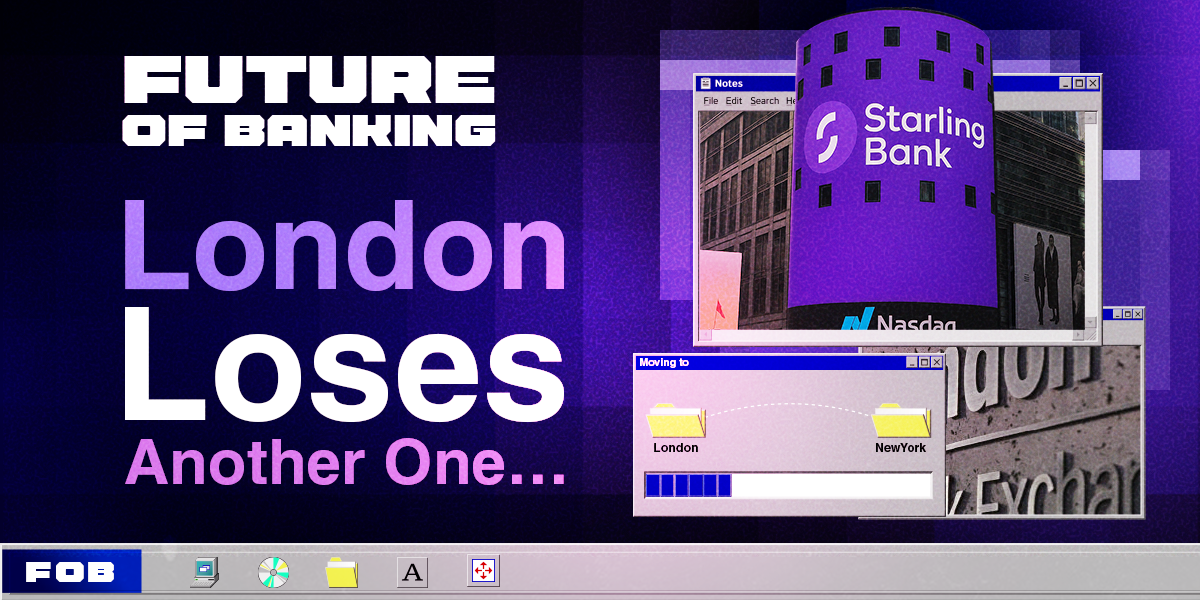

London or Wall Street? Starling Weighs Its Options

Hey Digital Banking Fanatic!

Another hit to the London Stock Exchange… According to the Financial Times, Starling Bank is considering a potential US listing, aiming for a possibly higher valuation. CFO noted that the bank hasn’t yet formed a “concrete view” on the matter.

Starling’s interest in a US listing might not be random. Bloomberg previously reported the bank was looking to acquire a US institution, which could lay the groundwork for a future IPO.

But that’s not all, there’s more happening behind the scenes. Scroll down for more on Starling and the latest updates across the digital banking industry 👇

See you tomorrow!

Cheers,

Stay Ahead in FinTech! Subscribe to my Telegram channel for daily updates and real-time breaking news. Get the essential insights you need and connect with FinTech enthusiasts now!

NEWS

🇺🇸 Starling Bank weighs New York listing as part of US expansion plans. “We continue to observe what is happening externally with our peers, and also what is happening on the global stage in terms of the UK versus US, stock markets,” said Declan Ferguson, the Chief Financial Officer.

🇰🇷 Kbank runs a senior call center to meet the needs of the aging population. The call center for older adults opened in early June, as they increasingly make up a larger share of customers in the asset management market amid longer life expectancy.

🇬🇧 Monzo unveils flexible home insurance for homeowners. Monzo Home Insurance is available to UK homeowners, giving them a flexible and transparent approach to home protection. The Monzo app powers this digital insurance solution, which is designed to be simple, quick, and give customers control.

🇱🇹 myTU enables instant global payouts with Visa Direct and Mastercard cross‑border services. This integration empowers businesses and individuals to send real-time payouts, including salaries, insurance claims, refunds, and gig-economy payments to eligible cardholders, as well as directly to bank accounts in supported markets.

🇮🇳 Wise opens global office in Hyderabad and plans major hiring. The company, which currently has 70 employees on its rolls in Hyderabad, plans to expand its workforce over the next few years. Additionally, UniCredit picks Wise to handle FX payments in latest retail push. The partnership comes after the lender launched a review and found it had “shortcomings” in its mobile banking payments offerings.

🇮🇩 Jenius chooses Wise Platform to transform cross-border payments for millions of digitally-savvy Indonesians. Its customers will be able to benefit from faster cross-border payments, full price transparency, and real-time transaction tracking, as funds can be sent directly from their Jenius Foreign Currency accounts.

🇮🇹 BBVA appoints Walter Rizzi as head of digital banking in Italy. His strong technical and strategic background makes him a key leader to drive the bank’s growth, aligning BBVA’s value proposition with the specific characteristics of the Italian market and cementing its position as an innovative digital banking institution.

🇺🇸 BlockFi co-founder Flori Gilroy hired to lead revamped SoFi crypto unit. The new hire was quietly made official via an update to the masthead on SoFi’s website and confirmed by a source familiar with SoFi’s business operations. It’s unclear when Gilroy took on the new role.

🇮🇳 FinTech majors are counting on co-branded cards in returns play. Google Pay is in discussions to build a co-branded credit card with Axis Bank. This marks a shift for Google, which has so far avoided regulated businesses in India and pulled back its FinTech bets globally.

🇬🇧 StanChart launches bitcoin and ether spot trading for institutional clients. Institutional clients, including corporates, investors, and asset managers, can now trade digital assets through familiar FX interfaces, and will soon be offered non-deliverable forwards trading, StanChart said in a statement.

🇺🇸 Former Coinbase exec raises $12.5 million for Dakota, a stablecoin-powered neobank. The injection of capital into Dakota, which uses stablecoins to move money between itself and its customers, is the latest bet from VCs on a company involved in one of the buzziest sectors of crypto.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.