N26 Targets Its First Full-Year Profit in 2025… and Looks Ahead to an IPO

Hey Digital Banking Fanatics!

N26 just confirmed it expects to reach its first-ever full-year profit in 2025.

And profits are set to climb again in 2026, according to Co-CEO Marcus Mosen. The bank also reiterated its IPO ambitions. Before that happens, Mosen says there is still homework to do across compliance, risk, and operations.

It’s been a long rebuild. Regulatory clean-up, tighter risk controls, and a full shift toward sustainable, profitable growth.

But this is the milestone that has eluded so many European neobanks for years.

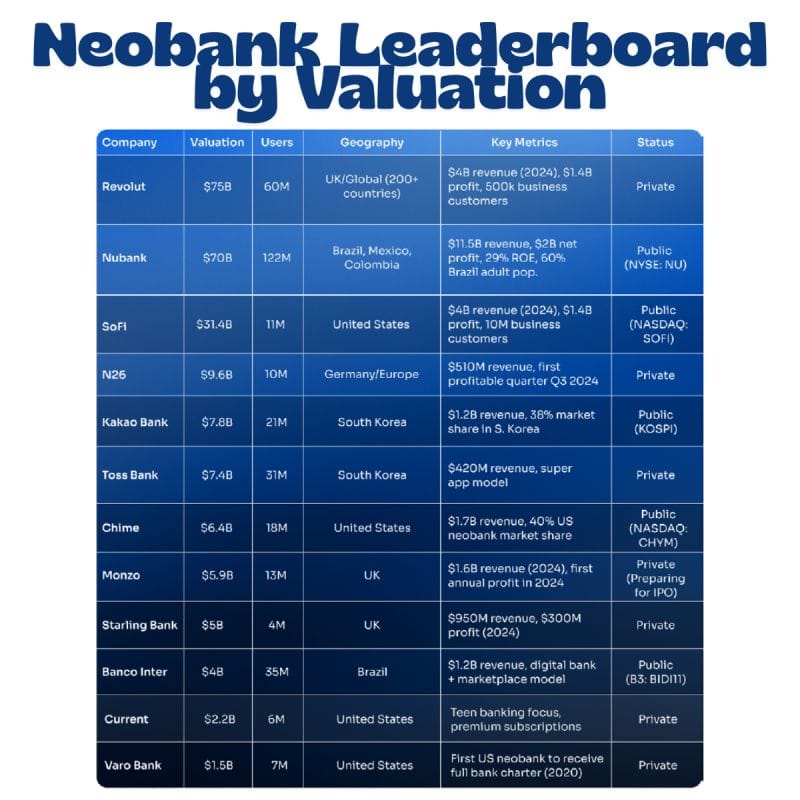

Crossing it puts N26 back in the conversation alongside players like Revolut and Nubank.

If it delivers 2025 profitability and accelerates in 2026, it could finally re-enter the top tier of global neobanks and reset its narrative ahead of a public listing.

If you're into Digital Banking shake-ups, definitely check out the updates below 👇

Cheers,

INSIGHTS

🌍 The Global Neobank Leaderboard

NEWS

🇩🇪 Digital bank N26 aims for its first annual profit in 2025. N26 expects to report its first full-year profit in 2025, with new co-CEO Marcus W. Mosen projecting a positive result that should grow significantly in 2026, improving the FinTech’s flexibility around future financing.

🇬🇧 SumUp expands banking capability as it gets ready for listing. “We’re in the process of preparing. When the time is right, we want to obviously be able to react and go quickly,” said Luke Griffiths, CCO and UK CEO, in an interview. Starting this month, small businesses using SumUp’s platform can deposit cash at certain retailers in the UK, Italy, Spain, and France.

🇬🇧 Barclays joins bank rivals buying stake in United FinTech. The money brought in by Barclays will go directly into the business to fuel further investments, including companies that focus on solutions using artificial intelligence, Christian Frahm, the FinTech’s founder, said.

🇨🇴 Ualá has added Bre-B to its platform, completing a key component of Colombia’s instant payments ecosystem by allowing customers to send and receive money instantly, free of charge, and without using account numbers; users simply register a Bre-B key, enabling transfers to be completed in seconds and significantly enhancing the overall payment experience.

🇬🇧 Tide appoints Dan McNally as SVP and CEO of Tide Insurance Services to lead its growing global insurance business and drive the next phase of Tide’s expansion into business protection for small and medium-sized businesses (SMBs).

🇮🇳 Tide now supports over 1 million small businesses in India. This rapid growth reflects the deep trust that Indian small businesses, from nano to micro and emerging SMEs, have placed in Tide to simplify how they register, run, and grow their businesses.

🇬🇧 Atom Bank achieves record quarter for commercial mortgages. The performance for the current October to December quarter has already surpassed the previous record set in July to September 2025. The value of offers already tracked is more than 7% higher than the previous quarter’s total.

🇳🇱 GoDutch lands a €3.6M Seed round as it accelerates SME banking across Europe. The Amsterdam-based SME banking platform has scaled to 12,500 business users and over €1.5 billion in annual payment volume in 18 months by replacing multiple finance tools with one AI-driven account, including three-second automated invoice payments.

🇬🇧 PayAdmit partners with Yaspa to integrate Pay by Bank on its payments platform. The partnership aims to bring Pay by Bank to its payments orchestration platform, giving merchants a faster, more secure, and cost-effective way to accept real-time bank payments with instant confirmation and improved conversion.

🇲🇦 Cash Plus IPO sets record with 80,759 investors, 64x oversubscription. The $40 million capital increase will support wider territorial coverage, a full-scale digital transformation via mobile services, and targeted external growth opportunities within the company’s strategic roadmap.

🇺🇸 The Metro Atlanta investor group is starting a new bank. A group of longtime community bankers is attempting to start Georgia Skyline Bank, based in Roswell. The upstart or the Novo Community Bank would target small and mid-sized businesses in the affluent north Fulton County market.

🇳🇴 Norway's central bank does not recommend the introduction of a digital currency to maintain secure and efficient payments, though Governor Ida Wolden Bache emphasized that the bank remains prepared to introduce a CBDC in the future should it become necessary to support the stability and effectiveness of the national payment system.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.