N26 Poaches from Trade Republic in Iberia

Hey Digital Banking Fanatic!

N26 has named Antón Díez Tubet as General Manager for Spain & Portugal, snagging him from fellow German player (and rival) Trade Republic, where he led the same markets.

With +400 team members in Madrid and Barcelona, the Iberian region is reportedly one of N26’s key growth engines. Díez is tasked with growing the user base and boosting engagement through an expanding suite of products.

N26 CEO Valentin Stalf said the region is in “safe hands,” noting that “his strong background in banking and FinTech, along with deep local insight, will be essential to maintaining Spain as one of our top growth markets.”

Read more on this and all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

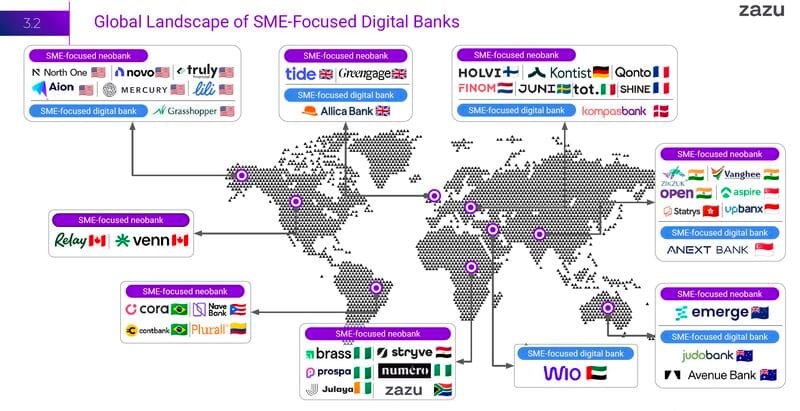

🌍 Here's a Global Landscape of SME-focused Digital Banks👇

Who is missing from this overview?

NEWS

🇪🇸 N26 appoints Antón Díez from Trade Republic as Managing Director for Spain and Portugal. Díez brings over 12 years of experience in financial services. His mission is to expand N26’s customer base, strengthen user engagement, and promote digital banking across Iberia.

🇪🇸 Neobank Vivid launches Spanish IBAN and offers 4% initial returns to businesses and self-employed individuals. This includes a return on your liquidity of up to 4% per year in the Interest Account during the first month and up to 3% per year during the second month.

🇩🇪 Deutsche Bank goes live with Swift Instant Cash Reporting. Through ICR, the bank's clients can collect real-time account and balance data via a single access point using the ISO 20022 data model and secure JSON format. Swift acts as the central connector, routing API pull requests from corporates to Deutsche Bank.

🇺🇸 Orion Innovation successfully implements Temenos’ digital banking platform for BNI. As a trusted Temenos partner, Orion delivers innovative and scalable digital banking solutions that empower financial institutions to stay ahead in a rapidly evolving digital landscape.

🇹🇭 Bangkok Bank launches Paybooc QR Payments. The Paybooc app allows South Koreans to shop and pay with ease while exploring all that Thailand has to offer, utilizing real-time exchange rates for transactions. Keep reading

🇺🇸 JPMorgan tells FinTechs to pay up for customer data access. The US bank has sent pricing sheets to data aggregators, which connect banks and FinTechs, outlining the new charges. The fees vary depending on how companies use the information, with higher levies tied to payments-focused companies.

🇨🇳 HSBC completes e-HKD trials of CBDC on public blockchains. The bank said it explored e-HKD payments on various public blockchains, including Arbitrum, Ethereum, Linea, and Polygon. Additionally, within the bank, it developed a private DLT solution using Hyperledger Besu, presumably to act as a tokenization platform before public issuance.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.