Monzo Surpasses 12 Million Customers as It Marks 10 Years of FinTech Innovation

Hey Digital Banking Fanatic!

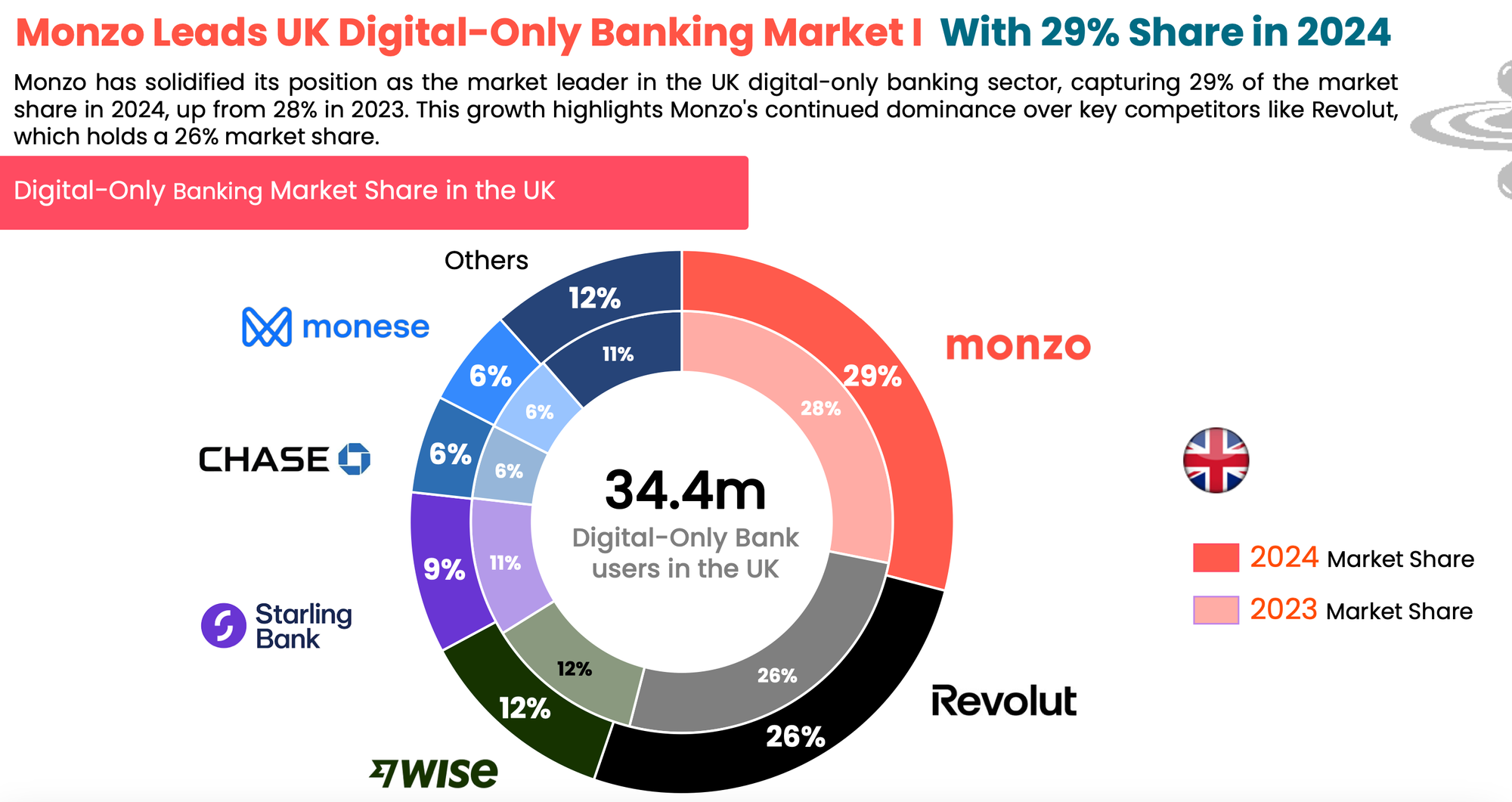

Monzo just crossed 12 million customers and it's not slowing down. The digital bank now serves one in five UK adults and over 600,000 businesses, a major milestone as it marks its 10th anniversary.

"12 million customers now bank with Monzo!" said CEO TS Anil. "Our growth continues to be driven by word of mouth. It's not just about opening a bank account—our customers are bringing more of their financial lives to Monzo than ever before."

The bank's rise has been powered by features people actually use, from viral savings tools like the 1p Challenge (with over 1 million users in a week), to business products like Monzo Team and innovative proprietary technology, offering tools such as Call Status, Trusted Contacts, and Known Locations to enhance security and user confidence.

Check out how Monzo leads the UK digital-only banking market here👇

Read all the other Digital Banking industry news below, and I'll be back with more on Monday!

Cheers,

Stay Updated on the Go! Join my new Telegram channel for daily Digital Banking updates and real-time breaking news. Stay informed and explore the Future of Banking—subscribe now!

DIGITAL BANKING NEWS

🇬🇧 Monzo surpasses 12 million customers. This milestone comes on the back of strong product momentum, with Monzo giving its customers even more visibility and control over their money with multiple new products and features over the past year. Read more

🇧🇷 Revolut launches interest-bearing account and begins Credit Card tests in Brazil. The goal is to expand its banking services and become the primary bank for its users. At the same time, the company has introduced instant access savings for under 18s. 'Revolut 18' is designed for children aged 6-17, and is linked to a parent or guardian's account. It said this new feature aims to empower children to make their pocket money earn money.

🇰🇪 Central Bank of Kenya lifts 10-year ban on new bank licences. Starting July 1, 2025, the regulator will begin accepting applications for fresh banking licences. This move comes as the Central Bank of Kenya cites significant improvements in the legal and regulatory framework governing Kenya’s banking industry.

🇬🇧 Haboo Money partners with Griffin to improve the loan repayment experience for lenders and borrowers. With this partnership, Haboo is going to offer a save-as-you-repay wallet that helps borrowers pay off their debt in a more flexible way.

🇦🇺 ANZ continues to work on a data "one-stop shop" for its Risk function. Artur Kaluza, head of data strategy and transformation within ANZ's Risk function, shared that three Google Cloud services are being used - Dataplex, BigQuery, and Vertex AI Platform.

🇧🇾 Belarus to fully launch CBDC. The country is getting ready to launch its central bank digital currency into full circulation by the second half of 2026. The plan is for businesses to begin using the digital ruble in 2026, followed by government agencies and individuals in 2027.

🇬🇧 New report suggests 79% of Londoners are open to ditching traditional banks for digital options. With the rise of mobile banking technology, a growing number of digital, branchless banks are emerging across the UK, offering a seamless and convenient banking experience.

🇹🇭 Thailand reportedly approves three digital bank bids, targets 2026 rollout. The selected groups are anchored by Krungthai Bank, SCB X, and Ascend Money. They were evaluated based on their financial capacity, business models, and readiness to meet regulatory requirements for digital banking operations.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.