🤯 MrBeast Just Filed to Launch His Own Bank, No Joke

Hey Digital Banking Fanatic!

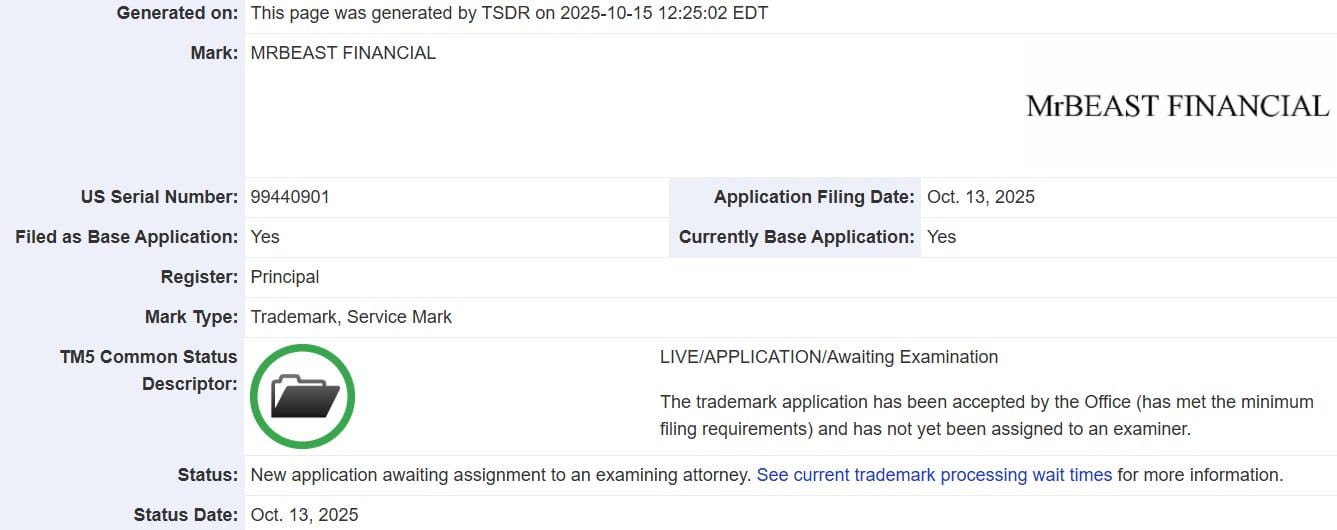

MrBeast just filed a trademark to launch his own bank. Yep, MrBeast Financial might soon be a real thing.

Kudos to Nik Milanovic for catching this one 👌

The filing was made on an intent-to-use basis, meaning this isn’t just a vanity play — there are genuine plans to bring it to life.

What’s wild is that Jimmy skipped the usual FinTech route of launching a co-branded neobank or card partnership. He’s going straight for the big leagues.

And honestly, the brand logic tracks:

- He’s already built an empire across YouTube, burgers, and chocolate.

- His audience trusts him.

- His whole thing is making good outcomes entertaining.

So what if banking became part of that story?

This could actually work. What do you think?

Cheers,

PODCAST

🎤 Episode 111 - Understanding Digital Money by Dashdevs. In this episode of the FinTech Garden podcast, hosted by Igor Tomych, presents an insightful conversation with Jonny Fry, Head of Digital Assets Strategy at ClearBank. The episode focuses on the evolving landscape of digital currencies, examining their potential impact on the future of payments and financial systems.

Understanding Digital Money by Dashdevs

NEWS

🇺🇸 FinTech giant SoFi expanding Utah operations. As part of the agreement, SoFi, a digital finance company with FDIC-insured online banking, is planning to add 410 new, high-paying jobs and invest $3 million in the Beehive State over the next decade. Keep reading

🇧🇷 Nu Holdings ranked #4 on Fortune’s 100 Fastest-Growing Companies List. The high ranking is a clear testament to the efficacy of Nu’s business model and its relentless focus on customer-centric technology and operational efficiency. Nu’s position at #4 underscores its ability to scale profitably in the highly competitive financial services sector.

🇩🇪 Trade Republic launches Bond ETFs after distributing €2.5 billion in interest. The digital bank said customers can now buy bond exchange-traded funds with defined maturity dates, earning yields that run 1 to 3 percentage points above typical instant-access savings accounts.

🇩🇪 BlackRock-backed Scalable Capital eyes European listing after securing banking licence. An initial public offering in Europe would be the “ideal scenario” for Munich-based wealthtech Scalable Capital, co-CEO Erik Podzuweit said, as it weighs up potential exit options after securing a €1.5bn valuation this summer.

🇺🇸 FinTech startup Upgrade is valued at $7.3 billion in a new funding round. LendingClub founder Renaud Laplanche mentioned that Upgrade is looking to IPO but wanted additional capital for its balance sheet in the meantime. He said the company is also establishing a new valuation as it begins to offer employee liquidity.

🇬🇧 Hyperlayer lands £30m to help legacy lenders take on FinTechs. The firm’s tech is designed to work alongside existing banking infrastructure, which it says allows the legacy businesses to launch new products without complexity. Read more

🇿🇦 Ripple and Absa Bank launch secure digital asset custody in South Africa. Absa Bank will integrate Ripple’s institutional-grade digital asset custody solution into its offerings. This allows Absa to provide regulated, secure, and scalable custody of tokenized assets such as cryptocurrencies for its clients.

🇬🇧 Klarna has launched Klarna Balance and the Klarna Card in the UK, expanding into everyday banking. Balance lets users hold e-money and earn rewards, while the Card offers debit payments with optional credit. Following FCA approval and global success, Klarna continues to grow its presence in retail banking.

🇺🇸 Brex announces partnership with Oracle as the first FinTech global issuer to power B2B payments in Oracle Fusion Cloud ERP. Leveraging Oracle’s integration with Mastercard, Brex will power Oracle’s global, embedded B2B payments solution in Oracle Cloud ERP, enabling customers to select Brex virtual cards directly from within payables workflows.

🇺🇸 Tech, Crypto-focused bank founded by billionaire Trump supporter, Erebor, wins US approval. A new US bank that aims to serve emerging tech firms in sectors such as crypto and artificial intelligence has received conditional approval to operate from the Office of the Comptroller of the Currency.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.