PicPay Sets IPO Price Range and Puts a $2.6B Valuation on the Table

Hey Digital Banking Fanatic!

PicPay has officially filed its IPO prospectus with a proposed price range between $16 and $19 per share.

That puts the company’s valuation between $2.2 billion and $2.6 billion ahead of its Nasdaq debut.

PicPay is aiming for a premium versus local peers like Inter, betting on scale, brand, and engagement to justify the multiple.

At the midpoint, the offering would raise roughly $400 million. Pricing is expected on the 28th, with the roadshow set to give investors a clearer view on profitability and growth expectations...

Meanwhile, Revolut Eyes A Bigger Move In Brazil 🇧🇷

Revolut, valued at around $75 billion, is signaling its next step in Brazil: pursuing a full banking license.

The plan is to move toward a multiple banking license, unlocking broader credit and financial services. CEO of Revolut Brazil, Glauber Mota, says the ambition is clear, even if timing depends on regulatory approval and business maturity.

Brazil keeps heating up. IPOs on one side. New licenses on the other. The competition for the next phase of digital banking is clearly intensifying.

If you’re tracking how Digital Banking players are positioning themselves globally, keep scrolling 👇

Cheers,

INSIGHTS

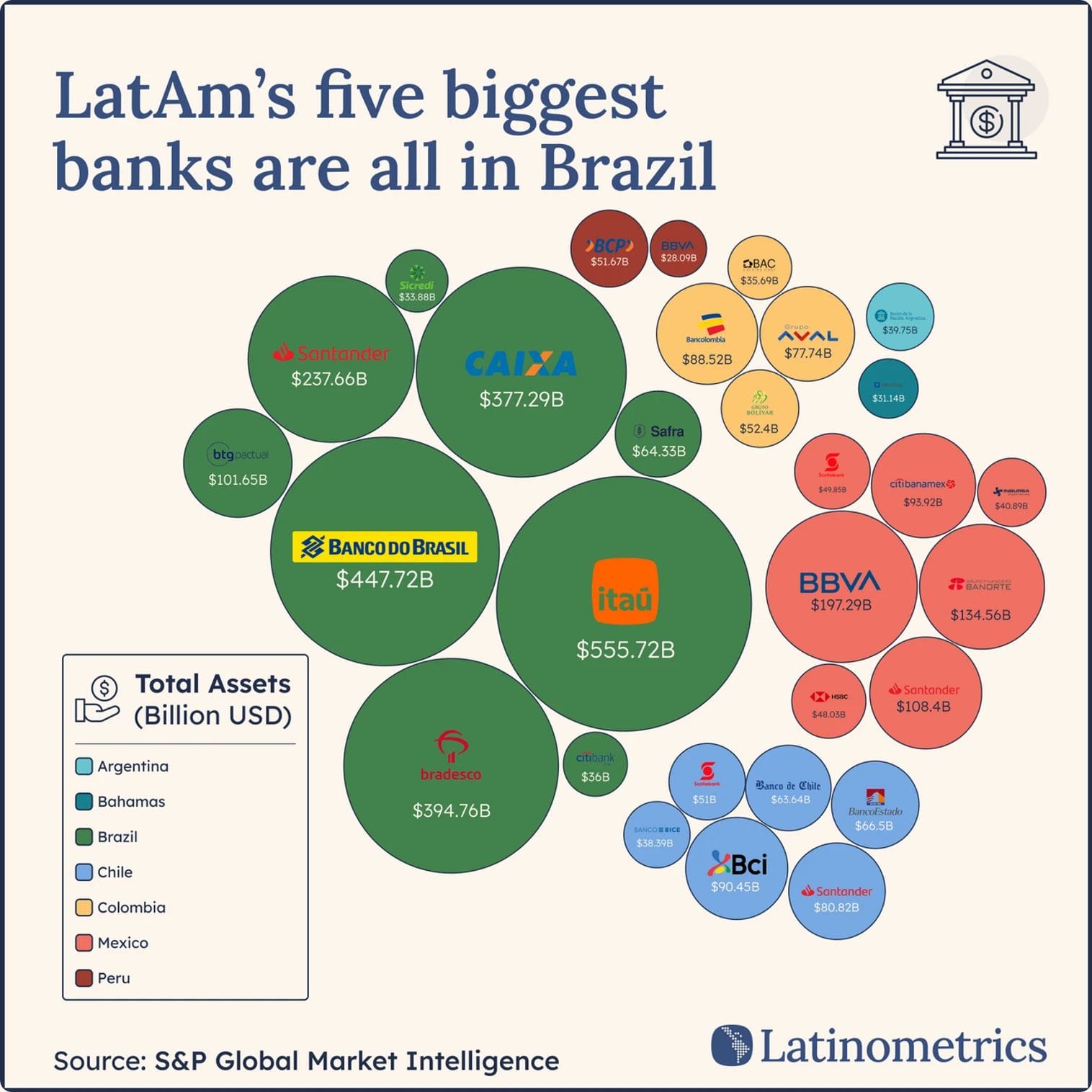

🇧🇷 LatAm's five biggest banks are all in Brazil🤯

NEWS

🇦🇪 Mastercard and Moneythor provide payment enrichment for First Abu Dhabi Bank. Through this collaboration, FAB’s customers now see real merchant names and logos, organised spending categories, intuitive summaries of transactions, and forward-looking cashflow forecasts.

🇧🇷 PicPay aims to be valued between US$2.2 billion and US$2.6 billion in its IPO. The goal is to attract investors who buy FinTech companies globally, not just in emerging markets, with a pitch focused on growth and profitability. PicPay's revenue grew 90% from January to September 2025, reaching R$7.3 billion.

🇧🇷 Revolut is aiming for a banking license in Brazil. Valued at approximately US$75 billion, the British FinTech aims to obtain a more comprehensive banking license in the country, to expand its product portfolio, and compete for customers not only with Nubank, but also with large traditional banks.

🇪🇺 Revolut Pay is now compatible with Google’s Agent Payments Protocol. By adapting the protocol for account-to-account flows, Revolut aims to position Revolut Pay as a default rail for agentic shopping, combining instant payments, built-in fraud monitoring, and higher conversion potential as commerce shifts toward AI-led experiences.

🇦🇱 Jet Bank partners with Backbase to power the launch of Albania’s first neobank. "The collaboration enabled Jet Bank to move from setup to user acceptance testing in approximately three months, with full operational capability as a licensed digital bank within as little as six months," the company said.

🇧🇷 Brazil Central Bank ex-official launches stablecoin. Tony Volpon, former deputy governor at the Central Bank of Brazil, unveiled the BRD stablecoin via his firm Inovação, offering institutional investors exposure to Brazil’s high-yield government debt through a digital token.

🇰🇿 New law on banks and digital financial assets approved in Kazakhstan. The key focus of the legislation is on the development of the FinTech sector, the regulation of digital assets, the modernization of financial infrastructure, and maintaining the stability of the banking system.

🇺🇸 Federal Reserve opens door to Main Street’s post-check payments future. The U.S. Federal Reserve is nudging modernisation, with an information request that underscores the risks of maintaining the status quo, giving businesses a concrete reason to plan a phased transition to electronic payments.

🇬🇧 Wise serves 11 million customers as volumes hit £47 billion. Wise moved £47.4 billion in cross-border transactions during its third fiscal quarter, a 26% jump from the same period last year as the London-based payments company continued adding customers and expanding its infrastructure footprint.

🇺🇸 Block, Inc. surpasses $200 billion in credit provided to customers, using real-time behavioral data rather than traditional credit scores. The approach has delivered high repayment rates and low losses, highlighting how Block’s integrated ecosystem supports more inclusive and sustainable lending.

🇬🇧 Former Barclays and Credit Suisse exec Brad Novak joins Rathbones as new CTO. Novak brings over 30 years of experience in the financial sector to the company, with the industry vet serving most recently as Chief Information Officer at DXC Technology.

🇺🇸 Affirm brings installment payments to housing costs. Affirm is piloting a new buy now, pay later option that allows renters to split monthly rent into two payments, expanding BNPL beyond everyday purchases to housing costs. The limited program is being launched in partnership with Esusu.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.