Revolut Appoints Ex-SocGen CEO as Chairman

Hey Digital Banking Fanatic,

Revolut has tapped former Societe Générale CEO Frédéric Oudéa as chairman of its new Western Europe operation, strengthening its push to challenge traditional banks across the region.

Oudéa, who ran SocGen for 15 years and oversaw the launch of its digital arm BoursoBank, said the move is a chance to join “a new venture” with the scale and technology to succeed.

The appointment comes as Revolut’s valuation hits $75 billion following a share sale, with the FinTech now serving 60 million customers worldwide. The firm is also seeking a French banking license and investing €1 billion in its Paris hub, where it plans to add up to 200 staff.

Here’s the rest of today’s news 👇

Cheers,

INSIGHTS

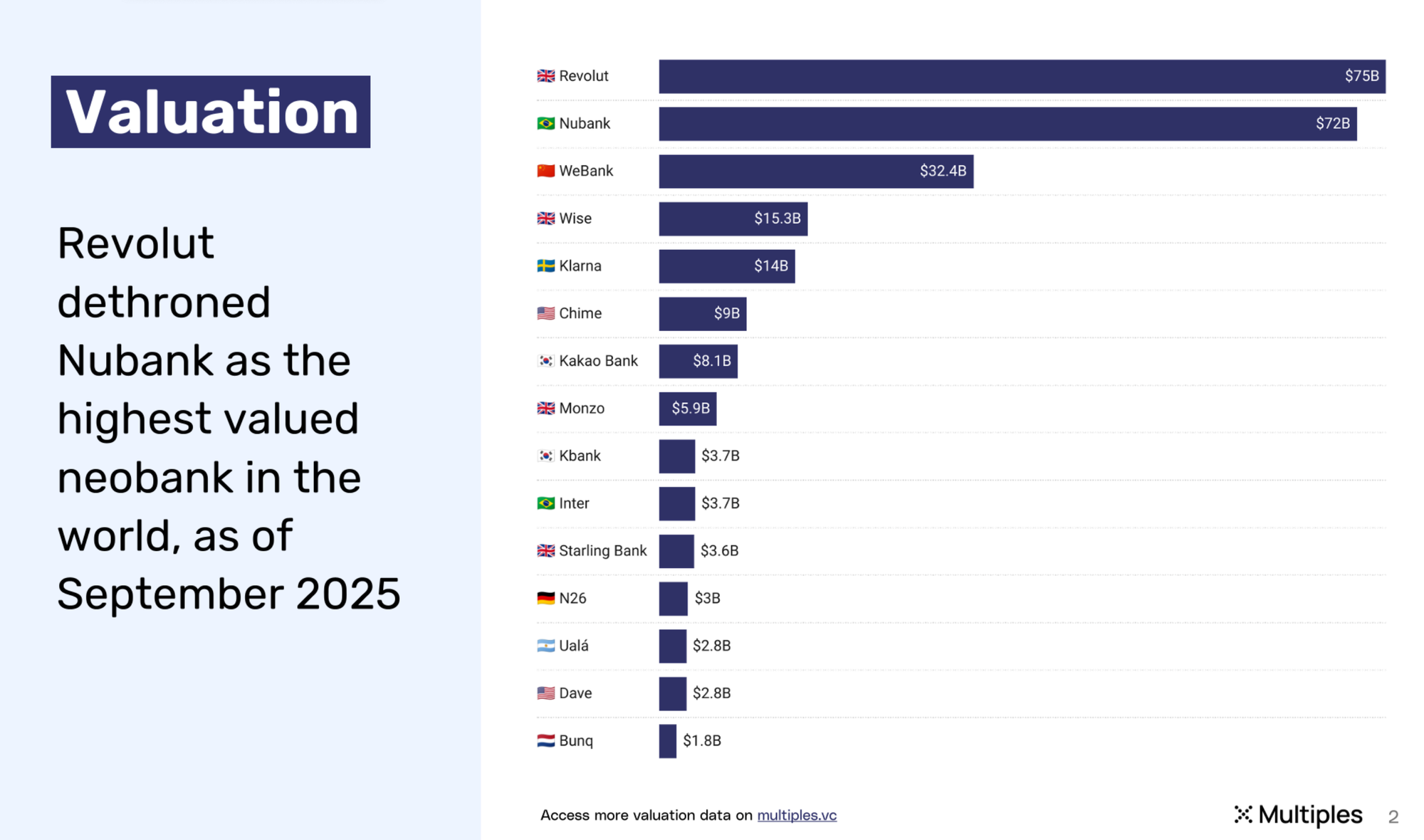

➡️ Revolut dethrones Nubank as the largest neobank in the world by valuation🤯

Here's the latest Global Neobank Valuation overview & comparison👇

NEWS

🌍 Revolut taps Former Societe Generale CEO Frederic Oudea as Western Europe Chairman. “I had no intention of returning to work for a traditional bank,” Oudea said. The role is a “good opportunity to take part in a new venture” in a firm that has the technological and financial means to succeed, he added.

🇺🇸 SoFi signs Josh Allen to a commercial deal. Allen has proven himself as an MVP, performing at the highest level. SoFi Plus matches that same superiority as America’s most rewarding financial membership, giving members the tools to help them bank, borrow, invest, and earn to get their money right, all in one app.

🇺🇸 Varo Bank to accelerate responsible and customer-focused AI efforts with New Chief Artificial Intelligence Officer Asmau Ahmed. She will lead company-wide AI and machine-learning efforts. Asmau has led teams and delivered products over the past 20-plus years, most recently sitting on the leadership team at Google X, where she led the development of new technologies.

🇲🇽 Mexico’s Klar catches up on race to bank license with Bineo Buy. If approved, the acquisition will allow Klar to operate with a banking license and catch up with other FinTechs betting on banking licenses to grow their market. Keep reading

🇧🇷 Nubank Appoints Patricia Whitaker as Chief Executive Officer of NuInvest. Previously, she served as chief investment officer at PicPay and led the equity division at XP Inc., and also worked at Nubank and Redpoint Ventures. Continue reading

🇺🇸 Andreessen-Backed FinTech Lead Bank hits $1.47 billion valuation. The funds will help the bank bolster its balance sheet as it’s looking to grow its business in the booming FinTech sector. Continue reading

🇺🇦 TASCOMBANK to launch digital bank on Trigger Neobank engine. The initiative is a step in the bank’s digital transformation strategy to deliver a mobile-first banking experience that will redefine service standards in the Ukrainian financial sector.

🇨🇭 Valiant is a Swiss bank that offers multibanking for private customers. With the Valiant app and e-banking, customers now not only have an overview of their Valiant accounts, but can also view those of third-party banks. Regardless of which bank the account is held with, both balances and account movements are clearly available.

🇪🇸 BBVA and SAP forge a strategic alliance to improve corporate and business banking services. The solution will enable BBVA to transform and optimize how financial transactions are carried out for corporate and business banking clients, making the whole process more efficient and agile.

🇨🇭 Temenos CEO Jean-Pierre Brulard steps down with immediate effect. Speaking on his departure, Brulard said: "I am proud of everything achieved since I joined; much was accomplished during the 16 months of my tenure." "I would like to thank everyone at Temenos, its customers, and partners for their confidence. I wish all the best to the company," he added.

🇬🇭 Bank of Ghana suspends Flutterwave, Cellulant, and 6 others over breaches. The Bank of Ghana stated that the crackdowns are part of an overall attempt to enforce compliance and enhance supervision of remittance and payment service companies operating in the country.

🇺🇸 Joe Wilson returns to bunq as Chief Evangelist. His return is driven by bunq’s relentless forward momentum and the intelligent ambition of its team. He promises to share data, stories, and insights as the company continues to redefine digital banking in Europe.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.