N26 Strengthens Austrian Presence with Credit Rollout

Hey Digital Banking Fanatic!

N26, the digital bank founded by Valentin Stalf and Maximilian Tayenthal in 2013, was born in Germany, the home country of its first co‑founder. Now, it’s stepping up its presence in Austria, the homeland of co-founder Maximilian Tayenthal.

Although the Berlin-based platform operates in 24 EU markets, its credit products have largely been confined to Germany and a handful of major markets nearby. Now, with three new launches, Austria finally gains the full suite.

First comes the personal loans. N26 introduced loans in Germany back in 2017, and expanded to France in 2021 through a partnership with Younited Credit. Now available in Austria, customers can borrow up to €15,000 for major life decisions, with repayment terms of up to five years and interest rates starting at 5.99%.

Next up are installment payments, now being introduced in Austria. Previously available only in Germany, Italy, and Spain, this feature brings retroactive flexibility, letting users split purchases from the past four weeks into monthly installments. Once a transaction is split, the full amount is credited back to the account, with the first installment debited one month later. It applies to purchases between €20 and €3,000, covering categories like electronics, furniture, fashion, and travel.

Finally, there’s N26 Overdraft, an on-demand liquidity product. It’s a standard overdraft facility with a fixed annual interest rate of 13.4%, letting customers overdraw up to €15,000 for unexpected expenses.

Austrian users now have access to a comprehensive credit suite within the same app that once simply held their balance, maybe a reflection of faster rollout, shaped by rising user demand and the growing presence of rivals like Revolut in the region?

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

Dominate the Payments Space! Subscribe to my Daily PayTech Newsletter for daily updates and trends in the evolving world of payment technology. Revolutionize your payments expertise today!

INSIGHTS

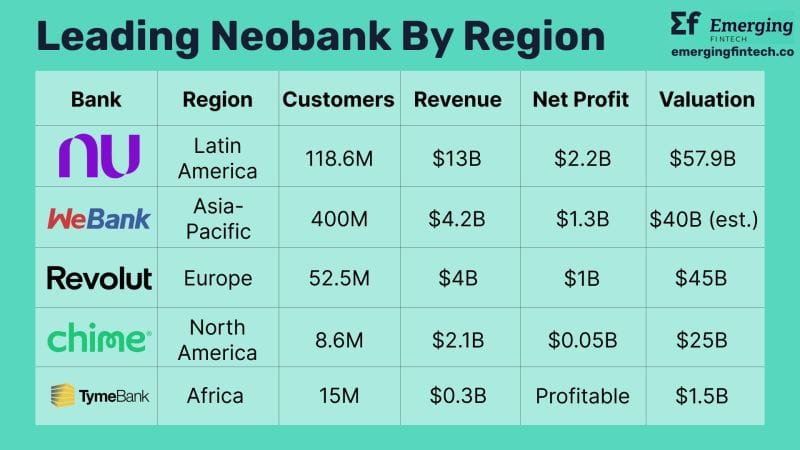

🌍 Leading Neobanks Per Region.

NEWS

🇦🇹 N26 launches loans and installment payments in Austria. The N26 loan is aimed at customers planning larger purchases or implementing financial projects. With a credit limit of up to €15,000 and flexible terms of up to five years, it offers maximum planning security.

🇰🇷 Kakao Pay plans to acquire SSG Pay and Smile Pay for digital optimisation in Korea. If successful, it will strengthen Kakao Pay’s position in the Korean mobile payments market. Additionally, Kakao Pay would expand its merchant relationships in retail and online marketplaces, paving the way for new financial products.

🇪🇸 BBVA launches new FinTech app in Spain with savings incentives. The new app multiplies the benefits of being a customer: direct access to cards and Bizum to make fast, simple payments, personalized savings plans, and a financial coach to help manage finances, among other new developments.

🇦🇺 ANZ Bank plans to use AI agents to boost productivity. Initially, AI agents will assist business bankers by generating company and sector reports to improve client meeting prep and engagement. Future uses may include automating tasks like triaging loan applications.

🇨🇴 Nu Colombia introduces an initiative for achieving savings goals and financial targets. Cajitas para mi gente aims to empower Colombians. New Nu customers will get a boost that allows them to open a Money Box (Cajita) with a balance of 10,000 Colombian pesos in their account.

🇲🇽 Nubank receives authorization for the organization and operation of a commercial banking institution in Mexico. The National Banking and Securities Commission stated that the documentation submitted met the established requirements and that the Bank of Mexico (Banxico) issued a favorable opinion for the requested authorization.

🇸🇦 D360 Bank welcomes one million customers in four months. This underscores the growing demand for seamless and secure digital financial solutions in Saudi Arabia. The bank offers an intuitive digital banking experience, enabling customers to open an account in two minutes and access personalized financial services.

🇺🇸 Banking groups ask SEC to drop cybersecurity incident disclosure rule. Five US banking groups asked the regulator to remove its rule, arguing that disclosing cybersecurity incidents directly conflicts with confidential reporting requirements intended to protect critical infrastructure and warn potential victims.

🇩🇪 Deutsche Bank partners with finaXai on token fund servicing. The partnership will assess the integration of machine learning and large language models into asset servicing workflows. The initiative aims to build on Project DAMA 2, a multi-chain asset servicing pilot designed to improve fund servicing efficiency.

🇩🇪 Bunq introduces stock trading in Germany. Users with bunq Stocks have access to over 400 stocks and ETFs, allowing them to buy and sell them around the clock. With Stocks, the neobank aims to simplify investing and offer people with an international lifestyle a product tailored to their personal needs.

🇵🇭 EastWest adopts Temenos SaaS for core modernisation. The Philippine-based universal bank plans to deploy the cloud-native system across its retail, SME, and corporate banking divisions as part of its digital transformation strategy.

🇫🇷 BNP Paribas launches tokenized money market fund shares. The tokenized fund is the result of a collaboration involving BNPP AM and Allfunds Blockchain as the technology provider, which serves as the transfer agent and fund-dealing service provider.

🌏 Areeba and Codebase Technologies' partnership to address the rising demand for banking-as-a-service across the Middle East. This collaboration aims to deliver turnkey BaaS solutions that empower banks and FinTechs to rapidly deploy modern, user-centric financial products and services across the region.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.