N26 Rolls Out eSIM Service for German Customers

Hey Digital Banking Fanatic!

N26 has launched mobile phone plans in Germany, and is planning to expand to other countries. Branded as N26 SIM, the service runs on Vodafone Germany’s 5G network, with connectivity provided by 1GLOBAL.

Rather than shipping physical SIM cards, the entire experience runs through eSIM technology, no paperwork, no store visits, no waiting lines. The plans are activated directly in the N26 app.

N26 offers three data tiers: 10 GB for €13.99, 30 GB for €19.99, and 100 GB for €34.99. Each comes with unlimited domestic calls and texts, EU and EEA roaming, and the ability to cancel with just a month’s notice. Customers can port their current number or get a new one, switching between plans as needed.

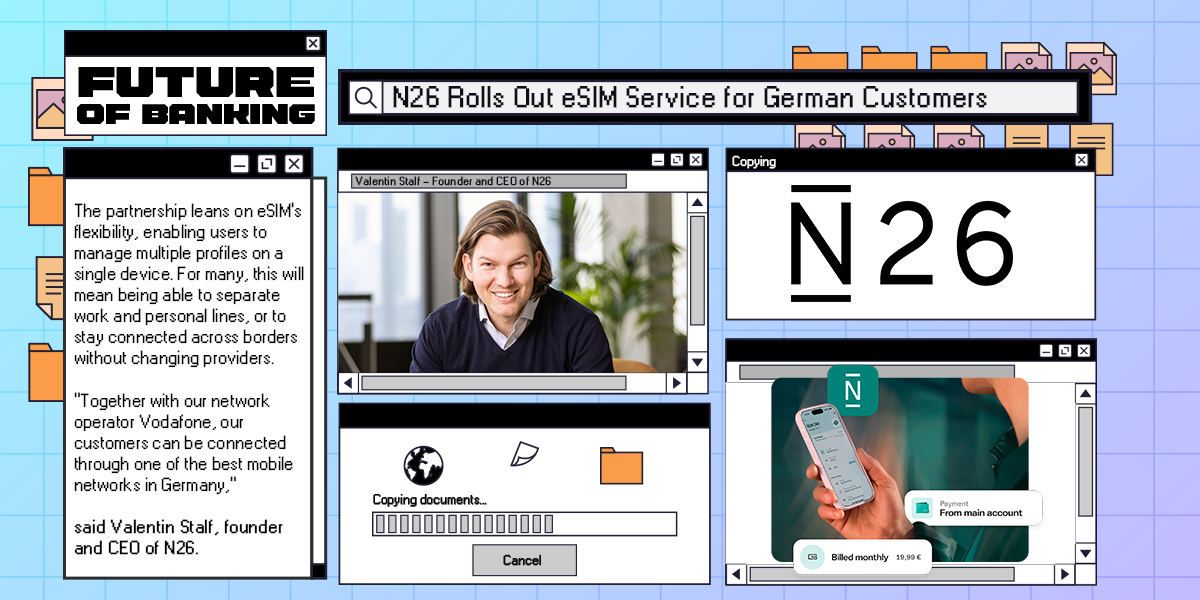

The partnership leans on eSIM’s flexibility, enabling users to manage multiple profiles on a single device. For many, this will mean being able to separate work and personal lines, or to stay connected across borders without changing providers.

“Together with our network operator Vodafone, our customers can be connected through one of the best mobile networks in Germany,” said Valentin Stalf, founder and CEO of N26.

The launch follows similar moves by others, including Revolut, which opened its waiting list for Revolut Mobile in Germany and the UK last week, after introducing eSIM services in Germany last year. It looks like the line between financial services and mobile connectivity continues to grow less distinct.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

DIGITAL BANKING NEWS

🇺🇸 BankThink: The future of finance is inclusion, or it's no future at all. Strong economic growth and future prosperity hinge on the ability of everyone in society to access financial services, writes Thomas Warsop, of ACI Worldwide. Keep reading

🇩🇪 Digital bank N26 launches mobile plans in Germany. Called N26 SIM, the digitally-activated mobile plans will be run off the back of Vodafone Germany’s 5G network, and will operate via eSIM as opposed to a physical SIM card. Plans can be activated directly in the N26 app quickly, without paperwork, and without the need to visit a local telco store.

🇬🇧 OakNorth and OpenAI partner to embed generative AI in banking operations. The collaboration aims to accelerate OakNorth’s integration of generative AI across its banking operations to improve speed, personalisation, and efficiency for its customers.

🇺🇸 Santander to shut 18 U.S. branches as it boosts digital bank. It plans to close about 4.5% of its U.S. branch network this summer, with all of the shutdowns slated to affect locations in the Northeast. The U.S. closures come as Santander pursues a nationwide digital banking strategy in the U.S.

🇱🇹 MyTU secures Visa and Mastercard acquiring licences. This milestone will enable myTU to process card payments directly through its own acquiring infrastructure, across e-commerce platforms, retail stores, and POS terminals.

🇬🇧 Plum launches Lifetime ISA to help people save for their first home. This offers an interest rate of 4.61% AER (variable), including a 1-year bonus of 1% AER (variable), and the Government bonus of 25%. This allows savers to build up their funds more quickly to give them the best chance of reaching their goals.

🇰🇷 KakaoBank’s operating profit up 23% to $131.09m in Q1 2025. This is also 59% higher than the $82.42m (KRW115b) operating profit that the South Korean digital bank reported for Q4 2024. Keep reading

🇺🇸 Bitcoin payments company Strike launches BTC-backed loans. The company is now giving loans to eligible customers who use their Bitcoin as collateral. Eligible U.S. customers can get 12-month loans starting at a minimum of $75,000 and capped at $2 million.

🇬🇧 Revolut will roll out Bitcoin Lightning Payments for users in the U.K. and select European countries through Lightspark. The integration aims to reduce transaction fees and payment processing time by using Lightspark's infrastructure for global payments.

🇬🇧 Revolut chooses Fourthline as a strategic partner. The partnership was further solidified by Fourthline's exceptional customer-centric approach, which includes dedicated account management and technical support tailored specifically to Revolut's unique operational needs.

🇬🇧 Ant International partners with Barclays on treasury management with an AI-powered FX model. By integrating the time series forecasting algorithms, the TST Model predicts patterns over time. Ant also created new pre-training and Supervised Fine-Tuning (SFT) frameworks to train the model and improve its predictions over time.

🇵🇰 Pakistan’s Bank Alfalah acquires nearly 10 percent stake in UAE FinTech Jingle Pay. The partnership draws on Bank Alfalah’s extensive infrastructure to boost Jingle Pay’s role in cross-border payments and digital banking, supporting its bold vision for the MENAP region, including the Middle East, North Africa, Afghanistan, and Pakistan.

🇪🇪 XData Group to go public on Nasdaq via blank check merger. XData Group CEO described the deal with Alpha Star as the next step in the company’s journey, adding that going public will provide the necessary resources to accelerate the development of new products and foster new industry partnerships.

🇬🇧 Saxo hires Michelle West as UK Head of Compliance. In her role, Michelle will focus on further enhancing Saxo’s risk and compliance functions, ensuring Saxo maintains the highest standards of operational integrity. Read on

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.