Nubank Freezes Argentina Comeback as Rivals Move In

Hey Digital Banking Fanatic!

Nubank just hit pause on its Argentina comeback tour 🇦🇷.

The Latin American neobank giant (122M customers across Brazil, Mexico, and Colombia) was in advanced talks to snap up Brubank — Argentina’s biggest digital bank — but political chaos and economic turmoil cooled the deal.

It’s not the first time Nubank has tiptoed into Buenos Aires only to back out. Remember 2019, when it set up shop with 12 employees and shelved a $2B plan shortly after? Déjà vu.

Meanwhile, competitors aren’t waiting around: Ualá already bagged Wilobank, Mercado Pago is chasing a banking license, and Revolut swooped in by grabbing BNP Paribas’ local unit earlier this year.

Nubank’s re-entry could now slip to 2026. Until then, Argentina’s neobank arena looks more like a free-for-all.

Speaking of Revolut — scroll down for some big updates from them 👇

Cheers,

INSIGHTS

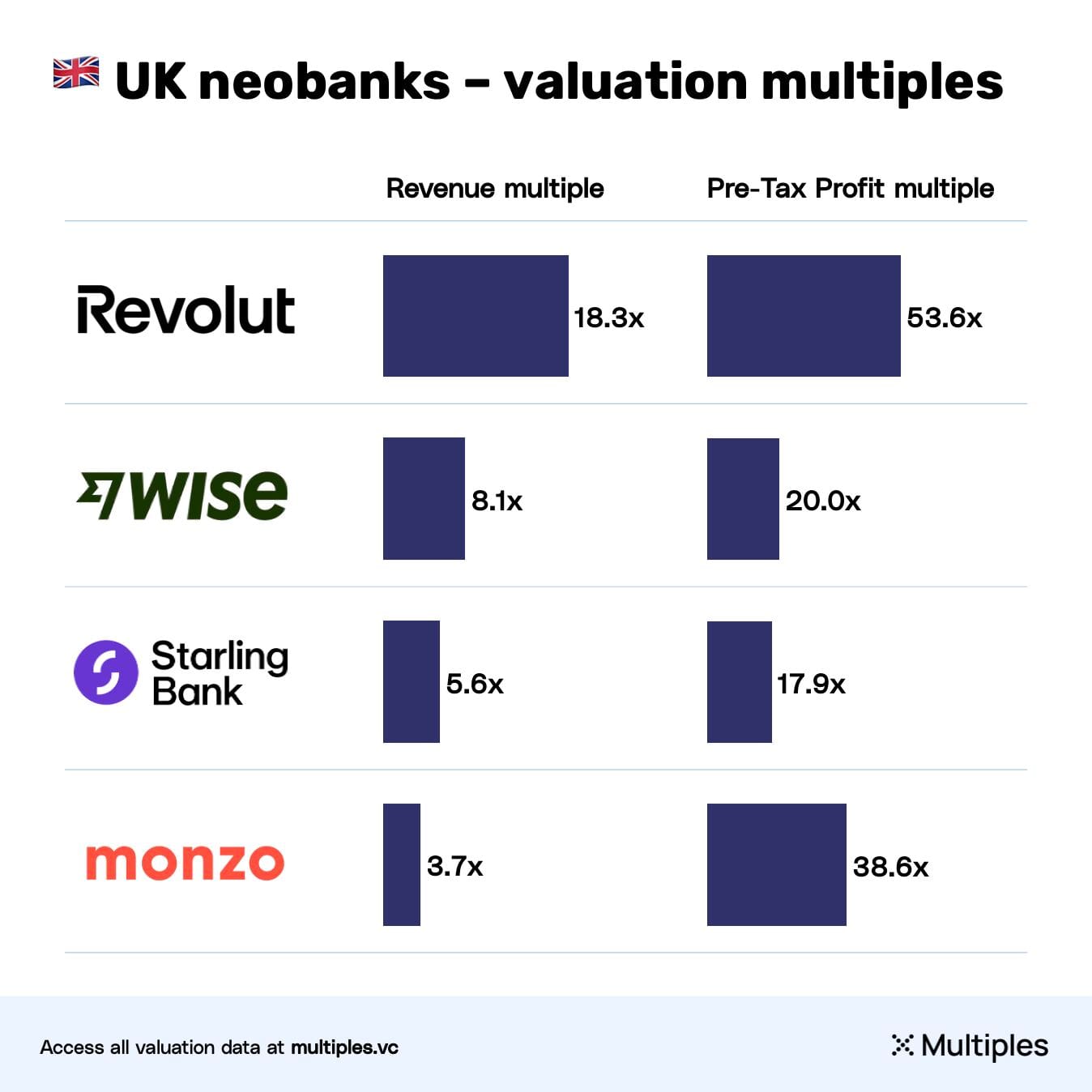

🇬🇧 Here is how UK neobanks' valuation multiples look compared to the latest reported financials.

NEWS

🇦🇷 Nubank recalculates its return to the country due to the "election effect" and reorganizes its plan to compete with Mercado Pago. Inconsistencies in the money supply and the unstable political and economic context that worsened after the election results in the province of Buenos Aires ultimately halted the return to Argentina of Latin America's largest online bank.

🇺🇸 UK FinTech Starling Shifts focus to New York IPO after key hire. Starling is part of a raft of UK FinTechs that are looking to expand to America to rapidly grow their customer base and take advantage of US President Donald Trump’s plans to usher in an era of financial deregulation.

🇺🇸 Dave Introduces CashAI v5.5. v5.5 nearly doubles CashAI’s feature set versus prior models and optimizes around Dave’s new fee structure. Dave expects this latest model to deliver expanded access to ExtraCash™ for Dave members, as well as improvements to credit performance and gross profit expansion.

🇬🇧 Revolut is building AI agents for sales, customer service, and more. In its bid to become the go-to financial superapp, it has pursued an ambitious product map with commitments to roll out a wide range of new products, including private banking, crypto derivatives, and rewards-based credit cards.

🇲🇦 British bank Revolut recruits a lobbyist to work in the kingdom. The British online bank has selected Hatim Benjelloun to represent its interests and assist in establishing its presence in Morocco. Read more

🇿🇦 Discovery Bank emerges as one of South Africa’s fastest-growing digital banks. Total clients grew by 30% year-on-year, reflecting continued adoption of the bank’s digital-first model and integration with Discovery’s broader ecosystem. Deposits expanded by 26%, supported by its competitive savings offerings, while loan advances grew by 39%, showing increased demand for its credit solutions.

🇪🇺 EU bank watchdogs must be bold in simplifying rules. Bundesbank President Joachim Nagel said a further suggestion to bundle various capital buffers for banks is intended to simplify regulation within the existing system of national and European authorities, rather than annul that division of responsibilities.

🇺🇸 Thread Bank appoints Dan Chang as Chief Compliance Officer. In a statement, Thread says its latest hire will "serve as the key legal and compliance advisor to the executive team and board", managing all legal affairs while overseeing the bank's partnerships and compliance framework.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.