Nubank Adds Contactless Pix Payments

Hey Digital Banking Fanatic!

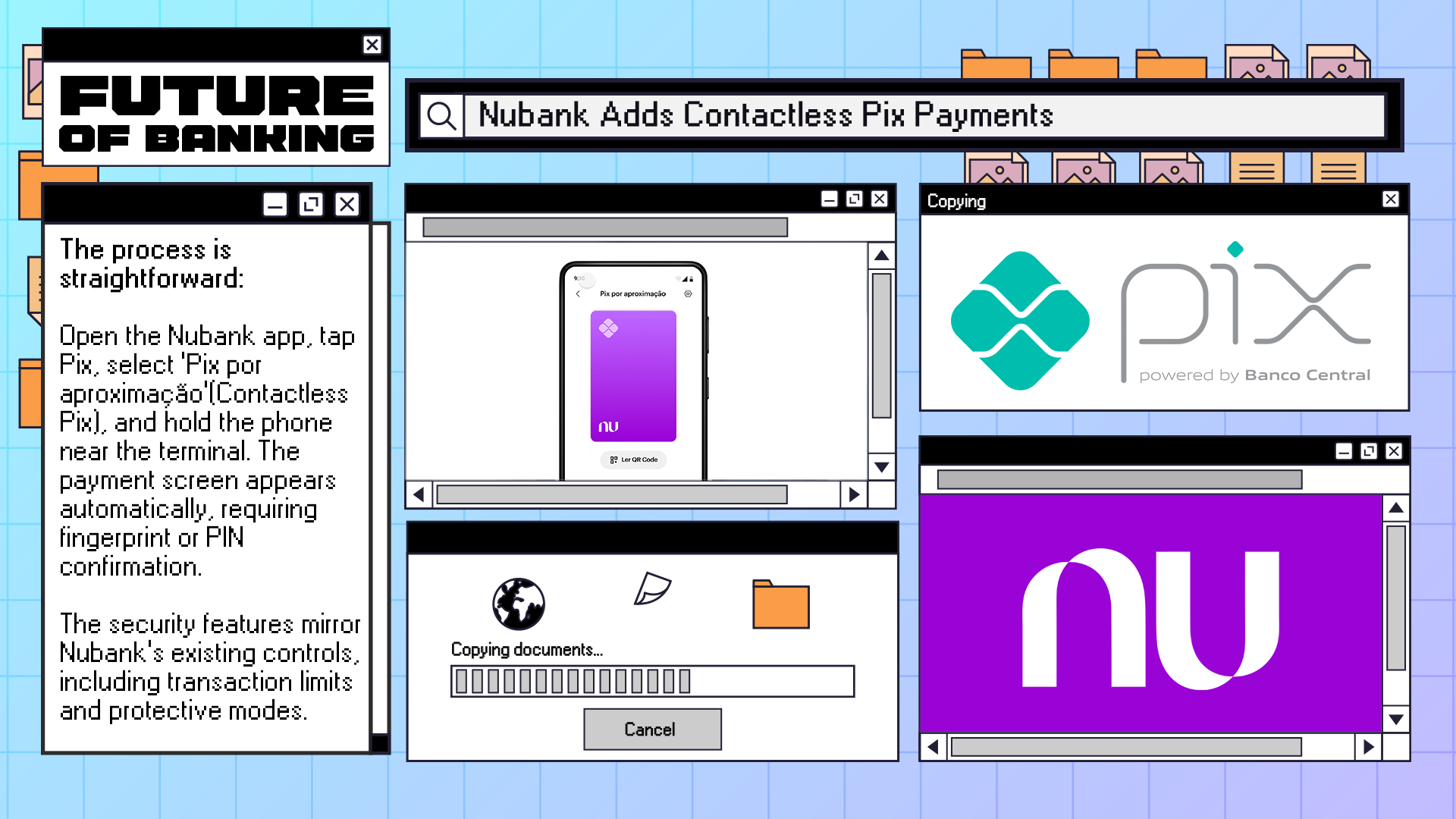

Nubank customers can now make Pix payments by holding their phone near a payment terminal. No physical card, QR code, or third-party app is needed.

To use it, customers need a registered Pix key and an Android NFC-enabled smartphone. At checkout, they can choose to pay directly from their account balance or split the bill into up to 12 installments on credit. For faster access, a shortcut to the feature can also be added to the phone’s home screen.

The process is straightforward: open the Nubank app, tap Pix, select ‘Pix por aproximação’ (Contactless Pix), and hold the phone near the terminal. The payment screen appears automatically, requiring fingerprint or PIN confirmation. The security features mirror Nubank’s existing controls, including transaction limits and protective modes.

The feature won’t be available for iPhone users. Apple’s limitations on third-party access to its NFC chip prevent banks from adding Pix contactless payments to their iOS apps. Brazil’s competition authority, CADE, has opened an inquiry to examine whether Apple’s NFC policies restrict competition in the country’s payments market. Apple has asked for the case to be dismissed.

Across the country, nearly 7 in 10 Brazilians now pay by tapping, according to Abecs. Pix by proximity arrives as part of this broader shift, folding instant transfers directly into daily routines.

Read all the other Digital Banking industry news below 👇 and I'll be back with more on Monday!

Cheers,

Stay ahead in the US FinTech revolution. Subscribe now for weekly insights delivered straight to your inbox.

DIGITAL BANKING NEWS

🇧🇷 Nubank launches NFC Pix for Android mobile phones. Users must link their Pix key to the Google Pay wallet and perform an initial transaction by inserting the card and entering the PIN; subsequent payments can be made by proximity. This enhancement aims to streamline in-person transactions, offering a faster and more convenient payment experience.

🇬🇧 Allica Bank completes £5.85 million bridging facility and celebrates record month for bridging finance. The facility, introduced by Arc & Co, was secured against an office building in Marylebone. Together, they have proven how a strong broker-bank relationship can support smooth execution.

🇵🇹 SPIN has more than 400,000 users. Launched a year ago by Banco de Portugal, the SPIN service has rapidly gained popularity. SPIN enables users to initiate credit and instant transfers using the recipient's mobile number or business identification number (NIPC) instead of the traditional IBAN.

🇵🇦 Panama's Mercantil Banco taps Galileo for digital banking platform, to revamp its digital banking infrastructure with the Cyberbank Digital platform. These features will enable Mercantil to offer personalised, mobile-ready services that improve customer satisfaction and streamline operations.

🇺🇸 US banks can handle customer crypto assets held in custody. The US Office of the Comptroller of the Currency (OCC) has confirmed banks under its jurisdiction can trade crypto on behalf of customers and outsource some crypto activities to third parties.

🇺🇸 Green Dot attracts private equity interest despite sluggish deal climate. However, the prospective sale has been complicated because Green Dot owns a bank, while federal law prohibits PE firms from owning more than 24.9% of a bank. As a result, Green Dot could be sold in parts.

🇦🇺 Yondr Money partners with Mastercard to supercharge its embedded finance solution, Kobble. This strategic collaboration enables Yondr to create Mastercard prepaid and debit products through its platform, providing businesses with the ability to launch embedded financial solutions in weeks rather than years.

🇸🇬 Sea injects additional S$78 million into MariBank. The new funds will support the expansion of MariBank digital banking services, enhance operational capabilities, and help the company better serve customers in a competitive market. Read more

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.