Mal Raises $230M to Build the World’s First AI-Native Islamic Digital Bank

Hey Digital Banking Fanatic!

Mal just secured $230 million to bring what it calls the world’s first AI-native Islamic digital bank to life.

The round was led by BlueFive Capital, alongside strategic investors and family offices. The ambition is big. Mal wants to serve 2 billion Muslims worldwide, while also targeting underbanked communities with a mobile-first banking model.

Founded by FinTech entrepreneur Abdallah Abu-Sheikh, the platform is being built from the ground up with AI at its core. Infrastructure first. Automation baked in. Ethics front and center.

The funding will go toward product development, licensing, and go-to-market execution. Launch is planned for 2026.

The Kontigo Story Out Of Venezuela 🇻🇪 Keeps Evolving…

Since yesterday, things have escalated. After the investigation shared by Jason Mikula gained wider traction, Kontigo publicly pushed back, warning that those sharing the reporting could face legal consequences.

That response quickly drew reactions across FinTech Twitter, including from Sebastian Siemiatkowski, publicly praising the depth and integrity of the reporting and backing independent journalism. What started as an investigation is now clearly resonating well beyond the original story.

What started as a report is now a broader conversation about sanctions, accountability, and how FinTechs respond when uncomfortable questions surface.

If you’re following how Digital Banking models are evolving beyond traditional markets, keep scrolling 👇

Cheers,

INSIGHTS

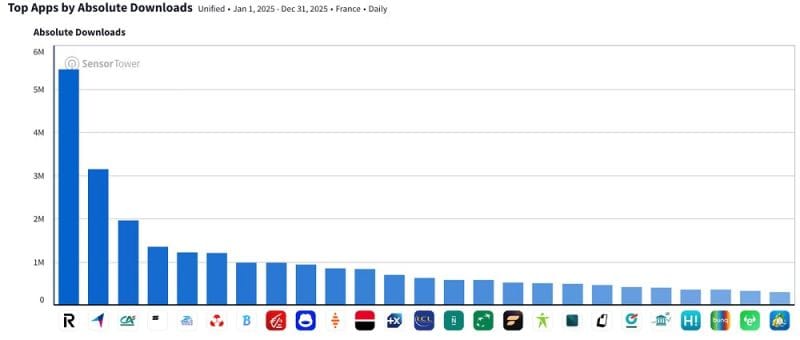

🇫🇷 Revolut is by far the most-downloaded financial app in France 🤯

NEWS

🇸🇦 STC Bank joins hands with Mastercard to transform Saudi remittances through Mastercard Move. The collaboration is fully geared towards transforming the Saudi payments landscape by accelerating the digital transformation of Saudi financial services in accordance with growing digital adoption and consumers’ changing preferences.

🇦🇪 Mal raises $230 million to launch world’s first AI-native Islamic digital bank. The initial funding round unites a worldwide network of investors, including prominent family offices and strategic funds, all committed to Mal’s mission of creating a smart, ethical, and inclusive financial service.

🇬🇧 Revolut amps up fight against impersonation scams with new call identification feature. The new feature detects when a customer opening the Revolut app is on the phone, which includes apps allowing voice calls, and confirms whether they are, or not, talking with a Revolut agent.

🇧🇷 Nubank customers saved $ 29 million in one year via strategic partnerships. Nubank enters 2026 with more than 110 million customers in Brazil, about 61% of the adult population, having saved users $20.5 billion in fees, and is deepening engagement as most customers now use it as their primary bank.

🇨🇿 Banking Circle opens new branch in the Czech Republic, marking the latest milestone in European expansion. With this latest move, Banking Circle will provide direct Czech koruna (CZK) payment capabilities for customers around the world, helping to support global customers in accessing this dynamic market.

🇺🇸 US senators introduce long-awaited bill to define crypto market rules. If signed into law, it would clarify financial regulators' jurisdiction over the burgeoning sector, potentially boosting digital asset adoption. Read more

🇬🇧 ClearBank selects Taurus to support its stablecoin-related services. The agreement will enable ClearBank to leverage Taurus’ technology to advance its digital asset strategy in a secure, scalable, and compliant manner, with a focus on supporting stablecoin-related services for its clients.

🇺🇸 Deutsche Bank expands support for PayPal to strengthen global payment capabilities. Under this expanded agreement, Deutsche Bank will scale up the merchant settlement, payouts, and begin withdrawals and collection solutions for PayPal in the US.

🇺🇸 Crypto-friendly lender Old Glory to go public through a SPAC deal. Old Glory has deep roots in Oklahoma as a traditional lender, but re-branded as a digital bank in 2022 and touts its intention to fully embed cryptocurrency into loans, deposits, and investment offerings.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.