Openbank Lands in Mexico, Competing with FinTech Heavyweights

Hey Digital Banking Fanatic!

Openbank, the Spain-based digital-only bank backed by Banco Santander, has officially launched in Mexico after attracting over 30,000 waitlist sign-ups within weeks. The bank enters a competitive market, going up against unicorns like Nubank and Ualá, as well as local players such as Stori and Klar.

Customers can open an account in just 5 minutes and gain access to interest-bearing accounts, debit and credit cards, and fee-free cash withdrawals at 10,000 Santander ATMs. Standout features include the Débito Open account, offering a 10% annual yield on deposits up to MXN 3.35 million with no minimum balance or fees, and a 3% cashback on online credit card purchases.

Openbank also operates in Germany, the Netherlands, Portugal, Spain, and the U.S., where it secured $2 billion in deposits within its first three months.

Scroll down for more interesting Digital Banking industry news updates and I'll be back in your inbox tomorrow! 👇

Cheers,

Stay on top of FinTech trends. Subscribe to FOMO now and catch the week’s most important news and updates.

INSIGHTS

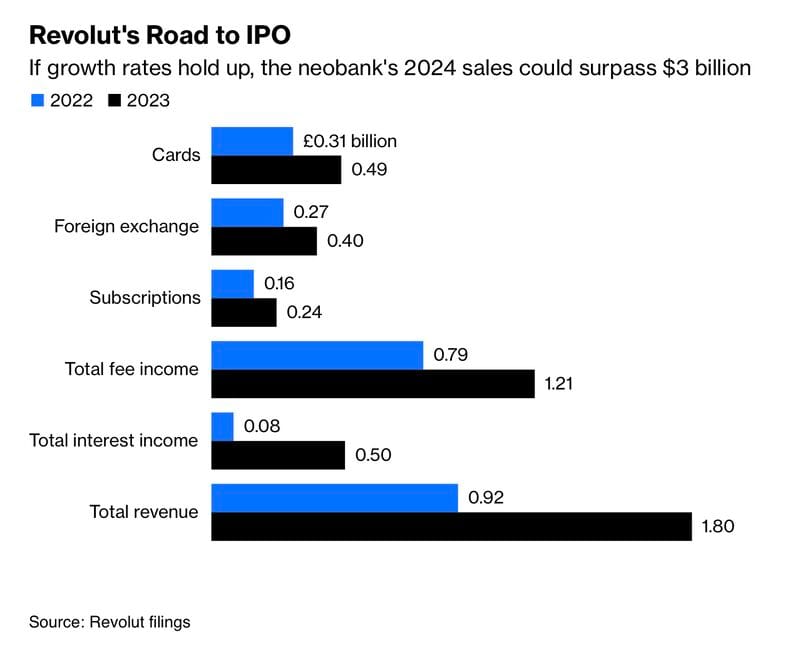

Revolut’s $𝟰𝟱 𝗕𝗶𝗹𝗹𝗶𝗼𝗻 valuation: Can it hold up on its road to IPO?

DIGITAL BANKING NEWS

🇲🇽 Openbank launches in Mexico. The bank is now up and running across all of Mexico with a comprehensive suite of everyday banking products that includes interest-bearing accounts, debit and credit cards, and cash withdrawals at 10,000 Santander ATMs.

🇺🇸 Revolut's road to IPO will test FinTech’s hype. For neobank Revolut, the FinTech hype looks set to be tested, with co-founder Nik Storonsky recently flagging that backers will want an initial public offering “sooner or later” and that the US looks a preferable listing destination.

🇬🇧 Lanistar hit with second winding-up petition in less than six months. The latest petition application was filed by Accomplish Financial Limited, a payments solution provider working with Lanistar. The new filing follows a previous winding-up petition in September by its London landlord over unpaid rent.

🇺🇸 HSBC sees $1.8 billion in revamp-related costs. The bank expects to incur these expenses by the end of next year related to an overhaul initiated by its new CEO to cut long-term costs and boost profits while navigating diverging interest rate policies and geopolitical turmoil.

🇪🇸 CaixaBank is launching the “Cosmos” plan. The plan proposes to articulate the bank's technological strategy in the upcoming years around four major objectives: enhancing agility and commercial capability, developing new services through innovation and simplification, boosting efficiency, and strengthening its platform with top-tier security.

🇬🇧 BNP Paribas' Securities Services Business adopts Broadridge's Global Class Action Solution to help clients identify and act on asset recovery opportunities. This includes a seamless process for identifying, filing, and recovering investment losses, backed by Broadridge's industry expertise.

🇷🇴 FinTechOS launches Evolv, bringing advanced AI capabilities to banks and insurers. Evolv enables institutions to leverage the power of Agentic AI, Generative AI, and advanced automation to deliver unique customer experiences, modernize administrative processes, and drive smarter business decisions.

🇮🇩 GoTyme Indonesia offers flexible financing for MSMEs with Danabijak and Olsera. The program allows eligible merchants using the Olsera point-of-sale platform to access business loans without needing collateral. The application process is fully digital and can reportedly be completed in under 10 minutes.

🇬🇧 Planixs partners with Finastra to deliver real-time liquidity solutions for banks. This partnership offers Finastra customers the option to implement Realiti’s real-time capabilities, supporting compliance with the BCBS 248 intraday reporting requirements while delivering significant benefits in cash management, funding efficiency, and liquidity risk management, all in real-time.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.