Nubank Leads as Primary Bank in Brazil

Hey Digital Banking Fanatic!

Here’s something you don’t hear every day, or maybe haven’t heard at all. Not because it’s not happening, but because the industry is still early. The truth is, it still is early.

According to new research from consultancy Okiar, 21.7% of Brazilians now consider Nubank their primary bank. That places it ahead of long-established institutions like Itaú (14.2%) and Bradesco (12%), closing out the top three.

The study, conducted in the first half of 2025, surveyed over 1,000 individuals to better understand how people engage with financial institutions. On average, Brazilians hold four different bank accounts, a number that reflects both market competition and the growing personalization of financial relationships.

Despite leading as the most cited “main bank,” Nubank still ranks third in total customer base, behind Caixa Econômica and Bradesco. It’s a revealing contrast: while legacy banks retain broad reach, digital-first institutions are becoming the go-to for daily financial management.

The report also looks at product engagement. Traditional bank customers use an average of ten financial products. Digital bank users average eight. A narrow margin, but one that shows digital banks are catching up in breadth, not just in brand.

So yes, credit where it’s due: becoming someone’s main bank is no small thing. Shifting everyday banking behavior is no small feat. But in the broader picture, this market still feels it's just getting started.

Read all the other Digital Banking industry news below 👇 and I'll be back with more on Monday!

Cheers,

INSIGHTS

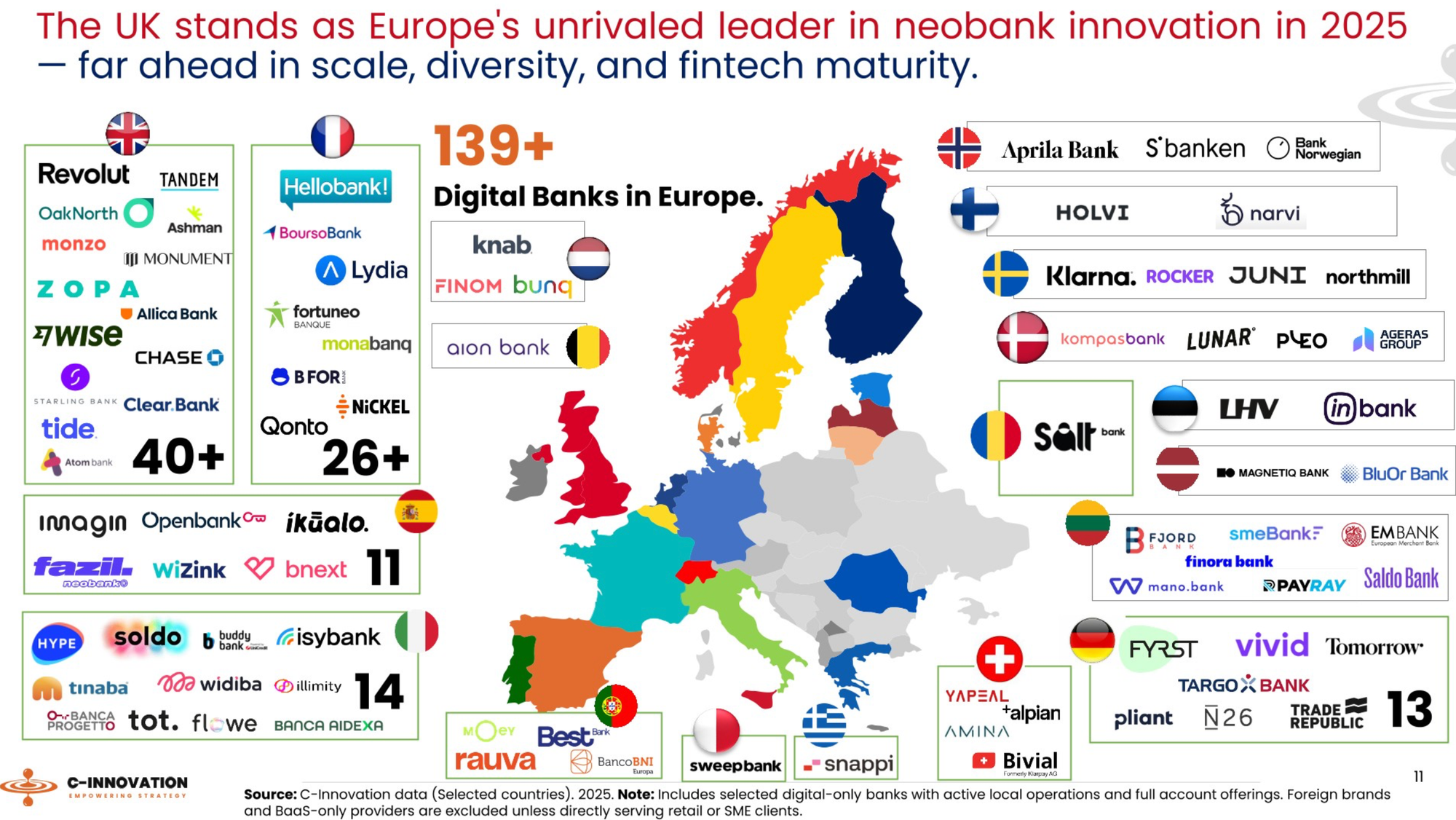

📊 The UK stands as Europe's unrivaled leader in neobank innovation in 2025.

Check this out👇 Any neobanks missing on this market map?

NEWS

🇧🇷 Nubank is the main bank for 21.7% of Brazilians. Okiar Consultancy surveyed more than a thousand Brazilians to analyze users' relationships with financial institutions. The survey revealed that each Brazilian has, on average, four bank accounts, highlighting the multiplicity of options available on the market.

🇹🇭 Kakao Bank wins approval for Thailand's first virtual bank. Thailand's central bank said the digital lenders are expected to enhance customer experience, increase efficiency, and drive healthy competition through innovation and better pricing.

🇬🇧 OnePay adopts Flagright’s AI-Powered AML and transaction monitoring platform. OnePay will gain real-time oversight of all customer transactions, including domestic transfers, card activity, and international payments. This partnership supports OnePay’s efforts to strengthen its compliance operations as it scales its services and navigates evolving regulatory expectations across the UK and EU.

🇬🇧 Salt Edge, Tuum, and LHV Bank partner to accelerate growth through secure open banking. The partnership between Tuum and Salt Edge aims to help financial institutions across Europe access the full spectrum of open banking features quickly and securely while enabling integration with an API-first and modular core banking platform. LHV Bank is one of the beneficiaries of this collaboration.

🇷🇴 Revolut announces changes in Romanian branch management team. Gabriela Simion has recently stepped into a new role at the group level, leading the Global Credit Insurance business. Gianmaria Scocca will oversee the operations of the RBUAB Vilnius Bucharest Branch. It has appointed Tamer Nurla as the Deputy Branch Manager.

🇰🇷 K-Bank launches third attempt at IPO, targeting $3.6 billion valuation. This is similar to the valuation it aimed for during its previous IPO attempt, based on the upper end of the indicative price range, and the company is once again seeking investors at that level.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.