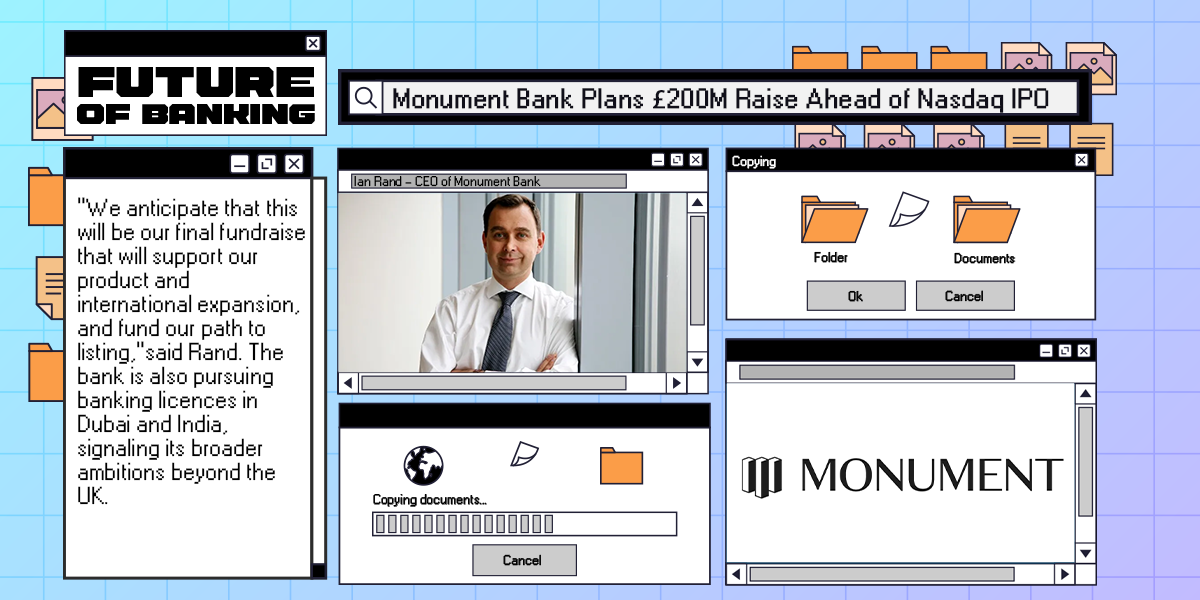

Monument Bank Plans £200M Raise Ahead of Nasdaq IPO

Hey Digital Banking Fanatic!

Monument Bank, the UK-based lender targeting mass-affluent customers, is in discussions to raise £200 million in a Series C round as it prepares for a Nasdaq listing by 2027. The bank, which launched in 2019, so far has already secured £30 million of this round and has raised £68 million to date.

Since its launch, Monument has focused on serving professionals, entrepreneurs, and property investors, opening over 60,000 accounts with an average deposit balance of more than £60,000. So far the bank has attracted over £5 billion in total deposits, positioning itself among the notable players in the UK’s specialist banking sector. The bank was founded under the leadership of former Co-operative Bank CEO Niall Booker and is now headed by ex-Barclays executive Ian Rand.

“We anticipate that this will be our final fundraise that will support our product and international expansion, and fund our path to listing,” said Rand. The bank is also pursuing banking licenses in Dubai and India, signaling its broader ambitions beyond the UK.

Scroll down for more interesting Digital Banking industry news updates and I'll be back in your inbox tomorrow!

Cheers,

INSIGHTS

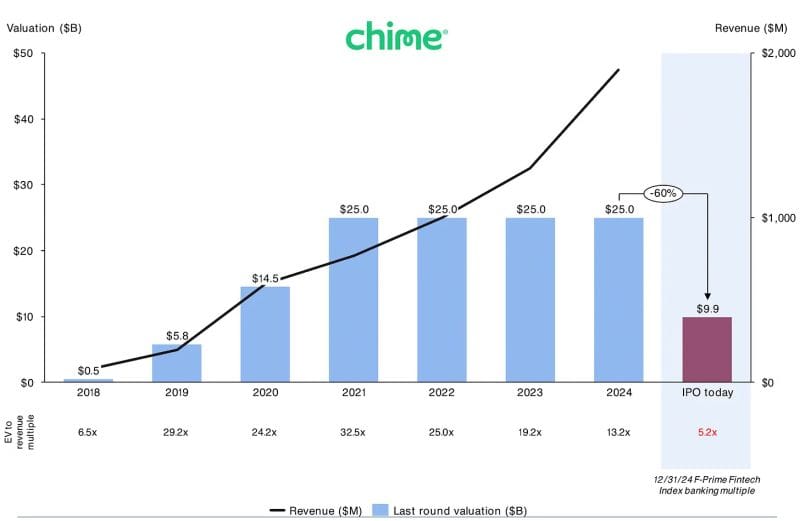

🇺🇸 Chime has confidentially filed to go public this year. If it were to go public today and receive a valuation in line with its peers, it could be worth $9.9B—less than one half of what they saw in the private markets, according to F-Prime. Read on

DIGITAL BANKING NEWS

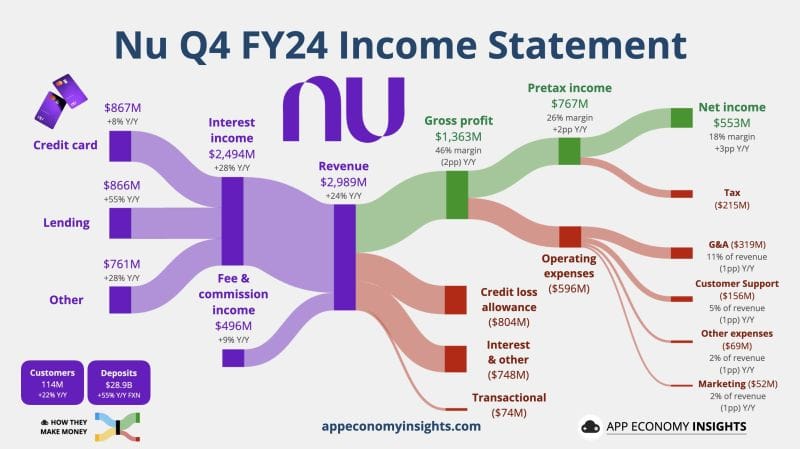

🔥 Nubank’s Q4 FY2024 Earnings are on Fire.

🇵🇹 Revolut has received authorization from the Bank of Portugal to open Revolut Bank UAB's branch in the country. With this legal presence, Revolut will be able to offer local IBANs and more credit products for its clients. Read on

🇬🇧 Monument Bank in talks to raise £𝟮𝟬𝟬𝗺 ahead of Nasdaq IPO. The British-based lender has already raised about £135m from blue-chip investors since it launched in 2019. It has now secured roughly £30m of the £200m Series C financing it wants to raise during this year.

🇸🇬 Trust Bank reaches 1 million customers and unveils TrustInvest. Through TrustInvest, customers can choose from five different funds. With each fund designed to meet differing investment goals and risk appetites, ensuring a smooth and accessible experience.

🇬🇧 Four banks fined by UK regulator over gilt information sharing. Citi, HSBC, Morgan Stanley and Royal Bank of Canada will pay the penalties after a Competition and Markets Authority investigation found that between 2008 and 2013, some traders shared sensitive gilt trading info in private chats.

🇺🇸 Chase to restrict use of Zelle for purchases through social media. Chase told customers that it will add some restrictions on their use of the peer-to-peer payment network Zelle with Chase. The new provisions include that it may delay, decline, or block Zelle payments that originate from contact through social media.

🇺🇸 Freedom Bank of Virginia modernizes digital banking services with Apiture. With Apiture’s Consumer and Business Banking solutions, Freedom Bank’s customers benefit from modern, fully featured online and mobile solutions with innovative digital support options.

🇸🇬 Grab’s digital bank deposits surpass US$1.2B, loan disbursements hit US$639M. The company reported a 17% year-on-year increase in fourth-quarter revenue for 2024 to US$764 million, supported by growth across its ride-hailing, delivery, and financial services segments.

🇳🇱 Backbase partners with Siili Solutions. The collaboration is expected to expand the regional resource landscape and provide financial institutions with the possibility to address the demands of the Nordic market with tailored solutions for their customers.

🇺🇸 Dave completes transition to simplified fee structure. The company announced the completion of changes to its optional “Tips” and instant transfer feature for using its ExtraCash service. The model allows members to access credit with a simplified 5% fee structure including a $5 minimum and $15 cap.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.