OakNorth Reaches $1bn in U.S. Lending in Under Two Years

Hey Digital Banking Fanatic!

Since entering the U.S. market in July 2023, OakNorth has crossed the $1 billion mark in lending, an early milestone in what’s shaping up to be a steady expansion across the Atlantic. Known for focusing on the underserved lower mid-market segment, the London-based digital bank is building momentum.

Its approach has been consistent, measured, local, and focused on fundamentals. From commercial property deals in New Jersey to financing creative firms scaling in California, OakNorth’s U.S. portfolio reflects a practical commitment to businesses earning between $1m and $100m in annual revenue.

The strategy isn’t just transactional. In the past year, the bank secured approvals to open a New York representative office and announced the acquisition of Community Unity Bank in Michigan, pending regulatory clearance. These moves point to deeper ambitions across U.S. regions beyond the coasts.

When several regional lenders collapsed in 2023, OakNorth filled a critical gap. Its lending facilities, structured for flexibility, have supported everything from hotel conversions to international brand expansions.

“Reaching this $1bn milestone less than two years after launch is a huge achievement for our team and a testament to the strength of our offering,” said Ben Barbanel, Head of Debt Finance.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

INSIGHTS

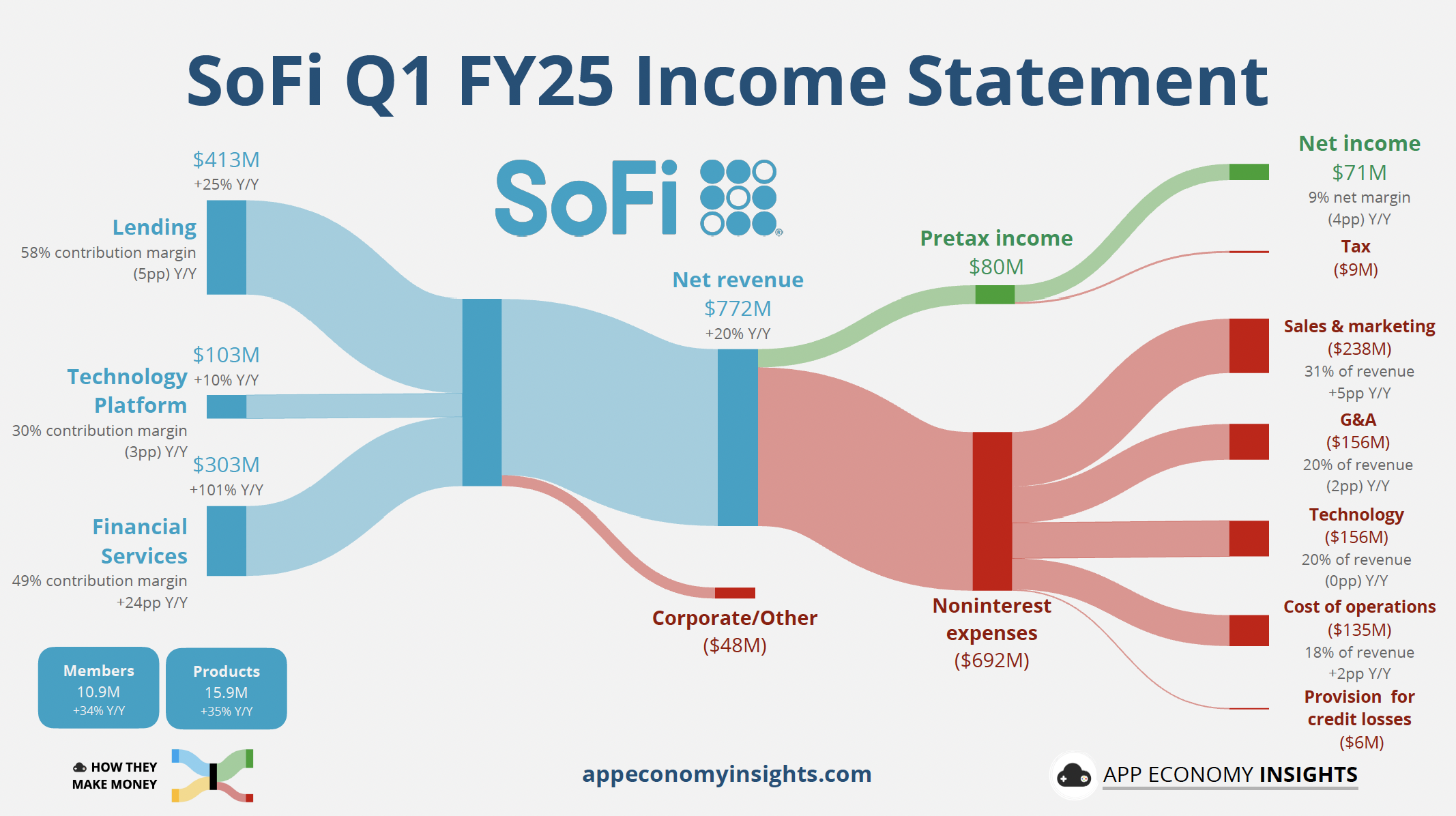

How SoFi makes money.

DIGITAL BANKING NEWS

🇺🇸 OakNorth has surpassed $1bn in lending to US businesses since July 2023. With a focus on supporting lower mid-market businesses with revenues between $1m and $100m, OakNorth’s backing continues to be a catalyst for growth, innovation, and market leadership for its customers.

🇦🇺 Revolut reports record profits in Australia & globally for 2024. The company announced a net profit before tax of AUD 4.4 million for its Australian operations in 2024, an all-time high for the business in this market. Australian revenue increased by 163% year-on-year. Meanwhile, the company is negotiating with the National Bank of Ukraine to obtain a banking license. The NBU is interested in the entry of the neobank Revolut into the Ukrainian market.

🇵🇭 Digital bank Maya throws hat into premium credit card market. The digital bank seeks to disrupt the credit card market with the rollout of a mobile-first credit card product that targets the country’s demographic sweet spot, the young, tech-savvy, and “unhappily banked” consumers.

🇨🇭 Temenos veteran Martin Bailey departs after 25 years. Martin Bailey has concluded a 25-year career at Temenos, announcing on LinkedIn this week that he has departed the core banking tech vendor. He first joined the Swiss vendor in 2000, initially taking charge of enterprise technology as product director.

🇺🇸 PowerPay secures $400 million committed multi-lender warehouse facility led by KeyBank. The collaborative effort among multiple financial institutions will ensure the Company’s long-term sustainability and continued innovation in lending solutions.

🌍 Tietoevry Banking’s new insight-report reveals an increase in digital payment fraud in Europe. The new Payment Fraud Report reveals a sharp increase in digital payment fraud across Europe, mainly driven by increasingly sophisticated social engineering tactics and the use of AI. Read on

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.