Nubank Moves Toward a Full Banking License in Brazil

Hey Digital Banking Fanatics!

Nubank is making a decisive move...

The company plans to obtain a full banking license in Brazil in 2026 after the new Joint Resolution No. 17 reshaped the classification of regulated institutions.

Brand stays the same. Operations stay the same. More than 110M customers won’t feel a thing.

Nubank already ticks every regulatory box across payments, credit, investments, and brokerage. No impact on capital, on liquidity. Full stability.

As Livia Chanes, CEO of Nubank Brazil, puts it, the company’s 12-year journey added 28 million people to the financial system, and the core mission "making life simpler" doesn’t move an inch.

I flagged this earlier... the new rule restricting the use of “bank” without an actual license makes the timing obvious. Worth a look if you missed it.

If you're into Digital Banking shake-ups, definitely check out the updates below 👇

Cheers,

Marcel

INSIGHTS

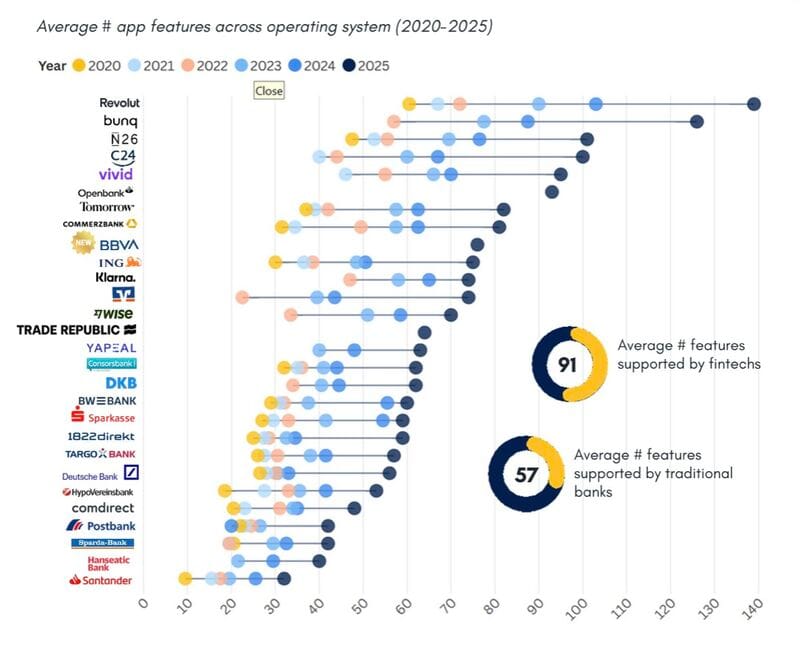

🇩🇪 FinTechs are pulling away in the banking app feature race in Germany.

And the gap with traditional banks is only getting wider👇

NEWS

🇧🇷 Nubank plans to obtain a banking license in Brazil in 2026. Nubank, already serving more than 110 million customers in Brazil, plans to obtain a banking license to align its structure with regulatory requirements under Joint Resolution No. 17, a change that will not affect customers or alter its brand.

🇵🇷 Toronto FinTech Propel eyes U.S. expansion with Puerto Rico banking licence. The Puerto Rico licence will let Propel work with banks in all 50 states and opens the door to further global expansion, Noah Buchman, Propel’s President and Chief Revenue Officer, said.

🇬🇧 NatWest, Monzo, and Santander amongst first to join FCA's AI live testing scheme. The “first of its kind” scheme gives firms access to tailored support from the UK watchdog’s regulatory team, as well as its technical partner Advai, to build, evaluate, and roll out "safe and responsible" AI applications.

🇸🇬 Grab-backed GXS Bank cuts 10% staff across Singapore and India. The reported layoffs follow a strategic review to identify roles needed for the next phase and were conducted across GXS Bank in Singapore and the technology center in India.

🇧🇷 PagBank launches mobile phone insurance and strengthens its digital protection offering. PagBank introduced PagBank Mobile Insurance as part of its expanding ecosystem of security-focused services, a move that supports its strategy of offering simple, essential, and integrated financial solutions.

🇮🇹 BBVA Italy expands its investment and lending offering to become a universal digital bank with lending, mortgages, and investment products, aiming to strengthen customer relationships and become users’ primary bank; its strategy includes enhancing mortgage and credit card services, launching a broader range of ETFs, and developing an AI-supported advisory model by 2026.

🇺🇸 Uniswap Labs is partnering with Revolut to offer a fast, seamless onramp. Users can purchase crypto using their Revolut balance or debit card, all within the Uniswap app. This integration gives users in 28 countries more choice in how they get on-chain.

🇵🇱 Santander sells 3.5% stake in Polish unit for $473m, following its earlier agreement to sell 49% of the Polish unit to Erste Group; the latest sale involved 3.58 million shares priced at 482 zlotys each and reduces Santander’s remaining ownership in Santander Bank Polska to approximately 9.7%.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.