Nubank Hits Record Revenue and Income in Q3

Hey Digital Bank Fanatic!

Q3 brought big numbers for Nubank.

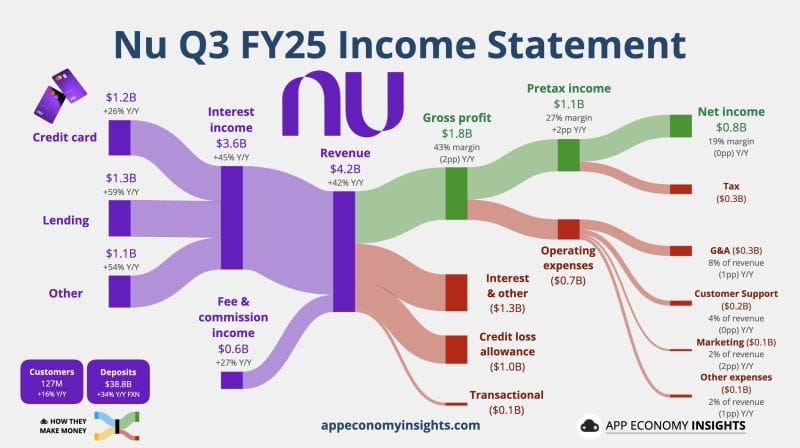

The company reported record revenues of $4.2 billion, a 39% year-over-year increase on a foreign exchange-neutral basis, and net income of $783 million.

Its customer base expanded to 127 million, with a strong presence in Brazil, Mexico, and Colombia, while its credit portfolio expanded 42% year-over-year, reaching $30.4 billion.

Speaking to Reuters, Nubank’s CFO, Guilherme Lago, said the profit growth was mainly driven by continued scale gains in Brazil, the bank’s core market, while in Mexico, the credit portfolio grew as deposit costs declined.

Net interest income (NII) rose 32%, hitting a new record of $2.3 billion. Meanwhile, the net interest margin (NIM) fell by 40 basis points, to 17.3%, while the risk-adjusted NIM increased by 70 basis points, to 9.9%.

Very few companies are executing at this level. Scroll down for the full line-up of today’s digital banking stories.

See you tomorrow!

Cheers,

INSIGHTS

📈 Nubank just dropped another monster quarter, and the numbers are on 🔥

NEWS

🇧🇷 Nu Holdings Ltd. reports third quarter 2025 financial results. Nu added 4.3 million new customers in Q3’25, a 16% year-over-year increase, reaching a total of 127 million customers globally. This expansion reinforces Nu’s position as the leading digital bank in Latin America and one of the leading FinTech platforms globally. Additionally, Nubank adopts AI to increase credit card limits for customers in Brazil to boost revenue and profit in the third quarter.

🇦🇪 UAE digital lender Wio is close to joining the Dh100 billion club. Wio Bank Chief Executive Jayesh Patel said that the company is on pace to reach its balance-sheet target within two to three years, noting it is already nearing Dh60 billion and could achieve the remaining Dh40 billion in roughly that timeframe if current growth rates continue.

🇦🇪 JPMorgan expands in Dubai as Middle East competition heats up. "There's a global focus on doing more in the midcap space," Stefan Povaly, London-based Co-Head of Corporate Banking for Europe, the Middle East, and Africa, said. Midcaps give JPMorgan another revenue stream beyond its traditional focus on the biggest blue-chip firms.

🇳🇱 Dutch banks to cut thousands of jobs amid cost drives and AI push. State-owned ASN Bank said it will eliminate as many as 950 positions by the end of next year, linking the plan to a previous decision to get rid of several brands. Read more

🇿🇦 Revolut has officially submitted a formal application to establish a bank in South Africa. Revolut submitted its Section 12 application to the Prudential Authority of the South African Reserve Bank, the crucial first step under the Banks Act. Also, the company appoints Dr Gaby Magomola as Chairman for South Africa. He will assume the role in January 2026.

🇷🇴 Banca Transilvania and BPC deliver Romania’s EU Digital Identity wallet payment. The wallet provides a single, interoperable identity framework across the EU, cutting cross‑border KYC friction and allowing banks to draw on verified attributes such as income, residency, or employment during onboarding and credit scoring.

🇺🇸 BNY launches stablecoin reserves fund and further expands BNY's leadership in digital assets. The fund is intended to enable U.S. stablecoin issuers and other qualified institutional investors acting for themselves or in a fiduciary, advisory, agency, brokerage, custodial, or similar capacity.

🌍 XTransfer and Maybank enter into a strategic partnership at the Singapore FinTech Festival 2025. Under the collaboration, XTransfer and Maybank will harness their respective strengths to deliver one-stop cross-border financial solutions, spanning domestic and cross-border payments and FX conversion, across key ASEAN markets, Hong Kong, the United Kingdom, and the United States.

🇬🇧 Lloyds clinches £120m deal for digital wallet provider Curve. Lloyds Banking Group has formally signed a controversial agreement to acquire Curve, which had ambitions to become one of the UK's most prominent FinTech champions. Read more

🇩🇪 Andreas Dombret, Daniel Terberger, and Byron Haynes were elected to the N26 supervisory board. All three candidates assume their positions with immediate effect, N26 announced. The supervisory board, which now has six members with the three new additions, is also to be expanded soon.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.