Nubank Introduces NuScore for Credit Transparency

Hey Digital Banking Fanatic!

Credit is often a story written in numbers — but seldom understood. For many, a credit score feels like a distant calculation, shaping decisions quietly and without explanation. In Brazil, Nubank is looking to change that.

The Brazilian digital bank unveiled NuScore, a tool designed to bring clarity to how customers build their credit profile within the bank. Instead of a mysterious score handed down without context, NuScore offers a window into the data behind the number — and guidance for the road ahead.

Available gradually to eligible customers, the tool rates profiles from 0 to 1,000 and classifies them from very low to very high. But it doesn’t stop there. NuScore breaks down the behavioral and historical factors behind each evaluation — from credit card usage and savings habits in Nubank’s Boxes (Caixinhas), to debt levels and external bureau scores.

“We believe that providing customers with a detailed view of their credit profile will contribute to greater financial education, allowing them to make more informed decisions,” said Arthur Valadão, general director of the Roxinho segment.

Read more on Digital Banking industry below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

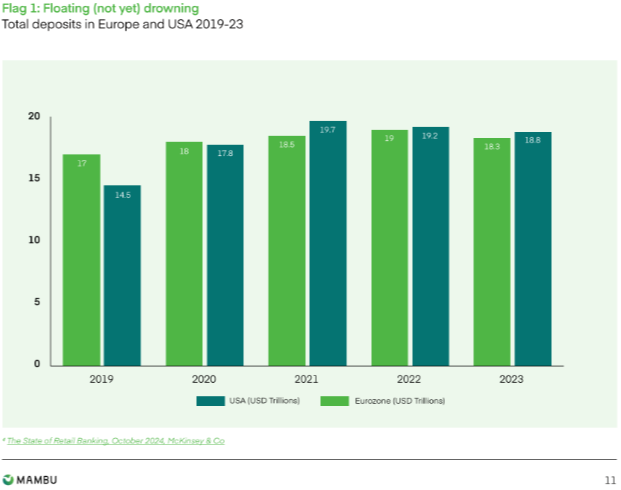

📊The Future of Deposits 2025.

DIGITAL BANKING NEW

🇸🇬 Airwallex reports triple-digit full year revenue growth in Singapore for 2024, unveils SME trends shaping business outlook in 2025. FY2024 revenue more than doubled, growing 153% year-on-year (YoY), fueled by strong transaction volumes and a standout Q4. In early 2025, it announced its launch in New Zealand and acquired Vietnam-based CTIN Pay.

🇧🇷 Nubank launches NuScore. The tool allows customers to understand the factors impacting their credit score within the bank. It includes behavioral insights, such as credit card usage, savings habits, and debt levels. Nubank aims to provide financial education and help users improve their credit profiles over time.

🇺🇸 BaaS platform Solid has filed for bankruptcy after years of controversy. What is known so far: Linked to banks like Evolve, CBW, and Lewis & Clark, the company faced a lawsuit from its own investors, FTV Capital, accusing it of inflating revenue during its Series B round. The case was settled with Solid buying back FTV’s stake at a 56% discount. Read the full story

🇺🇸 Bank of America: More than 90% of its employees now use AI. By answering employees' questions, the assistant, Erica for Employees, has reduced calls to the IT help desk by more than half, the bank said. The bank has also quietly rolled out generative AI in different areas to help advisors and relationship bankers.

🇺🇸 Stripe is not becoming a bank. Some wondered if Stripe would now be considered a bank. The short answer is: No. What is true is that this marks the first time that Stripe has applied for a banking license. This does not mean it will be accepting deposits, but will process its own payments if approved.

🇬🇧 Yapily and Allica Bank join forces to bring the power of open banking’s seamless, secure top-ups to UK SME current accounts. By leveraging Yapily’s open banking technology, Allica Bank is now building on its mission to give established businesses the banking they deserve by enabling them to top up their accounts even faster.

🇸🇦 Telr teams up with Saudi Awwal Bank to boost eCommerce payments. Merchants will gain access to a wide range of tools, including payment links, QR codes, digital invoicing, recurring payments, BNPL options, and other proprietary features.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.