Lunar Raises €46M to Scale Business Banking and Push Toward Profitability

Hey Digital Banking Fanatic!

Lunar just raised €46 million to accelerate growth across the Nordics.

Lunar serves more than one million users and has reached 40,000 business customers, with more users opting into paid subscriptions.

The focus now is on the following: scale business banking, build out lending, and expand further into Norway and Finland.

Founder and CEO Ken Villum Klausen says the strategy is proving itself, as Lunar doubles down on what’s working while opening up a much larger opportunity across consumer, SME, and platform services.

The round drew strong support from existing investors and brought in new capital, reinforcing confidence in Lunar’s execution as a full-service Nordic digital bank.

Meanwhile, Revolut Goes Fully Live In Mexico...

Revolut has officially ended its beta phase and launched full digital banking operations in Mexico. Users can now open accounts directly, with no waitlist.

This marks Revolut’s first fully licensed bank outside Europe and its 40th market globally. The Mexican entity launched with over $100 million in capital, more than double the regulatory requirements, and a capital ratio north of 400%.

CEO Juan Miguel Guerra says the goal is simple: help Mexicans get more out of their money, backed by a fully regulated banking setup.

If you’re tracking how Digital Banking players are expanding and maturing across markets, keep scrolling 👇 I'll be back tomorrow with more updates.

Cheers,

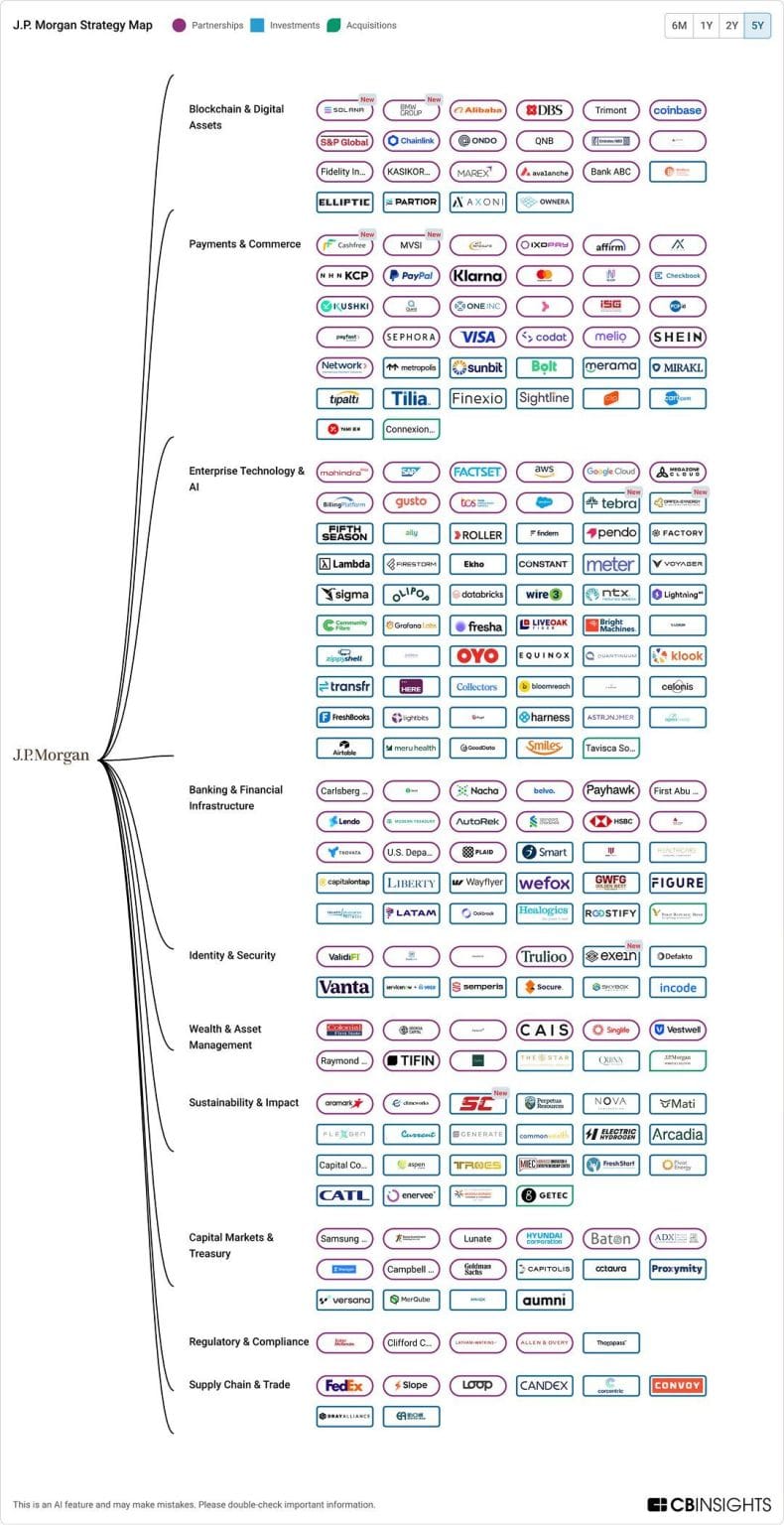

INSIGHTS

➡️ J.P. Morgan Strategy Breakdown.

NEWS

🇩🇰 Lunar raises €46 million to accelerate Nordic growth. The capital increase is to scale its fast-growing business banking, develop its lending proposition, and support continued expansion across the Nordics. Read more

🇩🇪 N26 launches ‘N26 for under 18s’, marking the first step in its family offering. The product provides a unified view of their child’s spending alongside their own, while allowing parents to effortlessly guide their child's first steps in money management in an increasingly cashless world, all within a completely secure environment.

🇦🇷 Pierpaolo Barbieri on power, competition, and the future of Argentina’s financial system. Barbieri, founder and CEO of Ualá, reflected on Argentina’s economy, consumption trends, and the region’s financial future in an interview at Forbes, emphasising how his background as a historian shaped his approach to building a FinTech serving more than 11 million users. Watch the full interview

🇬🇧 Revolut Business moves into revenue operations with a recurring billing tool. The tool allows merchants to build, automate, and optimise subscription plans directly within their Revolut Business app, aiding the platform's evolution from a payments processor to a full revenue operations partner.

🇲🇽 Revolut officially launches its full digital banking service in Mexico after closing the beta phase. Mexican users can download the Revolut app, available on both the Apple App Store and the Google Play Store, to open an account. Continue reading

🇧🇷 Inter abandons BDRs on the B3 and announces it will remain only on the Nasdaq. The proposal to discontinue the Level II Sponsored BDR Program aims to maximise efficiency and minimise redundancies resulting from maintaining the status of a publicly traded company in more than one jurisdiction.

🇳🇱 Netherlands set to scrap bonus caps for some banking and FinTech staff. The proposal would lift caps on variable pay for most bank and FinTech staff while keeping limits in place for top material risk takers, and still requires further approval from the chamber and the Senate.

🌍 ECB official explains why Europe needs a digital Euro, eyes 2029 rollout. An executive board member at the ECB said that a digital euro would function as a free, cash-like payment option available across the entire euro area while reducing reliance on foreign-owned financial infrastructure that could theoretically cut European users off from their own money.

🇮🇳 FinTech startup Mysa raises $3.4 million from Blume Ventures and Piper Serica. The company plans to use the fresh capital to expand its automation capabilities and launch additional banking products, including procurement tools, expense management linked to the UPI, and a corporate credit card.

🇺🇸 PAQ Wallet digital wallet, launches a new app to send money from the US to Guatemala in partnership with Leap Financial. Through credit cards, debit cards, bank accounts, or cash, users can make fast and secure digital transfers, typically processed in minutes, depending on the network and partner verification, at competitive costs compared to traditional methods.

🇨🇴 Terrenta begins operations in Colombia and becomes the first regulated real estate crowdfunding FinTech. Terrenta has begun operations in the country, focused on the real estate and construction sector, authorised and regulated by the Financial Superintendency of Colombia, expanding access to investment and financing alternatives within a regulated framework.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.