Revolut Hits Profit in Singapore & Considers M&A in Indonesia

Hey Digital Banking Fanatic!

Revolut’s Singapore operation has reached a new milestone. In the latest financial year, the digital bank posted its first profit in the market, achieving a 15% net profit margin. This marks a significant moment for the local team and hints at the potential for its wider ambitions across South-east Asia.

This performance marks a significant leap from the previous year. Revenue rose 72%, while interest income nearly doubled. The company attributes the growth to increased product usage and a growing youthful customer base, with 55% of its users in Singapore between 18 and 34 years old.

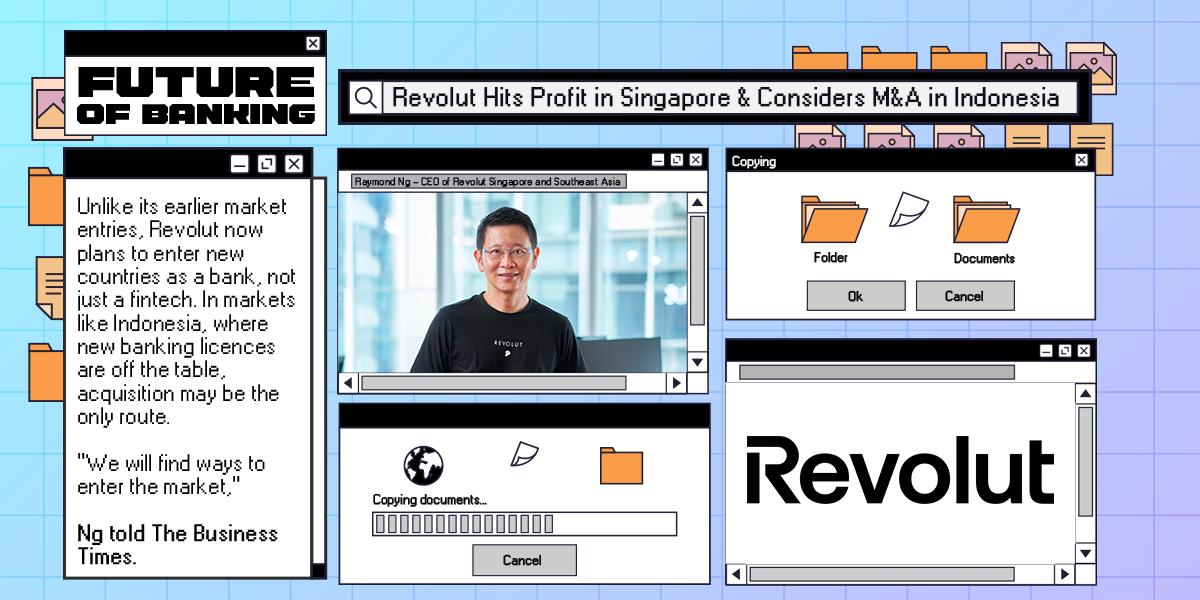

Behind the scenes, headcount in Singapore has grown by 50%. The momentum seems to be translating into new plans. Raymond Ng, who leads Revolut’s efforts in Singapore and the region, says the next step is regional expansion. Licences are already being pursued in up to 10 markets, with conversations underway with regulators.

Unlike its earlier market entries, Revolut now plans to enter new countries as a bank, not just a FinTech. In markets like Indonesia, where new banking licences are off the table, acquisition may be the only route. “We will find ways to enter the market,” Ng told The Business Times.

Closer to home, the business offering launched in mid-2024 is set to grow, with merchant payment tools and interest-bearing accounts in the pipeline. On the retail side, features like Ultra and RevPoints—already available in the UK—are being prepped for launch in Singapore.

Read all the other Digital Banking industry news below 👇 and I'll be back with more tomorrow!

Cheers,

Stay ahead in FinTech! Subscribe to my Daily FinTech Newsletter for daily updates and breaking news delivered straight to your inbox. Get the essential insights you need and connect with FinTech enthusiasts now!

INSIGHTS

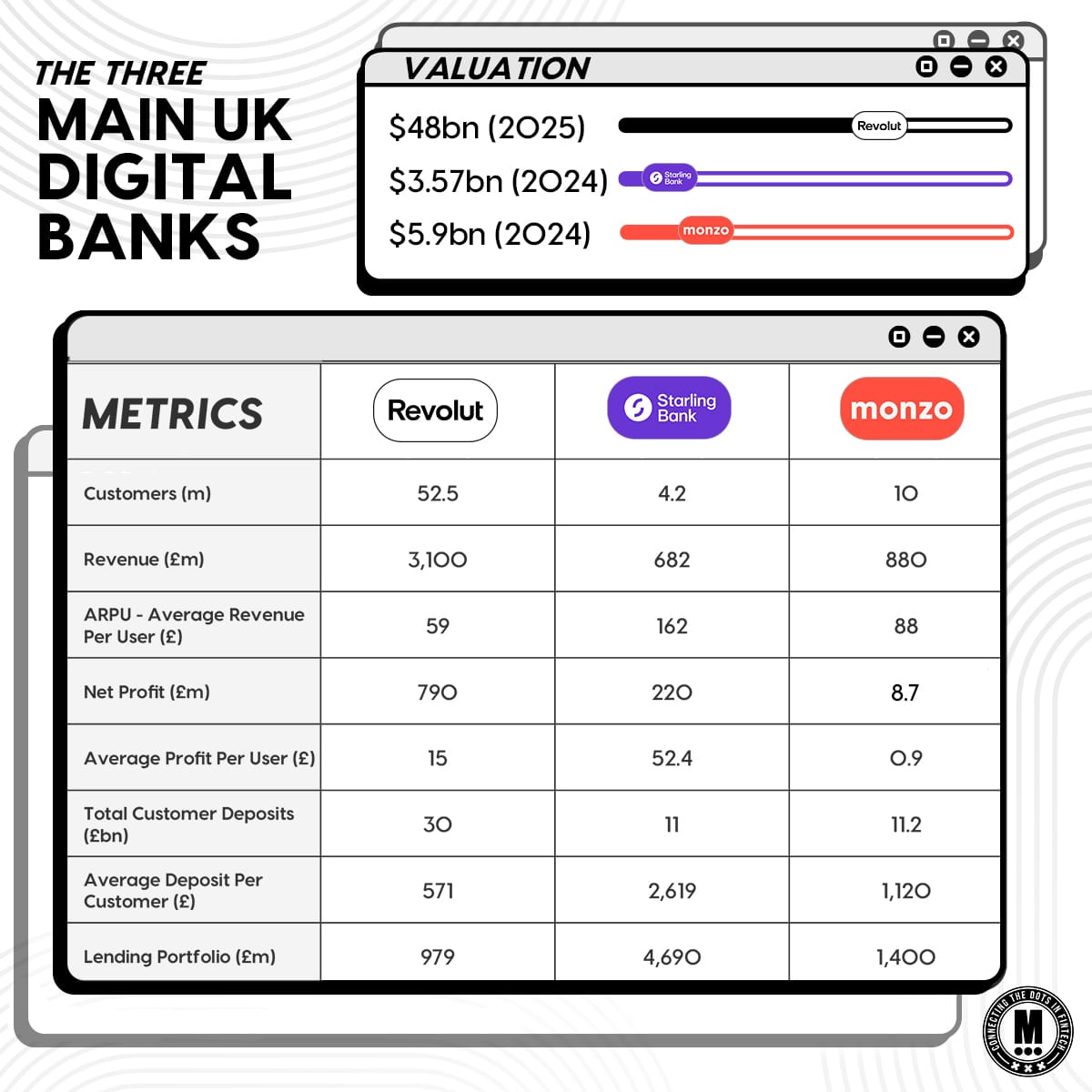

🇬🇧 Revolut released mind-blowing 2024 financial results. Here’s how the numbers stack up against UK rivals Monzo Bank and Starling Bank in financial performance in 2024.

DIGITAL BANKING NEWS

🇸🇬 Revolut Singapore hits first year of net profitability in 2024. Annual revenue in Singapore rose by 70% year-on-year in the banking services and finance app. Deposit balances more than doubled across both retail and business accounts, Revolut claimed.

🇷🇴 Romanian users hold over EUR 1.2 billion in Revolut accounts, lending up 88%. Romanian users and businesses also hold large amounts of money in their Revolut accounts and have used the lending facility extensively relative to the previous year.

🇺🇸 Circle executive Dante Disparte denies claims of seeking US banking license. Instead, he said that Circle intends to comply with future US regulatory requirements for payment stablecoins, “which may require registering for a federal or state trust charter or other nonbank license.”

🇦🇪 UAE Digital Bank Ruya becomes first Shariah-Compliant Islamic Bank to enable bitcoin purchases with licensed partner Fuze. This new service is enabled through Ruya's licensed partner, Fuze, allowing everyday halal savers to buy and hold Bitcoin directly within their banking app for the first time worldwide.

🇧🇷 Nubank (ROXO34) is set to launch a new private payroll loan product. Eligible customers will be able to apply for and manage the loan directly through the Nubank app, with approval confirmations expected within 24 hours. Meanwhile, Nu Mexico receives banking license approval, paving the way for product portfolio expansion and increased financial inclusion, including the introduction of a payroll account, a key opportunity to increase financial inclusion in Mexico.

🇧🇷 Moneythor has recently expanded into Brazil. The company's goal is to "strengthen the relationship between banks and customers" by assisting financial institutions in transitioning to a model focused on loyalty and personalization, known as "deep banking."

🇺🇸 NuMark Credit Union selects Alkami to power its digital banking platform. The integration of Alkami Data & Marketing Solutions will empower NuMark with advanced data analytics and personalization tools, enabling the credit union to engage members with tailored financial solutions and timely insights.

🇺🇸 Pinwheel announces Integration with Q2's digital banking platform. With this integration via the Q2 Digital Banking Platform, banks and credit unions can provide consumers with instant direct deposit switching within their account onboarding journey.

Want your message in front of 100.000+ Digital Banking fanatics, founders, investors, and operators?

Shoot me a message on LinkedIn or send me an e-mail.