Nu México Doubles Down with a $2.5B Push Into the Country’s Banking Future

Hey Digital Banking Fanatics!

Nu México is making a massive move as it prepares for its next stage of growth in the country.

The company plans to invest 2.5 billion dollars in México over the rest of the decade as it prepares to become a full multiple-bank institution.

New leadership is in place. Nu México CEO Armando Herrera steps in to lead a platform with 13.1 million users already competing at the top of Mexico’s financial ecosystem.

The goal is clear. Scale fast, grow steadily, and build the largest digital bank in Mexico by users.

This investment alone doubles what the company has put into the country over the last six years. Strong intent. Strong momentum.

And the mission stays simple. Become the number one banking relationship for millions of customers.

And the momentum in Mexico keeps building... 🇲🇽

Revolut Bank just entered Mexico with what it calls a full “menu” of banking services.

Aiming for lower prices, stronger value, and a big play in remittances, Revolut wants to become nothing less than the WhatsApp of banking in the country.

The ambition is clear: offer every major banking product from day one, not just a niche feature.

If you're into Digital Banking shake-ups, definitely check out the updates below 👇

Cheers,

INSIGHTS

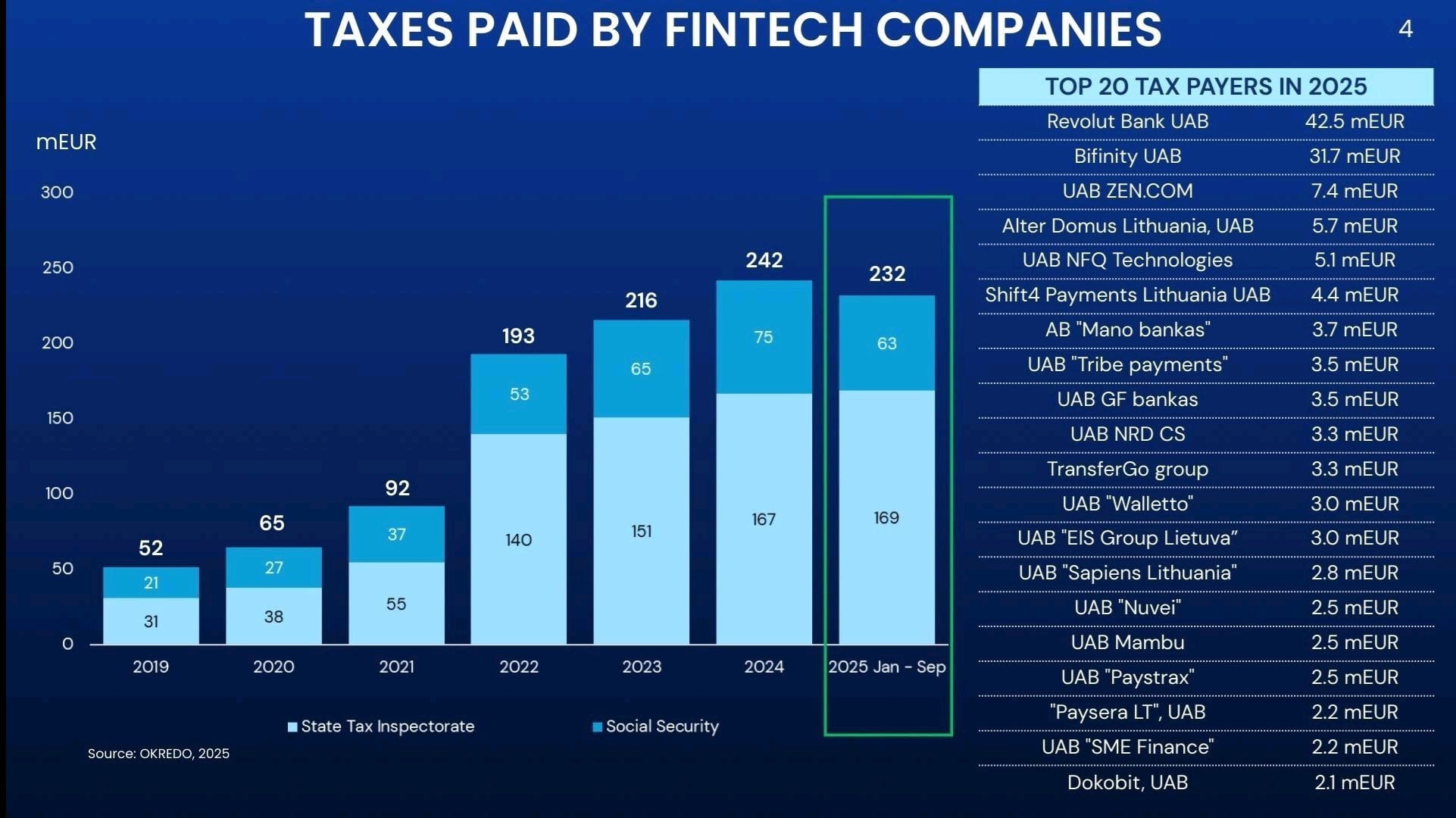

🇱🇹 The top 20 FinTech companies by taxes paid in Lithuania this year👇

NEWS

🇲🇽 Nu Mexico 'doubles down' on the national market and will invest $2.5 billion in the remainder of the decade. Nu Mexico is preparing to consolidate its transformation with new leadership and various plans aimed at achieving its goal of becoming the largest banking institution in the country. Additionally, Nubank launches a subscription manager to control recurring payments. The financial institution's goal is to help clients control their spending across various sources.

🇧🇷 Nubank CEO David Vélez told CNN Money that the company will pursue a Brazilian banking license to meet regulatory requirements, while also advancing expansion in Mexico, Colombia, and the U.S., where he sees major market potential.

🇧🇷 Mastercard and Mubadala work on a deal for embattled Brazilian FinTech. Mubadala is negotiating a deal that would see the sovereign-wealth fund acquire control of Will Bank and inject capital into the FinTech firm. Will Bank also pays a fee to Mastercard for its services.

🇺🇸 Revolut has launched Revolut BillPay, an AI-powered accounts payable automation tool that positions the company to compete in the $20B+ global AP automation and B2B payments market alongside firms. The product is expanding to Australia, Singapore, and the US.

🇲🇽 Revolut Bank arrives in Mexico, aiming to reach a minimum of 5.5M customers in its first 5 years and 40M customers in 10 years. In an interview, Juan Guerra, CEO of Revolut Bank in Mexico, emphasised that the firm's strategy is not subject to economic fluctuations, but to a fundamental value: offering better prices and more value for customers' money.

🇬🇧 Revolut offers ex-staff 30% discounted exit after $75 billion valuation. Revolut has offered former employees the chance to sell their shares back to the company at a price that implies a valuation of about $52.5 billion, roughly 30% below the $75 billion level set in its latest funding round completed in November.

🇭🇺 Revolut withdraws from Hungary with its crypto services, citing the need to comply with local regulations; despite securing MiCA licensing through its Cyprus entity, the company says regulatory conditions in Hungary require a full shutdown, and customers must now close or withdraw their crypto holdings before access ends.

🇰🇼 National Bank of Kuwait launches enhanced mobile banking app to elevate customer experience. The banking app aims to facilitate customer experience, provide better control, and ensure flexibility and convenience as they manage their finances digitally.

🇬🇧 ClearBank partners with Finseta to power its multicurrency and cross-border payments services. Under this partnership, Finseta will leverage ClearBank’s virtual IBAN technology to provide GBP and MCCY wallets for its UK customers, allowing Finseta’s customers to move money faster and more efficiently.

🇺🇸 Stakk secures Peter Thiel-backed neobank Panacea Financial as a key client. Under the terms of the agreement, Stakk will deliver Panacea Financial a solution encompassing its mobile image capture, PDF, and scanner imaging capabilities, image authentication, OCR, and document/data orchestration capabilities.

🇿🇦 Capitec buys Walletdoc in R400m deal to boost digital payments. Capitec noted that the acquisition is a strategic step in its ongoing commitment to lowering the cost of payments, broadening access to digital financial services, and promoting financial inclusion in South Africa.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.