Monzo Lines Up for Early 2026 IPO

Hey Digital Banking Fanatic!

Monzo, the UK-based digital bank known for its distinctive coral cards, is preparing for what could be one of the most closely watched FinTech listings in Europe.

Morgan Stanley, according to reports, is already meeting with potential investors as the bank inches toward a possible IPO in the first half of next year.

The listing could value Monzo at over £6 billion. That’s nearly £2 billion more than its latest valuation, following its first year of profitability, product expansion, and strategic restructuring.

With +11 million customers and 600,000 business accounts, Monzo’s scale rivals that of traditional high street banks—something few FinTech players have achieved so far.

The venue for the float remains open. While London appears to be the current favorite, internal debates suggest the decision hasn’t been easy. CEO TS Anil has reportedly leaned toward a New York listing, while the board has leaned the other way. Political currents, including the impact of recent US tariffs, are playing an unexpected role in shaping this cross-Atlantic dilemma.

Behind the scenes, existing investors like Alphabet’s Capital G, GIC, and Tencent continue to back the company’s long-term outlook.

Additionally, Monzo has also made structural changes to support international expansion, creating a holding group to shield it from punitive capital rules as it eyes the US and Europe.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

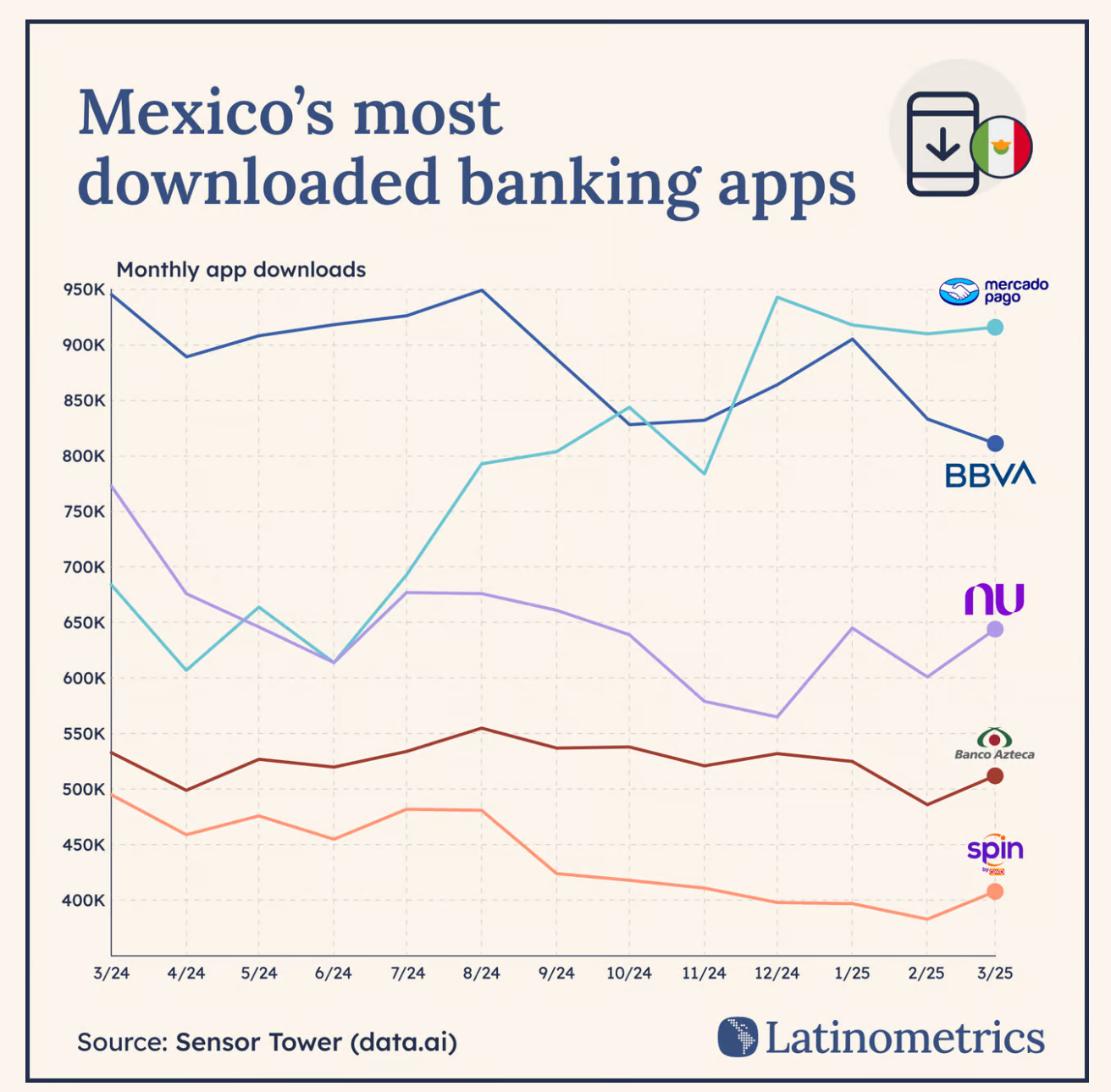

📊 Two challengers from Argentina and Brazil are taking on Mexico's big banks by becoming banks themselves.

DIGITAL BANKING NEWS

🇺🇸 Monzo lines up bankers to steer blockbuster IPO. According to reports, Monzo was in the process of hiring senior bankers from Wall Street stalwart Morgan Stanley to help steer the float, which is expected to value the company at over £6bn. Read more

🇧🇭 ila Bank partners with Mastercard to launch innovative solutions and expand into new markets. ila Bank will leverage Mastercard’s expertise to introduce a loyalty program that supports cardholders’ lifestyle, providing added value across a wide range of areas, including dining, luxury shopping, travel, and priceless experiences.

🇸🇬 DBS introduces Mobile Wallet Toggle to help prevent phishing-linked fraud. The added step is intended to create a deliberate pause, giving users time to verify their actions and reduce the risk of unauthorised transactions. Continue reading

🇧🇷 Banco Neon enters 'third phase': doubling in size in two years through new products and expanding potential customers. Neon plans to broaden its product offerings to attract a wider range of customers. This includes introducing new financial products and services to cater to the diverse needs of its clientele.

🇬🇧 Chetwood Bank reports £4 billion in customer savings deposits. The bank says the milestone reflects its rapid growth and commitment to savers in the UK. The company wants to be the leading challenger bank in the UK. Keep reading

🌍 BBVA expands its agreement with OpenAI to 11,000 ChatGPT licences, as part of its plan to extend generative AI capabilities across the entire organisation. Employees report that automating routine tasks with this tool allows them to save an average of nearly three hours of work per week.

🇳🇱 Mambu's product update Q1. The focus was on delivering key enhancements aimed at improving operational agility and streamlining account management. These updates empower institutions to better handle real-world banking scenarios, automate complex processes, and remain aligned with regulations.

🇮🇪 Revolut extends RevPoints rewards programme to credit card users. Customers will be able to earn rewards on their transactions, such as airline miles, gift cards, and discounts on hotel stays and other experiences. All paid plan users will receive a greater earn rate of up to 2x versus their debit card.

🌎 MercadoLibre and Nubank get more aggressive in the LatAm digital banking race. Both companies are always making strong pushes in the same markets: “difficult” Mexico, the more tech-savvy Brazil, and Colombia, which Bloomberg described as “less-developed but potentially interesting.

🇧🇷 Nubank innovates by allowing card limits to become account balances. The new feature allows customers to convert part of their credit card limit into available balance in their checking account. This functionality aims to provide greater financial flexibility, especially in situations where a merchant doesn't accept credit card payments.

🇮🇹 UniCredit partners with Google Cloud to accelerate digital transformation across 13 markets. This is an investment in its cloud infrastructure, delivering on one of the key pillars of the bank's digital strategy, which involves migrating large sections of the bank's application landscape to Google Cloud's scalable and secure platform.

🇳🇱 BUX CEO Yorick Naeff to be appointed Head of Innovation at ABN AMRO. Following ABN AMRO’s acquisition of BUX, Yorick has played a key role in guiding the integration process between the two companies. He will continue to serve as CEO of BUX during the transition period.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.