Nubank Crosses 112M Customers and Takes the Top Spot in Brazil

Hey Digital Banking Fanatic!

Nubank just became the largest private financial institution in Brazil by number of customers, according to the latest data from the Central Bank of Brazil.

The total now tops 112 million users, roughly 61% of the country’s adult population. About 85% of Nubank’s Brazilian customers remain active every month, while average revenue per active customer hit a new all-time high in Q3 2025.

The results show up beyond growth charts. Lower complaint rates, a ninth straight Reclame AQUI award, and more than R$111 billion saved in fees for customers over less than a decade.

Livia Chanes, CEO of Nubank Brazil, points to depth over vanity metrics, highlighting a strategy built around everyday relevance, long-term relationships, and products people actually use.

This is what digital banking at a national scale looks like when distribution, engagement, and execution line up...

FinTech Running Club, São Paulo 🇧🇷

While I'm on the topic, I wanted to flag something fun coming up in São Paulo. The FinTech Running Club is meeting on Saturday, Jan 31st, starting at 8 AM at the Nubank Ultravioleta Lounge.

It’s hosted by Fathi-Alexandre de Souza, and it’s exactly what it sounds like. A relaxed run, good conversations, and a strong FinTech crowd to start the weekend right. If you’re around São Paulo, this one’s worth joining.

If you’re tracking how Digital Banking players are consolidating entire markets, keep scrolling 👇 More stories shaping the industry coming tomorrow.

Cheers,

INSIGHTS

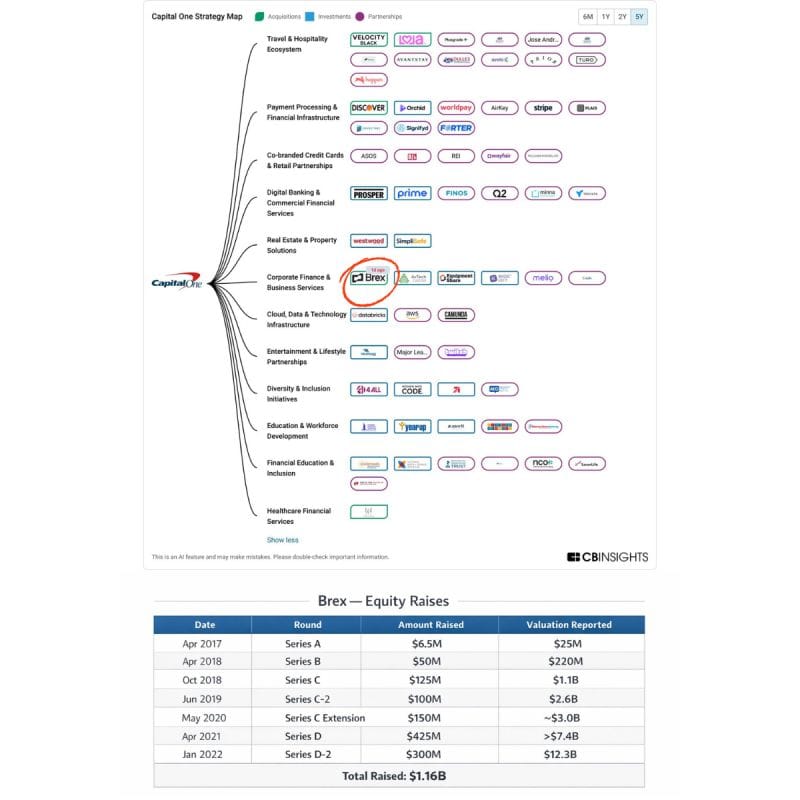

➡️ The $5.2 Billion Capital One X Brex deal feels like a turning point.

This deal signals the next phase of FinTech:

NEWS

🇧🇷 Nubank surpasses 112 million customers and becomes the largest private financial institution in Brazil, according to the Central Bank. The continued growth in its customer base was accompanied by record engagement, the result of a strategy to deepen customer relationships and increase the use of Nubank products and services, said Livia Chanes, CEO of Nubank Brazil.

🇦🇪 Wio Bank joins NVIDIA Inception Program to accelerate AI-driven banking innovation. By joining NVIDIA Inception, Wio gains access to cutting-edge developer resources and advanced training, accelerating its mission to redefine banking for the region’s new economy.

🇺🇸 Revolut scraps plans to buy US lender in favour of push for standalone licence. The company has held talks with US officials about seeking a licence through the Office for the Comptroller of the Currency in hopes of a quick process amid the Trump administration's deregulatory push, according to the report.

🇺🇸 Affirm seeks a Nevada bank charter. Affirm is pursuing the creation of a banking subsidiary as it looks to expand beyond traditional FinTech offerings into services typically provided by banks in the U.S. Keep reading

🇲🇽 Hey Banco will begin operating as an independent bank on January 31, 2026, after receiving final authorization from Mexico’s National Banking and Securities Commission. The neobank serves more than 500,000 customers, focuses on consumer banking products, and holds about 1.5 billion pesos in assets.

🇬🇧 Banking behemoth JP Morgan Nutmegs rivals with the purchase of WealthOS. JP Morgan Chase, the US-based banking giant, has swooped to buy a British pensions technology company as it tries to augment its retirement planning services to personal investing clients.

🇺🇸 UST acquires leading FinTech innovator Tailwind. With this strategic acquisition, UST will be able to increase its share of digital banking solutions implementation and support services for banks and credit unions. Read more

🇨🇳 Tinaba extends Alipay+ Pact, enabling payments in China. The new service enables Tinaba users to pay at over 80 million merchants across China. Customers can complete these transactions by simply scanning a QR code directly within the app.

🇺🇸 FIS has selected Anil Chakravarthy to join its board of directors. Jeffrey Goldstein, independent chairman of the board, comments: "We are pleased to welcome Anil to the FIS board. He is an accomplished technology leader who brings deep expertise in enterprise software, cloud transformation, and AI-powered enterprise solutions.

🇺🇸 UBS Group AG plans to make crypto investing available for some private banking clients. The Swiss banking giant is in the process of selecting partners for a crypto offering. High-net-worth individuals could access spot Bitcoin and Ethereum, as well as derivatives, with a potential rollout to Asia-Pacific and the US.

🇺🇸 Donald Trump files lawsuit against JPMorgan and Jamie Dimon. The case, which was filed in Miami, Florida, on 22 January, is being brought on behalf of the US president and several of his companies. The US president had said that he would sue the bank for “incorrectly and inappropriately” debanking him.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.