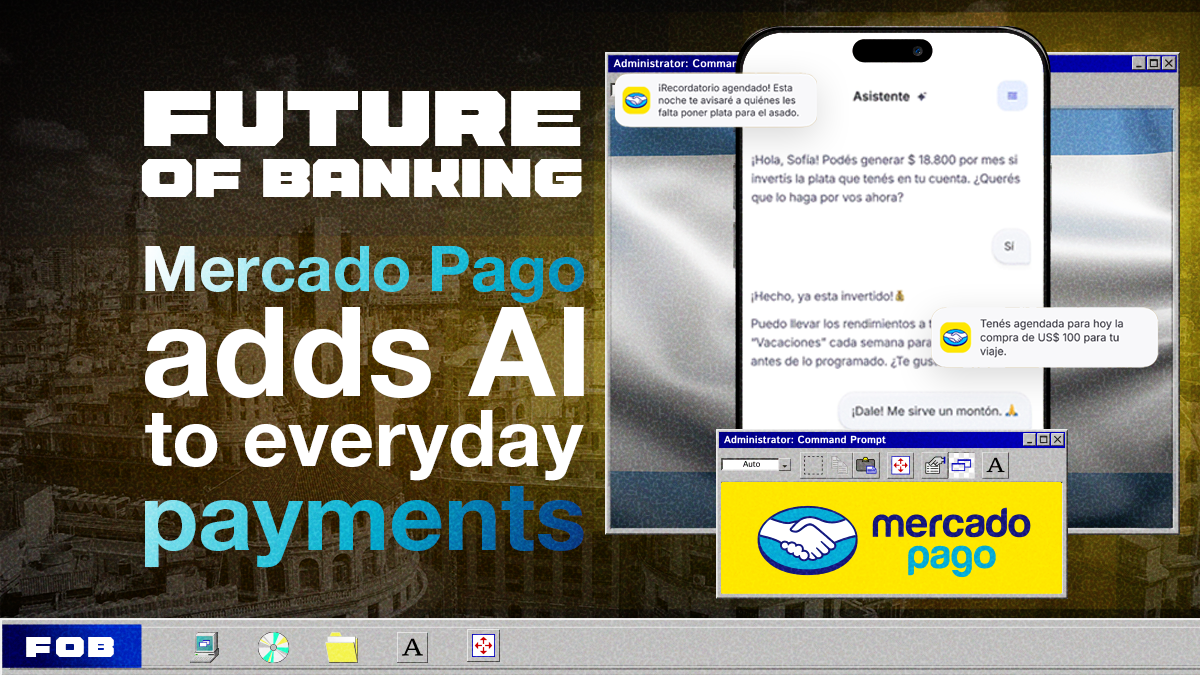

Mercado Pago Rolls Out an AI Assistant to Simplify Everyday Money Tasks

Hey Digital Banking Fanatic!

Mercado Pago just launched a new AI-powered personal assistant built directly into its app and web platform. It’s a smart strategic move.

Make daily money management faster and easier. The assistant handles payments with a photo. Upload a bill, and it reads the barcode or reference number automatically.

Security is part of the pitch. The new Personal Assistant helps verify official company phone numbers, reviews active security settings, and lets users quickly report issues like card theft. Trust stays front and center.

I see this as a pivotal move towards 'intent-based banking'. Instead of forcing users to navigate complex menus, the app understands the context, like a screenshot or a simple question. It turns passive data into an immediate financial action.

Mercado Pago confirmed that user data isn’t used to train external models, a crucial detail here. Also, no sensitive action happens without confirmation.

Now that it's live nationwide, I see it as a major step: One interface. Many tasks.

If you’re watching how Digital Banking platforms are weaving AI into everyday finance as well, keep scrolling 👇 I'll be back tomorrow to keep you updated!

Cheers,

Want your message in front of 275.000+ FinTech fanatics, founders, investors, and operators?

NEWS

🇦🇷 Mercado Pago launched its new integrated AI assistant. The new Personal Assistant, an integrated smart tool, is designed to simplify users' daily financial management. It can quickly handle everyday tasks, combining automation, expense analysis, and security features in one convenient platform.

🇫🇷 HSBC accepts $313 million fine to settle France tax-fraud claims. French authorities said lender HSBC agreed to pay a fine of nearly 268 million euros ($312.9 million) in connection with an investigation into accusations of tax fraud relating to dividend payments.

🇧🇷 Brazilian FinTech Agibank faces a hurdle in its plan for IPO in the US. Brazilian FinTech Agibank’s plan to go public in the US is facing hurdles after the nation’s social security system suspended the firm from making new payroll-deduction loans for retired workers, one of its main businesses.

🇨🇳 PhotonPay raises tens of millions in Series B to pioneer stablecoin-centric financial infrastructure. The funds will enable PhotonPay to accelerate the expansion of its next-generation stablecoin financial rails, hire key talent, and broaden its global regulatory footprint.

🇺🇸 BNY launches tokenized deposits in digital assets expansion. The service enables clients to move funds over blockchain rails, offering an on-chain representation of bank deposits. It can be used for payments, collateral, and margin transactions, supporting faster settlement.

🇧🇷 Influencers received millions to promote the owner of Banco Master on social media. The strategy consisted of defending the banker's image and raising doubts about the Central Bank's actions regarding the financial institution. Read more

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.