Nomura’s Laser Digital Joins the Rush for a US Banking Charter

Hey Digital Banking Fanatic!

Laser Digital, the digital assets arm of Nomura, has applied for a US national trust bank charter as crypto firms continue moving operations onshore.

The application was filed with the Office of the Comptroller of the Currency. If approved, it would allow Laser Digital to operate nationwide without juggling state-by-state custody licenses.

The charter wouldn’t include retail deposits, but it would support custody, settlement, and spot crypto trading under federal supervision. A familiar structure for firms aiming to scale compliantly.

Laser Digital (Nomura) isn’t alone. Circle, Ripple, BitGo, Fidelity Digital Assets, and Paxos have all received conditional approvals, while others line up behind them as US policy turns more accommodating.

This is less about crypto experimentation and more about institutional positioning. Regulation, charters, and infrastructure are becoming the real battleground...

If you’re tracking how Digital Banking and crypto firms are embedding themselves deeper into the US financial system, keep scrolling 👇 I'll be back here tomorrow.

Cheers,

INSIGHTS

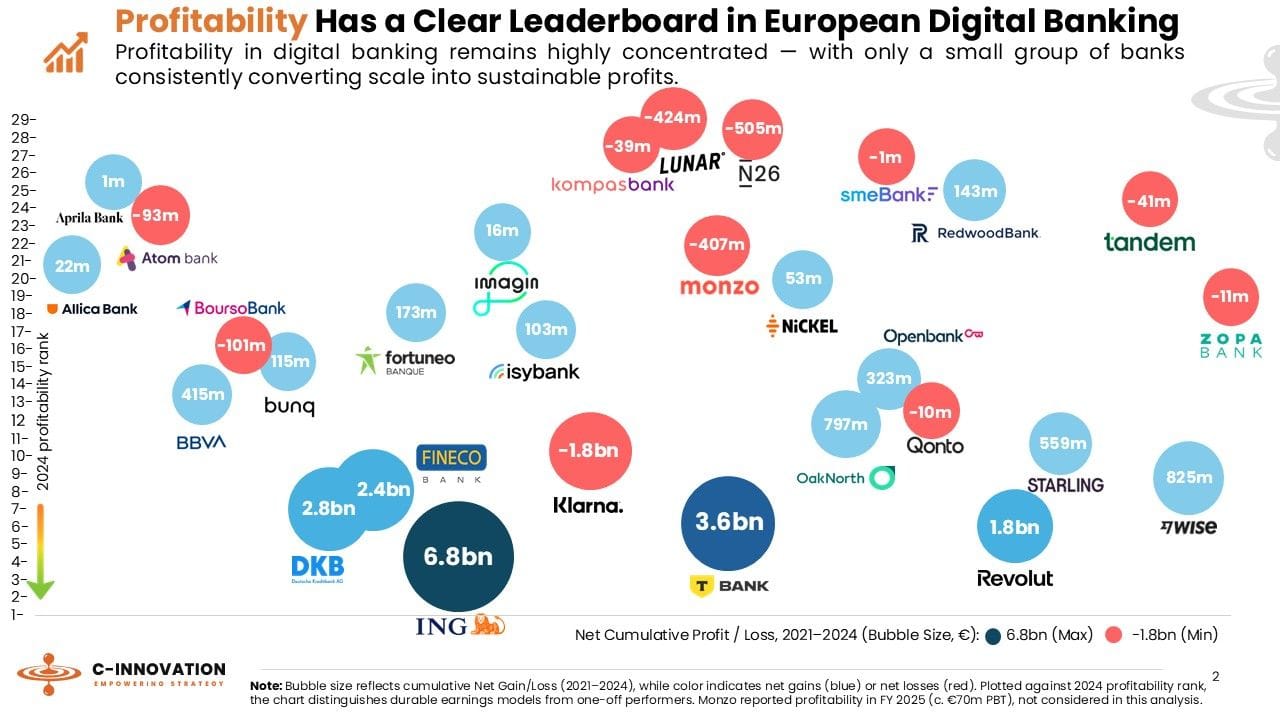

🇪🇺 Profitability in European digital banking is not evenly distributed.

NEWS

🇺🇸 Laser Digital seeks US banking charter amid crypto firms' push onshore. The application was filed with the Office of the Comptroller of the Currency. A federal charter would allow Laser Digital to operate nationwide without securing state-by-state custody licenses, while stopping short of taking retail deposits.

🇵🇹 Bison Bank advances with first Portuguese stablecoin. Bison Bank plans to issue Portugal’s first bank-backed stablecoin, expand asset tokenization, and become the country’s first cryptobank, enabled by the EU’s MiCA framework. The bank aims to launch the services in the first half of the year, according to CEO António Henriques.

🇩🇪 Vivid Money just hit its biggest milestone so far: 100,000 SMB customers in less than two years. Alexander Emeshev, CEO of Vivid Money, said the company has shifted strategy from aggressive consumer marketing to a full focus on business clients after rapid early growth and $200 million in funding from investors.

🇧🇷 XP, BTG, and Nubank are being sued for misleading advertising regarding Master's CDBs. The lawsuit was filed by Abradecont (Brazilian Institute for Consumer and Worker Defense). According to Abradecont, the platforms omitted the real risks of the securities and failed to properly curate investment recommendations.

🇺🇸 Prosperity Bancshares to acquire Stellar Bancorp in $2 billion deal. The transaction, combining cash and Prosperity shares, significantly expands Prosperity’s presence in the Houston market. Continue reading

🇳🇱 Plumery and Lokalise partner to embed enterprise-grade localisation functionality, including translation and market adaptation, directly into digital banking experiences. This will enable financial institutions to deliver hyper-localised experiences at scale, improving accessibility, engagement, compliance, and customer satisfaction.

🇬🇧 ClearBank founder Andrew Smith is building the home of UK sports finance with new banking venture Sporta. Smith says the inspiration for Sporta came from his own experience at his local cricket club, where he was asked to become a benefactor. "Sport has been a big part of my life since I was a child. It’s where I learned discipline, resilience, and a sense of belonging," he explains.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.